- Canada

- /

- Real Estate

- /

- TSX:GDC

Discover 3 TSX Penny Stocks Under CA$300M Market Cap

Reviewed by Simply Wall St

Despite rising tariff rates, the Canadian market has shown resilience with inflation and economic data remaining stable, even as oil and energy prices have helped keep costs manageable. Penny stocks, often seen as relics of past market trends, still hold potential for growth by offering affordability and opportunities in smaller or newer companies. In this article, we explore three penny stocks that combine financial strength with the potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.67 | CA$70.8M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.11 | CA$107.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.80 | CA$176.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.43 | CA$171.55M | ✅ 1 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.69 | CA$153.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$185.15M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.80 | CA$10.51M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 449 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Genesis Land Development (TSX:GDC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genesis Land Development Corp., with a market cap of CA$181.46 million, is an integrated land developer and residential home builder focusing on owning and developing residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Operations: The company generates its revenue primarily from its home building segment, which reported CA$251.89 million.

Market Cap: CA$181.46M

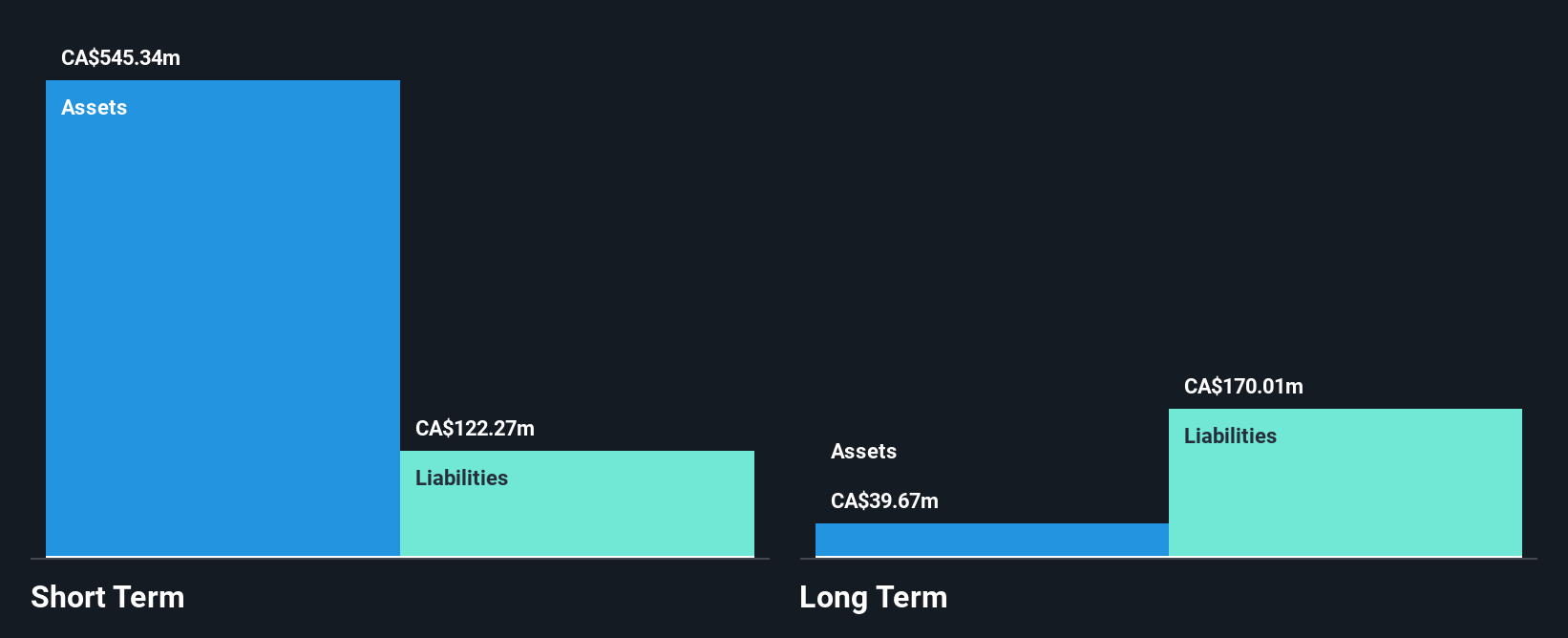

Genesis Land Development Corp. has shown significant earnings growth, with an 81.6% increase over the past year, surpassing the Real Estate industry average. Despite a low return on equity of 14.6%, its net profit margins have improved to 11%. The company's debt is not well covered by operating cash flow, yet interest payments are well managed with EBIT coverage at 13.7 times. Recent executive changes include Parveshindera Sidhu's appointment as CEO and President, potentially impacting strategic direction. Genesis declared a special dividend of CA$0.105 per share and completed a minor share buyback, reflecting shareholder value initiatives amidst stable weekly volatility.

- Click to explore a detailed breakdown of our findings in Genesis Land Development's financial health report.

- Evaluate Genesis Land Development's historical performance by accessing our past performance report.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector in Canada with a market capitalization of CA$266.61 million.

Operations: The company's revenue is derived from two segments: E-commerce, contributing CA$27.83 million, and Bricks and Mortar, generating CA$522.42 million.

Market Cap: CA$266.61M

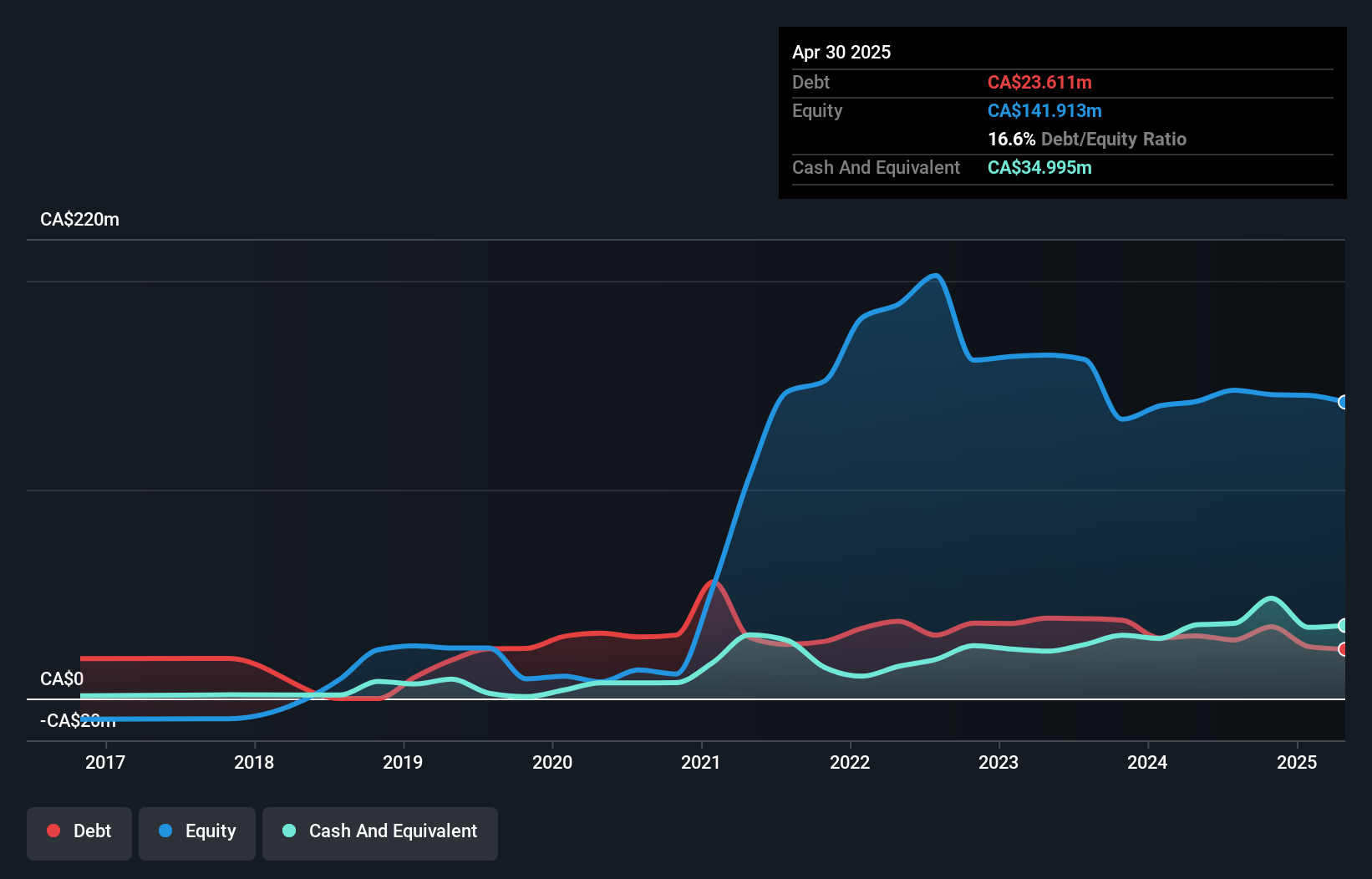

High Tide Inc. is expanding its retail footprint with recent openings bringing its Canna Cabana store count to 202 locations across Canada, including strategic sites in Winnipeg and Toronto. Despite being unprofitable with a negative return on equity of -6.7%, the company maintains a stable financial position, having more cash than debt and sufficient short-term assets to cover liabilities. Recent private placement secured CA$30 million from Cronos Group Inc., enhancing liquidity for future operations. While earnings are forecasted to grow substantially, current net losses have increased compared to the previous year, reflecting ongoing challenges in profitability amidst growth initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of High Tide.

- Review our growth performance report to gain insights into High Tide's future.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sintana Energy Inc. is involved in the exploration and development of crude oil and natural gas, with a market capitalization of CA$234.31 million.

Operations: Sintana Energy Inc. has not reported any specific revenue segments.

Market Cap: CA$234.31M

Sintana Energy Inc. remains pre-revenue with a market cap of CA$234.31 million and is currently unprofitable, reporting increased net losses over the past year. Despite this, the company holds strategic assets such as its 49% interest in Namibia's PEL 79, recently granted a license extension to July 2026. This asset is positioned near promising oil prospects and ongoing exploration activities by other operators could enhance its value potential. Sintana has also formed a strategic partnership with Corcel plc for opportunities in Angola's Kwanza Basin, potentially diversifying its future revenue streams despite current financial challenges and going concern doubts from auditors.

- Dive into the specifics of Sintana Energy here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Sintana Energy's track record.

Where To Now?

- Access the full spectrum of 449 TSX Penny Stocks by clicking on this link.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GDC

Genesis Land Development

An integrated land developer and residential home builder, owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives