- Canada

- /

- Energy Services

- /

- TSX:AKT.A

AKITA Drilling And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

The Canadian market has been navigating a landscape of uncertainty, with recent tariff threats and political ambiguities influencing investor sentiment. Amidst these challenges, investors often look for opportunities that balance affordability with growth potential. Penny stocks, despite their somewhat outdated name, continue to offer intriguing possibilities for those seeking hidden value in smaller or newer companies. These stocks can present significant upside when backed by strong financials and solid fundamentals, making them an area of interest for discerning investors looking beyond the surface of larger market movements.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.58 | CA$168.53M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$450.76M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.89 | CA$78.83M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$595.66M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.06 | CA$36.92M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.93 | CA$79.09M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$30.09M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.43 | CA$3.43B | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.83 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AKITA Drilling (TSX:AKT.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AKITA Drilling Ltd. is an oil and gas drilling contractor operating in Canada and the United States, with a market cap of CA$63.92 million.

Operations: AKITA Drilling Ltd. has not reported any specific revenue segments.

Market Cap: CA$63.92M

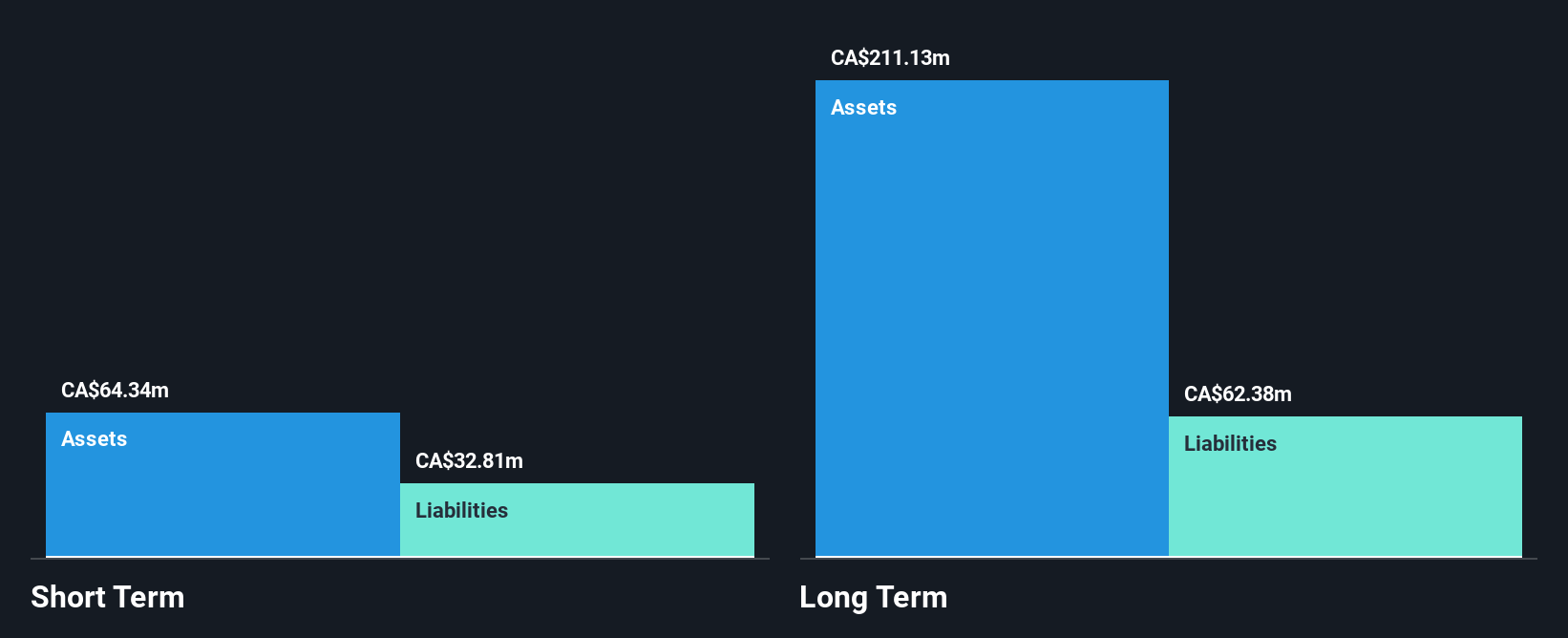

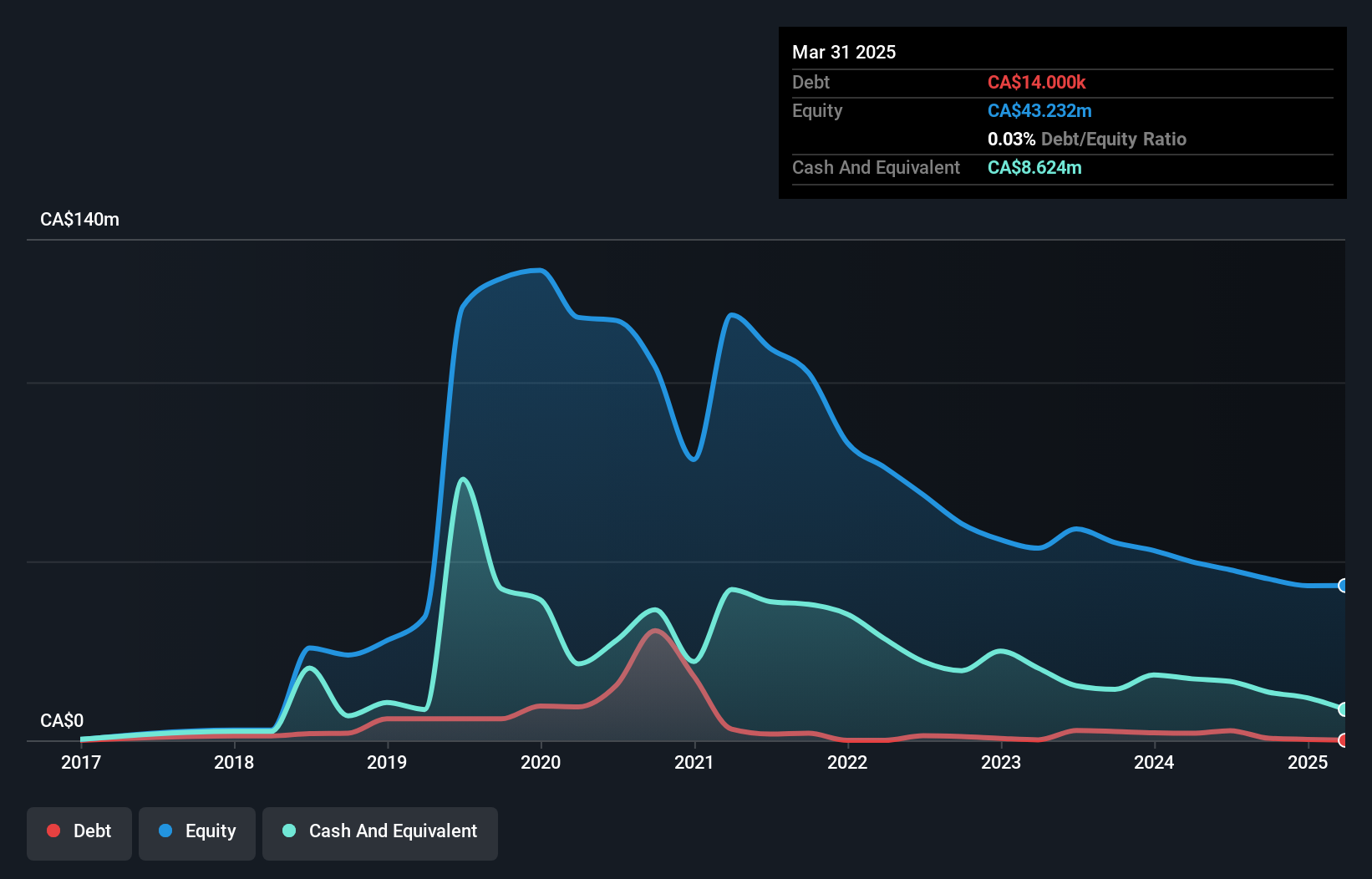

AKITA Drilling Ltd., with a market cap of CA$63.92 million, recently reported a decline in sales to CA$193.33 million for 2024, down from CA$225.48 million the previous year, alongside reduced net income and earnings per share. The company's debt-to-equity ratio has improved over five years to 28.9%, though its return on equity remains low at 7.5%. Despite high-quality past earnings and satisfactory net debt levels, AKITA faces challenges with interest coverage and negative earnings growth over the past year. Revenue is forecasted to grow annually by 9.36%, suggesting potential future recovery opportunities.

- Unlock comprehensive insights into our analysis of AKITA Drilling stock in this financial health report.

- Examine AKITA Drilling's earnings growth report to understand how analysts expect it to perform.

MediPharm Labs (TSX:LABS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MediPharm Labs Corp. is a pharmaceutical company focused on producing and selling purified, pharmaceutical-quality cannabis extracts and derivative products in Canada, Australia, Germany, and internationally, with a market cap of CA$32.89 million.

Operations: The company generates CA$39.05 million in revenue from its operations involving the production and sale of cannabis extracts and derivative products.

Market Cap: CA$32.89M

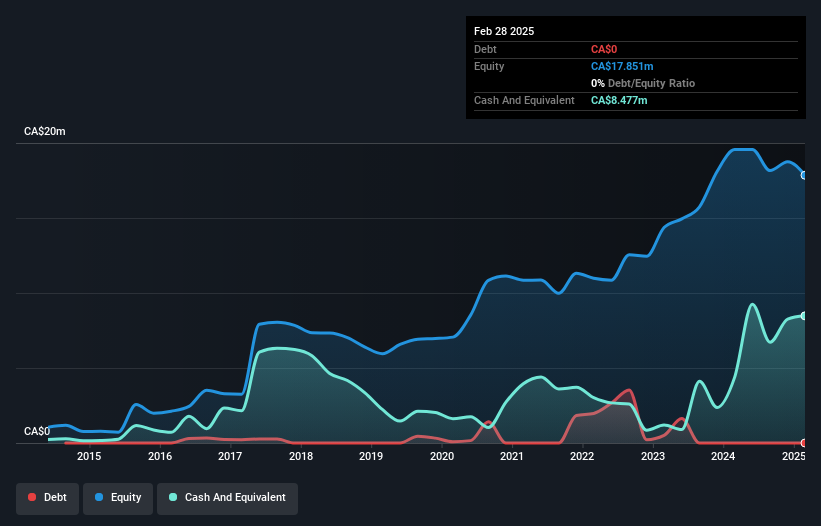

MediPharm Labs Corp., with a market cap of CA$32.89 million, has recently secured a significant commercial agreement with Laboratorio Teuto, expanding its presence in the regulated medical cannabis market. The company achieved ANVISA approval for two products, marking a compliance and quality milestone. Despite being unprofitable and having negative return on equity (-26.09%), MediPharm's revenue is projected to grow by 18.12% annually. Its short-term assets (CA$34.6 million) cover both short- and long-term liabilities, while its debt-to-equity ratio has improved significantly over five years, indicating better financial management amidst high share price volatility.

- Click to explore a detailed breakdown of our findings in MediPharm Labs' financial health report.

- Gain insights into MediPharm Labs' future direction by reviewing our growth report.

Gatekeeper Systems (TSXV:GSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gatekeeper Systems Inc. designs, manufactures, markets, and sells video security solutions for mobile and transportation environments focused on the safety of children, passengers, and public safety in Canada and the United States with a market cap of CA$47.80 million.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, which generated CA$35.27 million.

Market Cap: CA$47.8M

Gatekeeper Systems Inc., with a market cap of CA$47.80 million, is navigating the penny stock landscape by leveraging its video security solutions for transportation safety. The company recently supported Transport Canada's regulation mandating perimeter visibility systems on new school buses, potentially expanding its market reach. Despite being unprofitable, Gatekeeper has reduced losses over five years and maintains a debt-free balance sheet with short-term assets covering liabilities. Recent contracts, including one with the Toronto Transit Commission for an Automated Streetcar Enforcement System pilot valued at CA$460,000, highlight ongoing business development amidst high share price volatility.

- Dive into the specifics of Gatekeeper Systems here with our thorough balance sheet health report.

- Explore historical data to track Gatekeeper Systems' performance over time in our past results report.

Summing It All Up

- Access the full spectrum of 936 TSX Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AKT.A

AKITA Drilling

Operates as an oil and gas drilling contractor in Canada and the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives