The board of NexLiving Communities Inc. (CVE:NXLV) has announced that it will pay a dividend of CA$0.01 per share on the 27th of September. The dividend yield will be 1.9% based on this payment which is still above the industry average.

Check out our latest analysis for NexLiving Communities

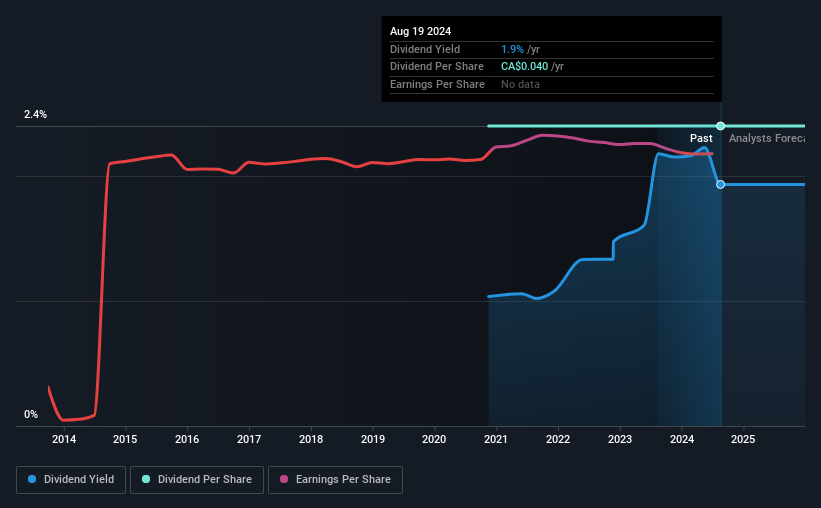

NexLiving Communities' Distributions May Be Difficult To Sustain

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even though NexLiving Communities isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share could rise by 29.9% over the next year if the trend from the last few years continues. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

NexLiving Communities Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The payments haven't really changed that much since 4 years ago. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. NexLiving Communities has seen EPS rising for the last five years, at 30% per annum. Even though the company is not profitable, it is growing at a solid clip. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

Our Thoughts On NexLiving Communities' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for NexLiving Communities you should be aware of, and 1 of them doesn't sit too well with us. Is NexLiving Communities not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if NexLiving Communities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NXLV

NexLiving Communities

Owns and manages multi-unit residential real estate properties in Canada.

Proven track record with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success