- Canada

- /

- Residential REITs

- /

- TSX:BEI.UN

Boardwalk REIT (TSX:BEI.UN): Assessing Value After Recent Share Price Shifts

Reviewed by Simply Wall St

Price-to-Earnings of 10.6x: Is it justified?

Boardwalk Real Estate Investment Trust appears undervalued compared to its peers when using the price-to-earnings ratio as a benchmark. Its P/E multiple of 10.6x is less than half the industry average, suggesting the market may be discounting potential growth or underlying fundamentals.

The price-to-earnings ratio compares a company's share price to its earnings per share. This ratio offers a quick sense of how the market values a company's profits. For REITs, this metric is especially relevant because it helps investors weigh current earnings in relation to sector norms.

This gap could reflect skepticism about Boardwalk’s growth prospects or may point to a potential opportunity for value-focused investors. The key question is whether the market is underestimating future earnings or if there are underlying reasons for the discount.

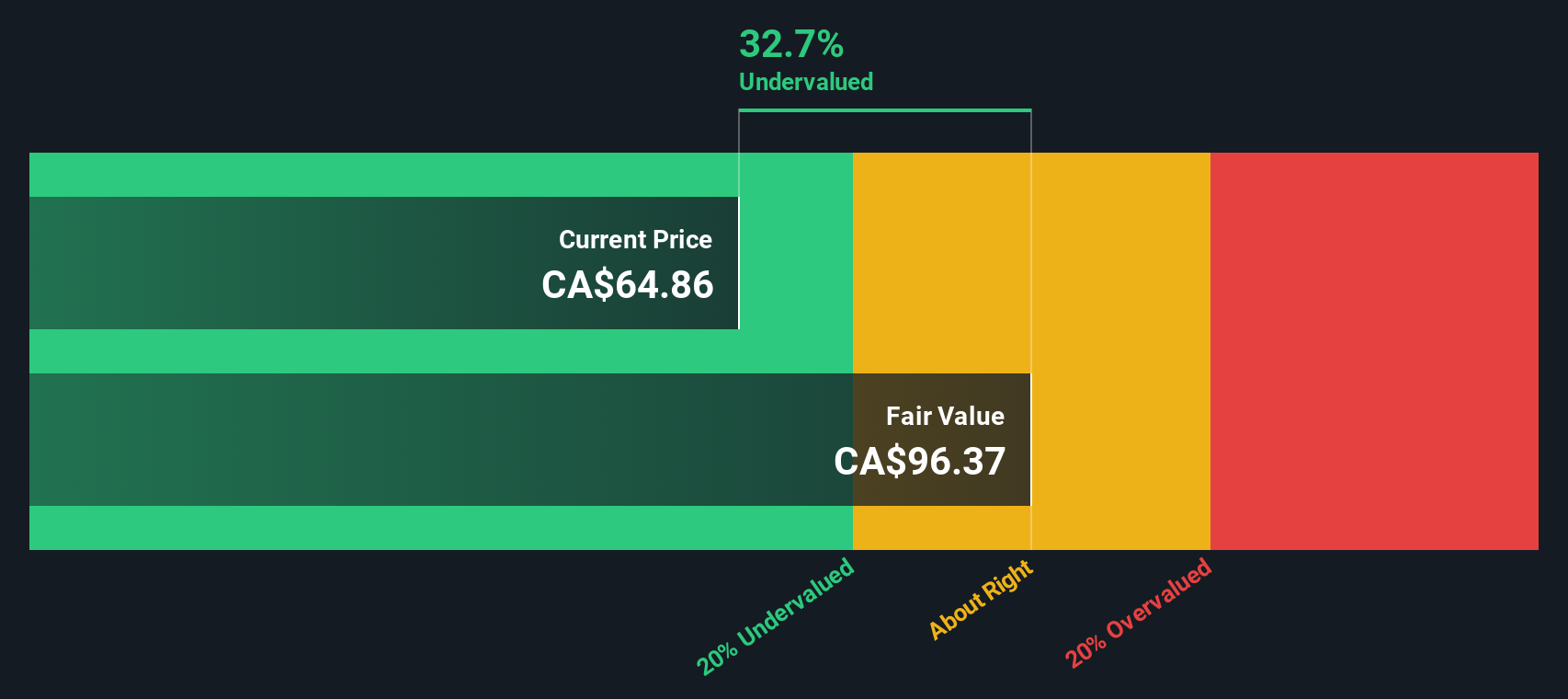

Result: Fair Value of $93.89 (UNDERVALUED)

See our latest analysis for Boardwalk Real Estate Investment Trust.However, continued earnings stagnation or shifts in sector sentiment could quickly offset the current value case for Boardwalk's shares.

Find out about the key risks to this Boardwalk Real Estate Investment Trust narrative.Another View: What Does the SWS DCF Model Say?

Taking a different approach, our DCF model also points to undervaluation for Boardwalk Real Estate Investment Trust. While both methods line up, the question remains: is the market really missing something bigger here, or is caution still justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boardwalk Real Estate Investment Trust Narrative

If you have a different perspective or prefer to form your own conclusions, you can assemble a personal view of the story in just a few minutes. Do it your way.

A great starting point for your Boardwalk Real Estate Investment Trust research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your research to just one company when you could uncover a world of opportunities? The market is full of unique stocks making waves right now. Let’s help you stay ahead with the right tools.

- Uncover hidden gems offering strong financial stability by checking out penny stocks with strong financials that may be flying under the radar.

- Target steady returns and boost your income potential with dividend stocks with yields > 3% that meet higher yield standards.

- Catch technology game-changers early by searching through AI penny stocks powering breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boardwalk Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:BEI.UN

Boardwalk Real Estate Investment Trust

Boardwalk REIT strives to be Canada's friendliest community provider and the first choice in multi-family communities to work, invest, and call home with our Boardwalk Family Forever.

Undervalued with slight risk.

Market Insights

Community Narratives