Khiron Life Sciences Corp. (CVE:KHRN) Stock's 47% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Khiron Life Sciences Corp. (CVE:KHRN) shares are down a considerable 47% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 84% share price decline.

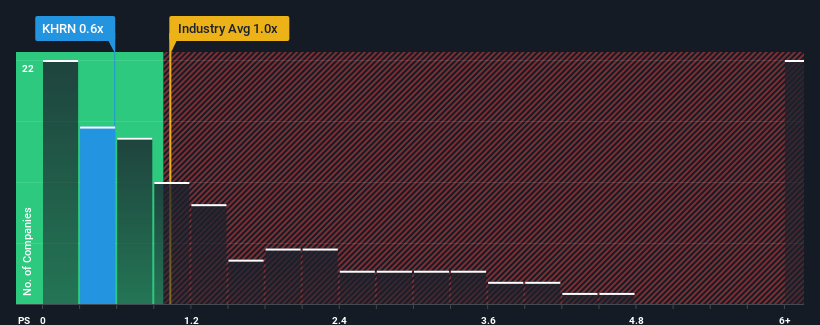

Although its price has dipped substantially, there still wouldn't be many who think Khiron Life Sciences' price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Canada's Pharmaceuticals industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Khiron Life Sciences

How Has Khiron Life Sciences Performed Recently?

Khiron Life Sciences could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Khiron Life Sciences will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Khiron Life Sciences' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. The strong recent performance means it was also able to grow revenue by 103% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 69% over the next year. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Khiron Life Sciences' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Khiron Life Sciences' share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Khiron Life Sciences' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Khiron Life Sciences (3 shouldn't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Khiron Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:KHRN.H

Khiron Life Sciences

Operates as an integrated medical and cannabis company in Latin America and Europe.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives