- Canada

- /

- Real Estate

- /

- TSX:SVI

Successful Hybrid Debenture Offering Could Be a Game Changer for StorageVault Canada (TSX:SVI)

Reviewed by Sasha Jovanovic

- StorageVault Canada Inc. recently completed a CAD 50 million offering of 5.60% senior unsecured hybrid debentures, which will trade on the Toronto Stock Exchange under the symbol SVI.DB.D.

- This move is designed to reduce bank debt, support future acquisitions, and strengthen the company’s financial flexibility amid ongoing growth within Canada’s storage sector.

- We'll explore how funding flexibility from this successful debenture offering shapes the company’s evolving investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is StorageVault Canada's Investment Narrative?

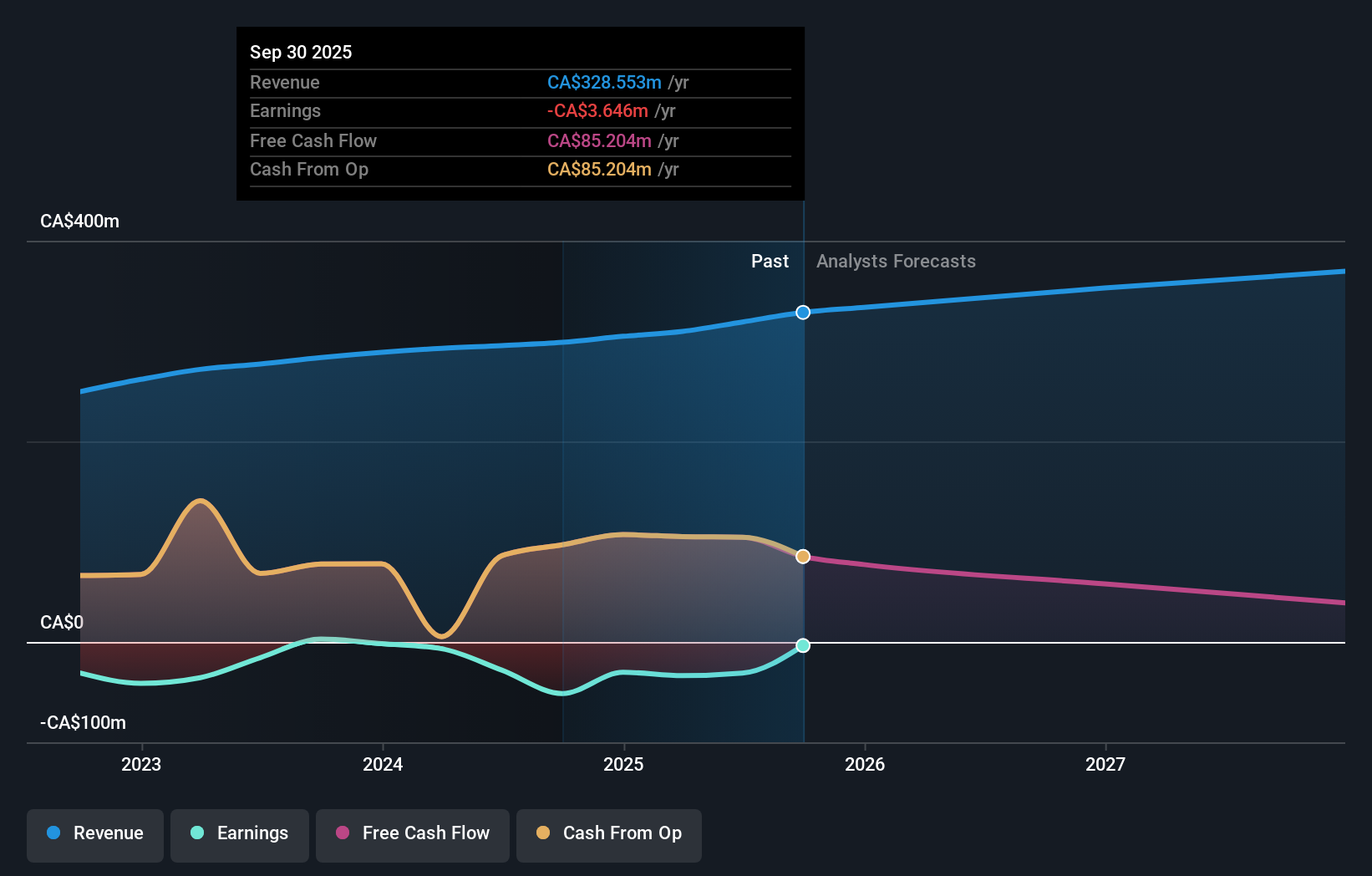

To get behind StorageVault Canada as a shareholder, it's important to see value in its ability to grow and consolidate within Canada's self-storage sector, especially as it builds out diverse service offerings. The recent CAD 50 million hybrid debenture offering, now trading as SVI.DB.D, directly increases StorageVault's financial flexibility and fuels its acquisition engine. Previously, the conversation was centered on strong revenue gains but the challenge of persistent unprofitability, relatively high valuation multiples, and ongoing integration risk from frequent acquisitions. Now, with the new funding set to pay down bank debt and support further expansion, StorageVault may be better positioned to manage near term catalysts, such as additional acquisitions or expansion of its management platform. At the same time, this financing move slightly eases but does not eliminate some of the biggest risks, like balance sheet pressure and integration challenges from rapid growth, which remain relevant, especially if acquisition execution falters or market conditions shift.

However, funding flexibility alone does not make the ongoing integration risk disappear for investors.

Exploring Other Perspectives

Explore 2 other fair value estimates on StorageVault Canada - why the stock might be worth as much as 19% more than the current price!

Build Your Own StorageVault Canada Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StorageVault Canada research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free StorageVault Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StorageVault Canada's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Mediocre balance sheet with concerning outlook.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026