- Canada

- /

- Specialized REITs

- /

- TSX:APR.UN

Automotive Properties Real Estate Investment Trust (TSE:APR.UN) Shareholders Have Enjoyed A 23% Share Price Gain

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the Automotive Properties Real Estate Investment Trust (TSE:APR.UN) share price is 23% higher than it was a year ago, much better than the market return of around 7.7% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 17% in three years.

View our latest analysis for Automotive Properties Real Estate Investment Trust

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Automotive Properties Real Estate Investment Trust actually shrank its EPS by 91%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Absent any improvement, we don't think a thirst for dividends is pushing up the Automotive Properties Real Estate Investment Trust's share price. It seems far more likely that the 39% boost to the revenue over the last year, is making the difference. After all, it's not necessarily a bad thing if a business sacrifices profits today in pursuit of profit tomorrow (metaphorically speaking).

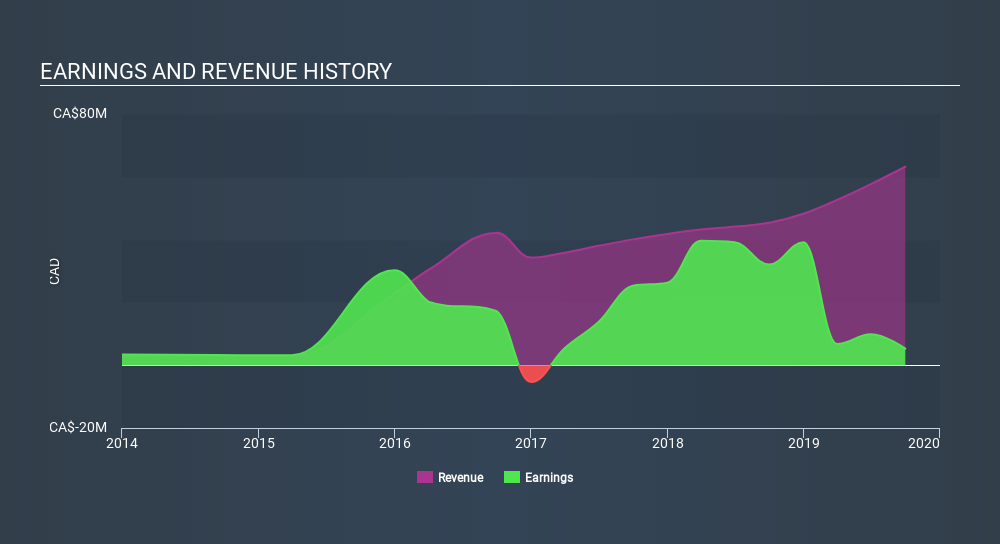

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Automotive Properties Real Estate Investment Trust, it has a TSR of 32% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Automotive Properties Real Estate Investment Trust shareholders have gained 32% (in total) over the last year. That's including the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 13%. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Automotive Properties Real Estate Investment Trust is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:APR.UN

Automotive Properties Real Estate Investment Trust

Automotive Properties REIT is an internally managed, unincorporated, open-ended real estate investment trust focused on owning and acquiring primarily income-producing automotive dealership properties located in Canada.

Good value average dividend payer.