- Canada

- /

- Residential REITs

- /

- TSX:BEI.UN

Boardwalk REIT (TSX:BEI.UN) Valuation in Focus After Q3 Earnings Beat on Sales but Net Income Slides

Reviewed by Simply Wall St

Boardwalk Real Estate Investment Trust (TSX:BEI.UN) just released its third quarter results, reporting higher sales than last year but a significant drop in net income. The company also slightly increased its full-year growth guidance and reaffirmed monthly distributions.

See our latest analysis for Boardwalk Real Estate Investment Trust.

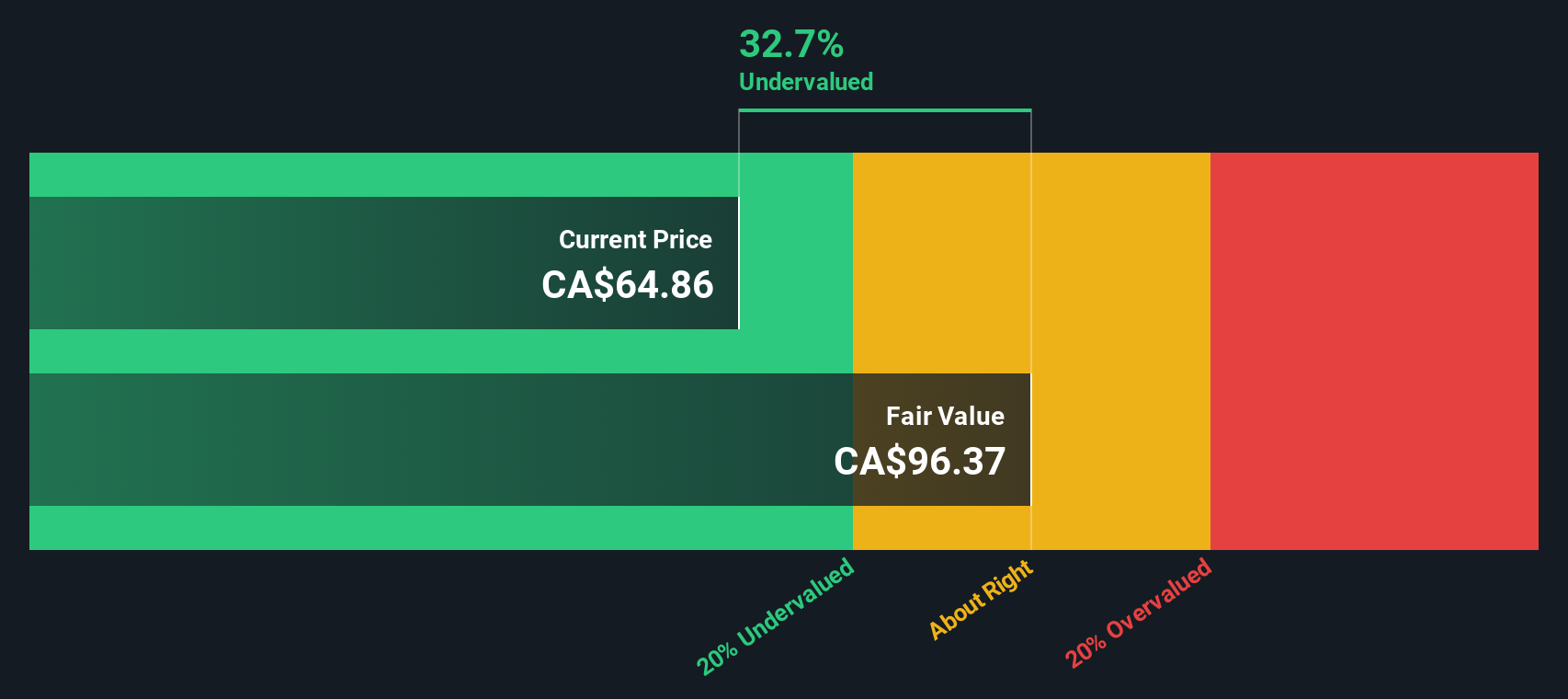

Boardwalk’s recent quarter drew investor attention after reporting higher sales and modestly raising full-year growth guidance, even as net income declined year over year. This mixed update fed into an already dynamic year, with a 1-year total shareholder return of -4.3%. The share price ended at $64.86 and has shown some resilience year-to-date. The long-run story remains impressive as total shareholder returns have climbed a striking 113% over five years. Momentum has cooled recently, but the big picture is still one of significant compounding gains.

If you’re curious what else is showing strong performance in real estate and beyond, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With sales rising but net income sliding this quarter, and a share price still well below analyst targets, the real question for investors is whether Boardwalk is now a buying opportunity or if the market already expects stronger growth ahead.

Price-to-Earnings of 10.2x: Is it justified?

Boardwalk Real Estate Investment Trust is trading at a price-to-earnings (P/E) ratio of 10.2x, making it look attractively valued relative to its peer group. With a recent closing price of CA$64.86, this multiple suggests the stock may be underappreciated compared to both its industry and sector averages.

The price-to-earnings ratio is a key measure for comparing how much investors are willing to pay for each dollar of earnings. In the context of real estate investment trusts, a lower P/E can signal undervaluation if the underlying business maintains solid earnings and steady cash flows.

Compared to the North American Residential REITs industry average of 26.9x and a Canadian peer average of 29.8x, Boardwalk's P/E is notably lower. This significant discount could indicate the market is cautious about recent earnings volatility or is overlooking a potential recovery story. If market sentiment changes, the stock could experience a substantial re-rating closer to peer levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.2x (UNDERVALUED)

However, ongoing earnings volatility and market caution toward the real estate sector could continue to weigh on Boardwalk's valuation in the short term.

Find out about the key risks to this Boardwalk Real Estate Investment Trust narrative.

Another View: Discounted Cash Flow Versus Multiples

While the price-to-earnings ratio paints Boardwalk as undervalued relative to peers, our SWS DCF model comes to a similar conclusion. The stock is trading 32.6% below our estimate of its fair value, suggesting the potential for meaningful upside if market sentiment shifts.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Boardwalk Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Boardwalk Real Estate Investment Trust Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can quickly build your own analysis and insights in just a few minutes. Do it your way

A great starting point for your Boardwalk Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities slip past while you focus on just one stock. Put your portfolio ahead of the curve by acting on trends shaping tomorrow's winners.

- Uncover reliable income with high-yield prospects when you review these 16 dividend stocks with yields > 3% to see which companies are rewarding their shareholders the most.

- Capture the next wave in healthcare innovation by browsing these 31 healthcare AI stocks to pinpoint firms advancing AI-driven medical breakthroughs.

- Ride the momentum of the digital asset revolution by checking out these 82 cryptocurrency and blockchain stocks, where you will find companies at the forefront of cryptocurrency and blockchain evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boardwalk Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEI.UN

Boardwalk Real Estate Investment Trust

Boardwalk REIT strives to be Canada's friendliest community provider and the first choice in multi-family communities to work, invest, and call home with our Boardwalk Family Forever.

Undervalued with slight risk.

Market Insights

Community Narratives