Canopy Growth Corporation's (TSE:WEED) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the Canopy Growth Corporation (TSE:WEED) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

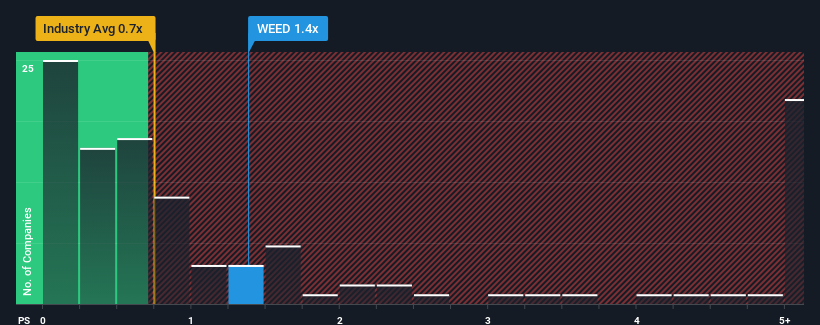

Even after such a large drop in price, given close to half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Canopy Growth as a stock to potentially avoid with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Canopy Growth

What Does Canopy Growth's Recent Performance Look Like?

Canopy Growth could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Canopy Growth's future stacks up against the industry? In that case, our free report is a great place to start.How Is Canopy Growth's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Canopy Growth's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.4%. This means it has also seen a slide in revenue over the longer-term as revenue is down 50% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 7.1% each year as estimated by the nine analysts watching the company. With the industry predicted to deliver 8.4% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Canopy Growth is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Despite the recent share price weakness, Canopy Growth's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Canopy Growth currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Before you settle on your opinion, we've discovered 2 warning signs for Canopy Growth (1 is a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of Canopy Growth's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WEED

Canopy Growth

Engages in the production, distribution, and sale of cannabis, hemp, and cannabis-related products in Canada, Germany, and Australia.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives