- Canada

- /

- Real Estate

- /

- TSX:SVI

Earnings Surge and Toronto Expansion Could Be a Game Changer for StorageVault Canada (TSX:SVI)

Reviewed by Sasha Jovanovic

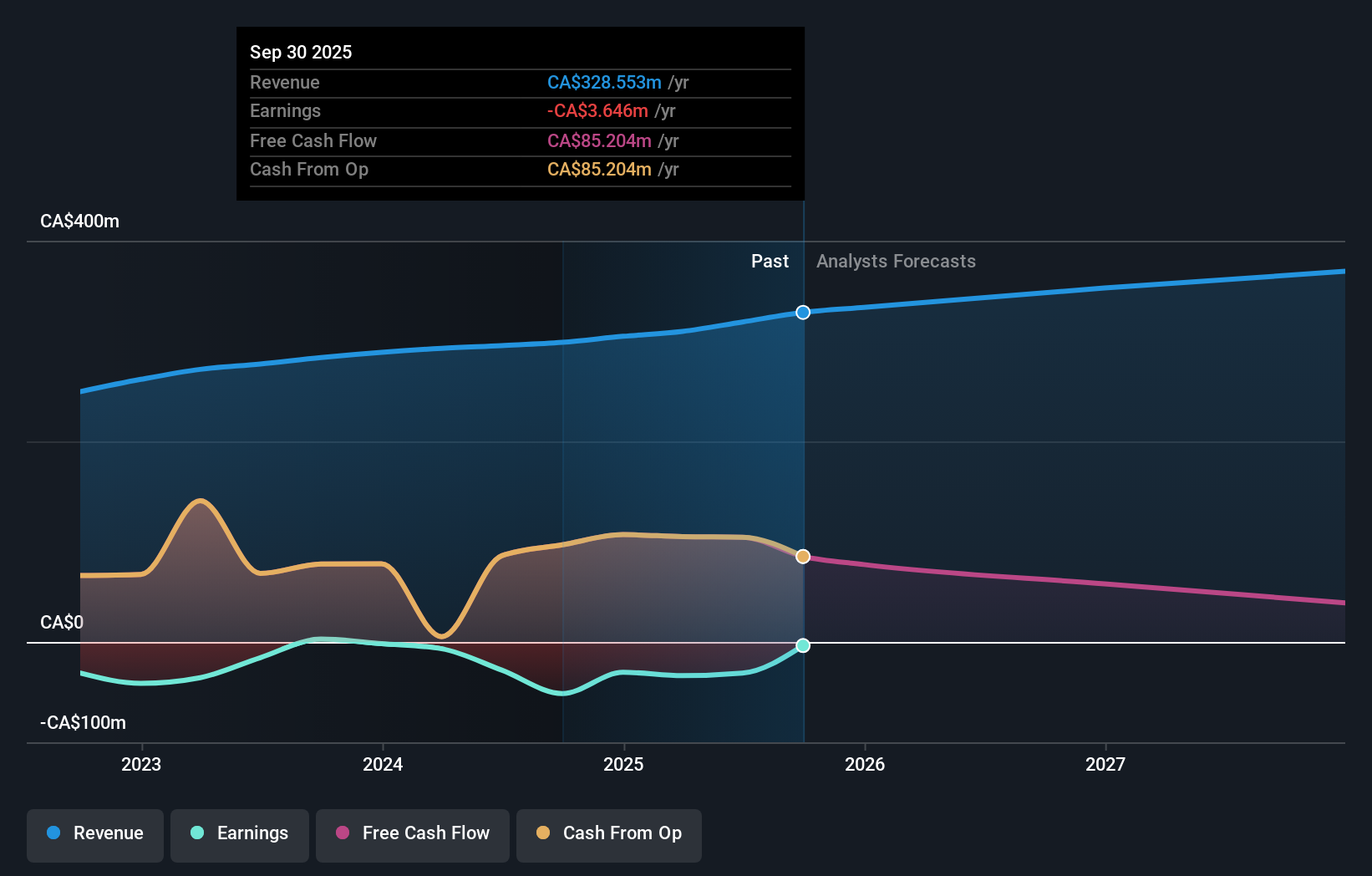

- StorageVault Canada Inc. reported third quarter 2025 earnings showing a significant increase in revenue to C$88.52 million and a turnaround to C$20.49 million in net income, alongside the expansion of its third-party management platform into high-profile Toronto locations and final proceeds from a property expropriation gain.

- The company also announced a 0.5% increase in its upcoming quarterly dividend, reflecting confidence in its operational momentum and future outlook.

- With StorageVault's urban management platform expansion standing out, we assess how these developments may shape its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is StorageVault Canada's Investment Narrative?

To be a shareholder in StorageVault Canada right now, it comes down to a belief in the company’s ability to drive steady self-storage demand in urban centers and execute on its expansion strategy, even with near-term profitability remaining a moving target. The strong Q3 results, swinging to a C$20.49 million net profit and notable third-party management wins in Toronto, partly reset expectations for a business that was previously unprofitable but had been cutting losses and ramping up revenue growth. The recent expropriation gain adds immediate cash and boosts headline numbers but likely only has a transient impact on the bigger story: managing acquisition integration, pricing power, and margins in a crowded Canadian storage market. The modest dividend increase signals board confidence, but persistent insider selling and premium price-to-sales multiples still shape the main risks. So while the recent momentum could fuel optimism, core questions about long-term profitability and valuation remain in play.

However, persistent insider selling could signal caution for investors tracking management confidence.

Exploring Other Perspectives

Explore 2 other fair value estimates on StorageVault Canada - why the stock might be worth less than half the current price!

Build Your Own StorageVault Canada Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StorageVault Canada research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StorageVault Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StorageVault Canada's overall financial health at a glance.

No Opportunity In StorageVault Canada?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Mediocre balance sheet with concerning outlook.

Market Insights

Community Narratives