- Canada

- /

- Real Estate

- /

- TSXV:BRED

Not Many Are Piling Into Purebread Brands Inc. (CVE:BRED) Stock Yet As It Plummets 33%

Purebread Brands Inc. (CVE:BRED) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

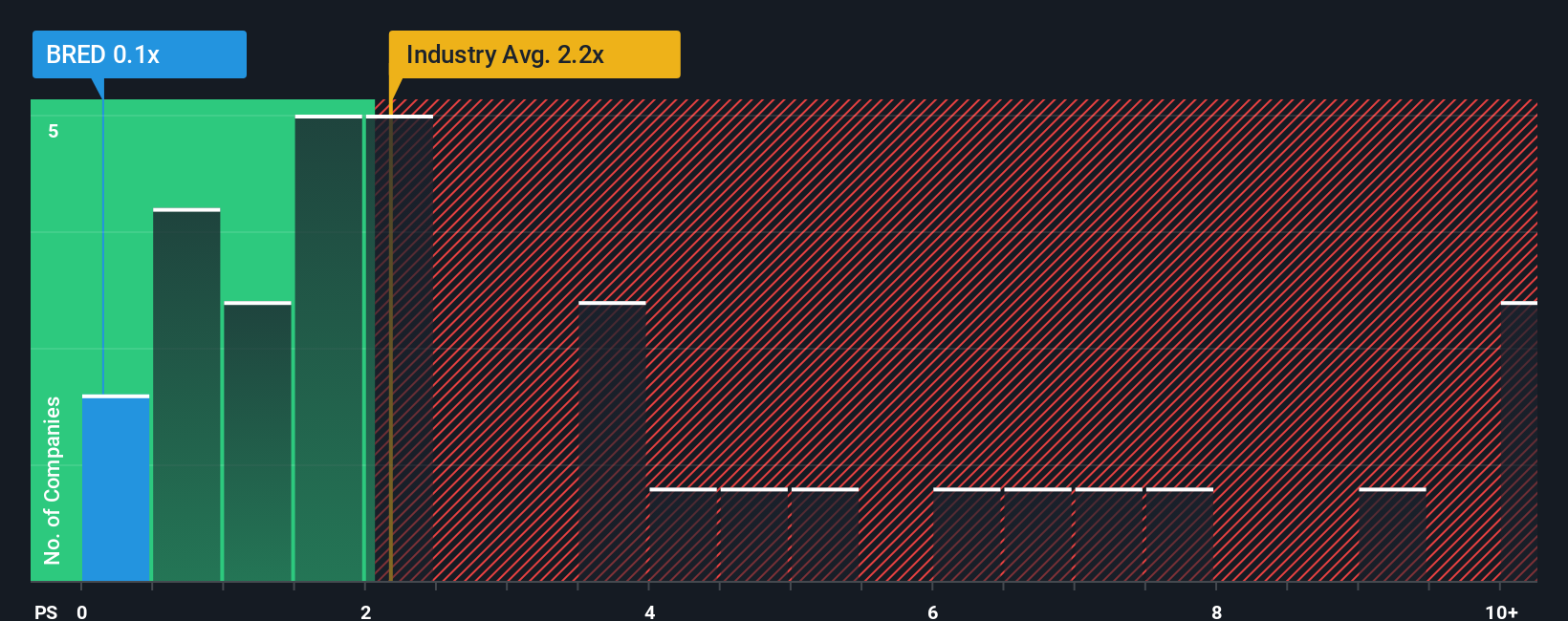

Since its price has dipped substantially, Purebread Brands' price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Real Estate industry in Canada, where around half of the companies have P/S ratios above 2.2x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Purebread Brands

How Has Purebread Brands Performed Recently?

With revenue growth that's exceedingly strong of late, Purebread Brands has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Purebread Brands will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Purebread Brands would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 126% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 7.1%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Purebread Brands' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Purebread Brands' P/S?

Purebread Brands' P/S looks about as weak as its stock price lately. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Purebread Brands currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Purebread Brands.

If you're unsure about the strength of Purebread Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BRED

Purebread Brands

A commercial real estate and food technology company, operates fast-casual cafes, bakeries, and shared-kitchen facilities in Canada.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success