- Canada

- /

- Office REITs

- /

- TSX:AP.UN

Swing to Net Losses Despite Steady Sales Could Be a Game Changer for Allied (TSX:AP.UN)

Reviewed by Simply Wall St

- On July 29, 2025, Allied Properties Real Estate Investment Trust reported a shift to a net loss of C$94.74 million in the second quarter, with sales of C$145.05 million, compared to a profit a year earlier.

- This marks a significant decline in profitability for the company, as it moved from positive net income to substantial losses despite relatively stable revenue.

- We'll explore how this swing to net losses, even with steady sales, could affect Allied Properties' investment narrative going forward.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Allied Properties Real Estate Investment Trust's Investment Narrative?

For Allied Properties REIT, the investment case has often leaned on consistent revenue, appealing property assets, and a historically reliable dividend. However, the recent report of a C$94.74 million net loss in the second quarter shifts the spotlight onto short-term catalysts and risks. In the immediate future, investors will likely be focused on how management addresses profitability in the face of stable sales but ongoing losses. The prior optimism around a possible return to profit within three years now faces greater uncertainty, raising concerns about debt servicing and dividend sustainability as key risks. While the fundamentals, such as experienced leadership and attractive price-to-fair-value discount, remain relevant, the size and persistence of these losses indicate that any catalyst, like occupancy improvement or asset recycling, must now be scrutinized against heightened financial headwinds. The latest results could materially change risk calculations for many.

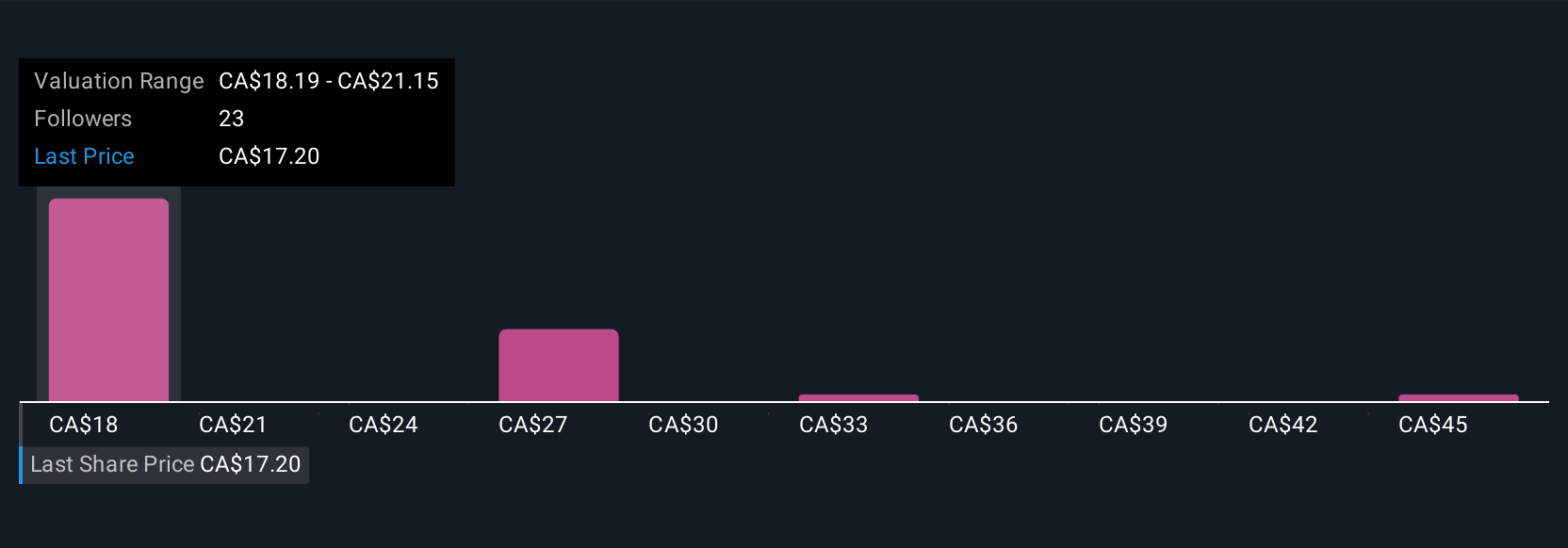

But sustained losses may challenge Allied’s ability to keep funding its current dividend. Despite retreating, Allied Properties Real Estate Investment Trust's shares might still be trading 37% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 9 other fair value estimates on Allied Properties Real Estate Investment Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Allied Properties Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allied Properties Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Allied Properties Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allied Properties Real Estate Investment Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives