- Canada

- /

- Construction

- /

- TSX:BDGI

3 Stocks That May Be Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

In the wake of recent global market shifts, where U.S. stocks have surged to record highs fueled by optimism over potential policy changes and tax reforms, investors are keenly observing opportunities that may arise from these developments. Amidst this environment, identifying stocks that are potentially trading below their estimated fair value can be a prudent strategy for those looking to capitalize on undervalued assets in a market characterized by heightened expectations and evolving economic policies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$178.25 | CA$354.07 | 49.7% |

| KMC (Kuei Meng) International (TWSE:5306) | NT$125.00 | NT$248.24 | 49.6% |

| Aidma Holdings (TSE:7373) | ¥1698.00 | ¥3388.64 | 49.9% |

| Adventure (TSE:6030) | ¥3590.00 | ¥7109.49 | 49.5% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.35 | CN¥22.56 | 49.7% |

| Laboratorio Reig Jofre (BME:RJF) | €2.87 | €5.74 | 50% |

| Medios (XTRA:ILM1) | €14.76 | €29.48 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3925.00 | ¥7814.84 | 49.8% |

| Delixi New Energy Technology (SHSE:603032) | CN¥17.95 | CN¥35.78 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.47 | €64.68 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Mobile Telecommunications Company Saudi Arabia (SASE:7030)

Overview: Mobile Telecommunications Company Saudi Arabia offers mobile telecommunication services within the Kingdom of Saudi Arabia and has a market capitalization of SAR9.51 billion.

Operations: The company's revenue segments include SAR9.79 billion from Mobile Telecommunications Company, SAR1.05 billion from Zain Sales Company, and SAR334.31 million from Zain Payments Company-Tamam, with a minor contribution of SAR0.17 million from Zain Drones Company.

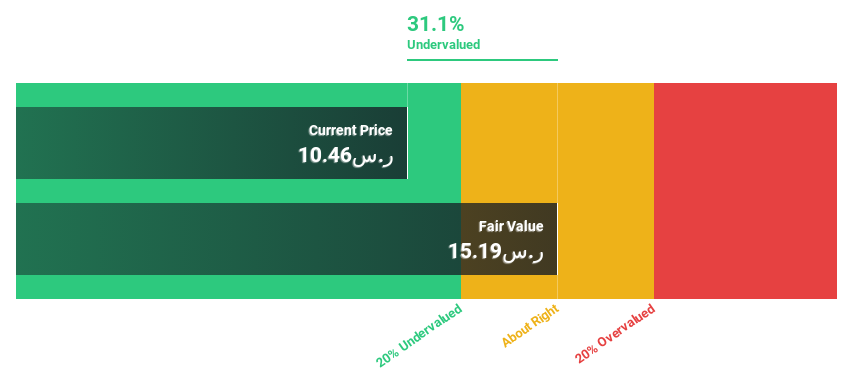

Estimated Discount To Fair Value: 30.3%

Mobile Telecommunications Company Saudi Arabia is trading at SAR 10.58, significantly below its estimated fair value of SAR 15.19, suggesting it may be undervalued based on cash flows. Despite recent earnings growth and expected annual profit growth of 23.7%, challenges include interest payments not well covered by earnings and a low forecasted return on equity of 6.2%. Revenue is projected to grow faster than the Saudi Arabian market average over the next few years.

- Insights from our recent growth report point to a promising forecast for Mobile Telecommunications Company Saudi Arabia's business outlook.

- Click to explore a detailed breakdown of our findings in Mobile Telecommunications Company Saudi Arabia's balance sheet health report.

JAPAN MATERIAL (TSE:6055)

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics sectors in Japan with a market cap of ¥184.21 billion.

Operations: The company generates revenue through its Electronics segment at ¥47.65 billion, Graphics Solution Business at ¥1.56 billion, and Solar Power Generation Business at ¥206 million.

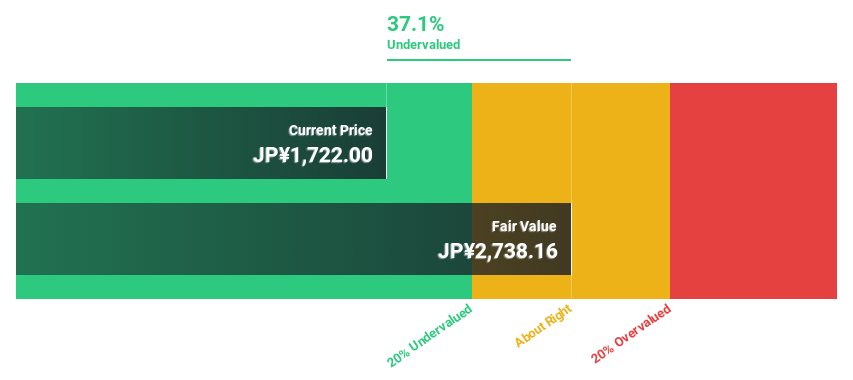

Estimated Discount To Fair Value: 34%

JAPAN MATERIAL is trading at ¥1793, approximately 34% below its estimated fair value of ¥2715.02, highlighting potential undervaluation based on cash flows. While earnings are expected to grow significantly at 20% annually, surpassing the JP market's growth rate, revenue growth is slower at 12.7%. Despite this, both metrics outpace market averages. However, challenges include a low forecasted return on equity of 17.9%, and recent share price volatility may concern investors.

- According our earnings growth report, there's an indication that JAPAN MATERIAL might be ready to expand.

- Unlock comprehensive insights into our analysis of JAPAN MATERIAL stock in this financial health report.

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$1.30 billion.

Operations: The company generates revenue of $730.92 million from its non-destructive excavating services in Canada and the United States.

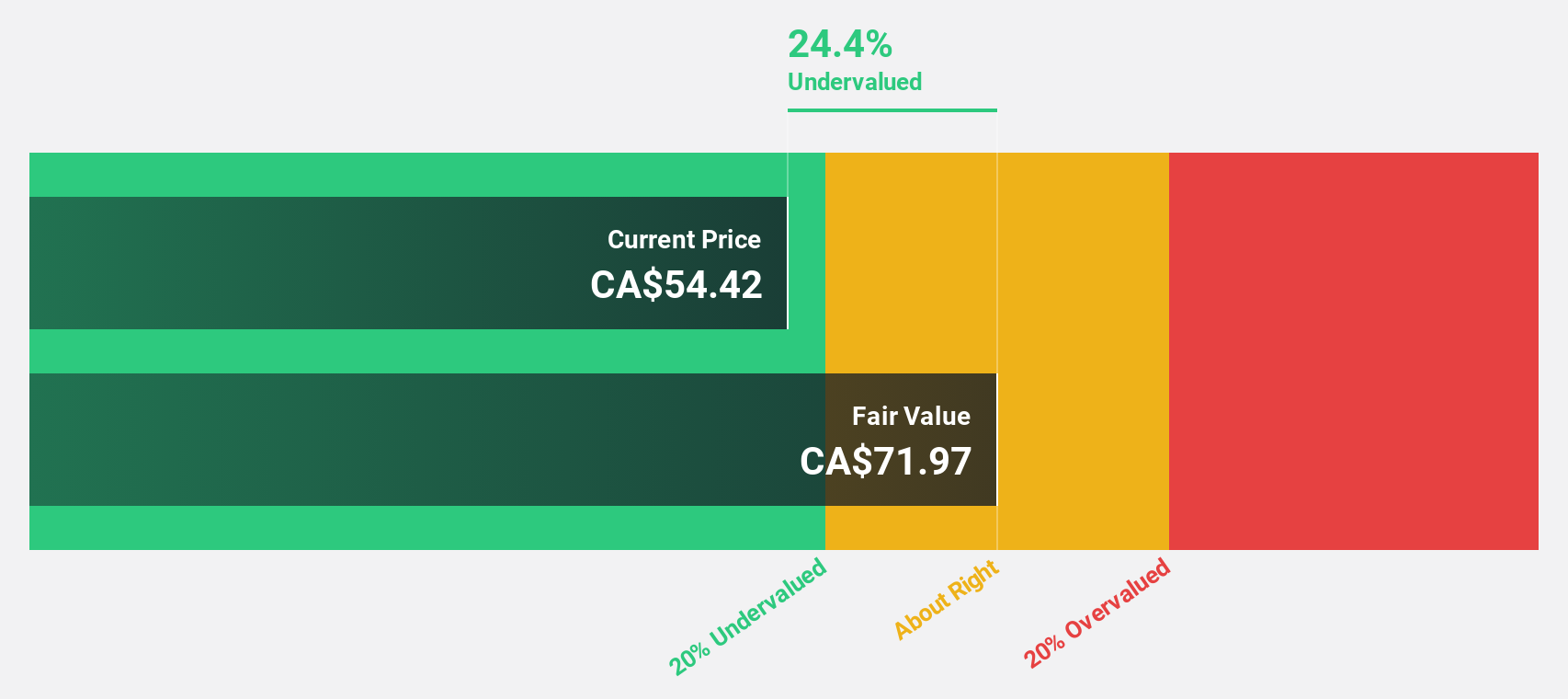

Estimated Discount To Fair Value: 29.6%

Badger Infrastructure Solutions is trading at CA$38.25, over 20% below its estimated fair value of CA$54.33, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 37.3% annually, outpacing the Canadian market's growth rate of 16.6%. However, revenue growth is slower at 9.5%, and the company holds a high level of debt with an unstable dividend track record, which may concern investors despite strong earnings prospects.

- Our earnings growth report unveils the potential for significant increases in Badger Infrastructure Solutions' future results.

- Delve into the full analysis health report here for a deeper understanding of Badger Infrastructure Solutions.

Make It Happen

- Unlock our comprehensive list of 890 Undervalued Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Very undervalued with high growth potential and pays a dividend.