- Canada

- /

- Commercial Services

- /

- TSXV:BRM

3 Promising TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

Canadian equities have recently reached new record highs, buoyed by supportive signals from the Bank of Canada and the Federal Reserve. In this context, penny stocks—though a somewhat outdated term—still represent an intriguing investment area, often involving smaller or newer companies that can offer growth potential at lower price points. By focusing on those with robust financials and clear growth trajectories, investors may uncover promising opportunities within this niche market segment.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$53.59M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.27 | CA$249.69M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$123.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.93M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$52.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.33 | CA$884.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.78M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.01 | CA$148.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$189.25M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 389 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

MediPharm Labs (TSX:LABS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MediPharm Labs Corp. is a pharmaceutical company specializing in the production and sale of purified cannabis extracts, concentrates, active pharmaceutical ingredients, and advanced derivative products across Canada, Australia, Germany, and internationally with a market cap of CA$29.45 million.

Operations: The company's revenue primarily comes from the production and sales of cannabis extracts and derivative products, amounting to CA$46.10 million.

Market Cap: CA$29.45M

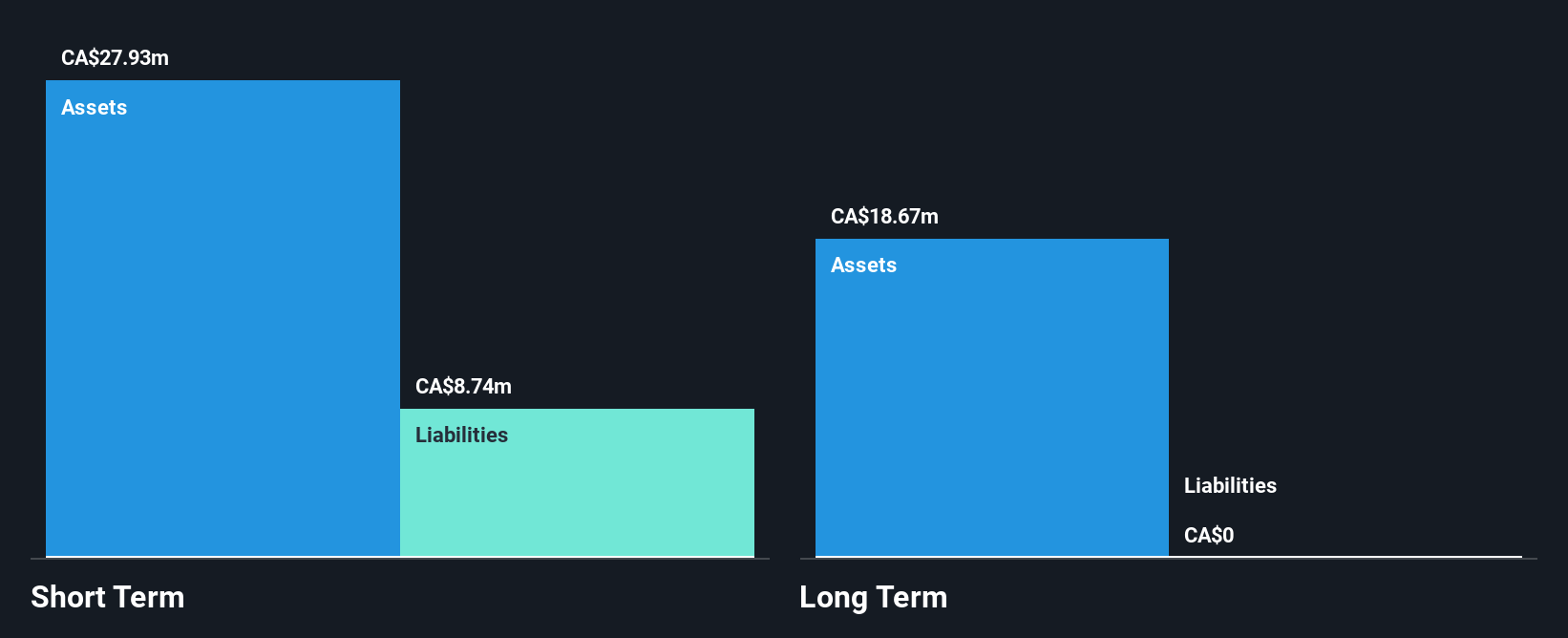

MediPharm Labs, with a market cap of CA$29.45 million, is navigating the volatile penny stock landscape by leveraging its international reach in the cannabis sector. Recent strategic moves include expanding into France's burgeoning medicinal cannabis market and strengthening its board with experienced leadership from Michael Bumby. Despite being unprofitable, MediPharm has shown revenue growth and reduced losses over five years. The company maintains a stable cash position with more cash than debt and no long-term liabilities, though it faces challenges in achieving profitability within the next three years amid ongoing operational adjustments and legal resolutions.

- Unlock comprehensive insights into our analysis of MediPharm Labs stock in this financial health report.

- Understand MediPharm Labs' earnings outlook by examining our growth report.

BioRem (TSXV:BRM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BioRem Inc. is a clean technology engineering company that designs, manufactures, distributes, and sells air pollution control systems to eliminate odors, volatile organic compounds, and hazardous air pollutants, with a market cap of CA$43.15 million.

Operations: The company generates its revenue primarily from the manufacture and sale of pollution control systems, amounting to CA$34.73 million.

Market Cap: CA$43.15M

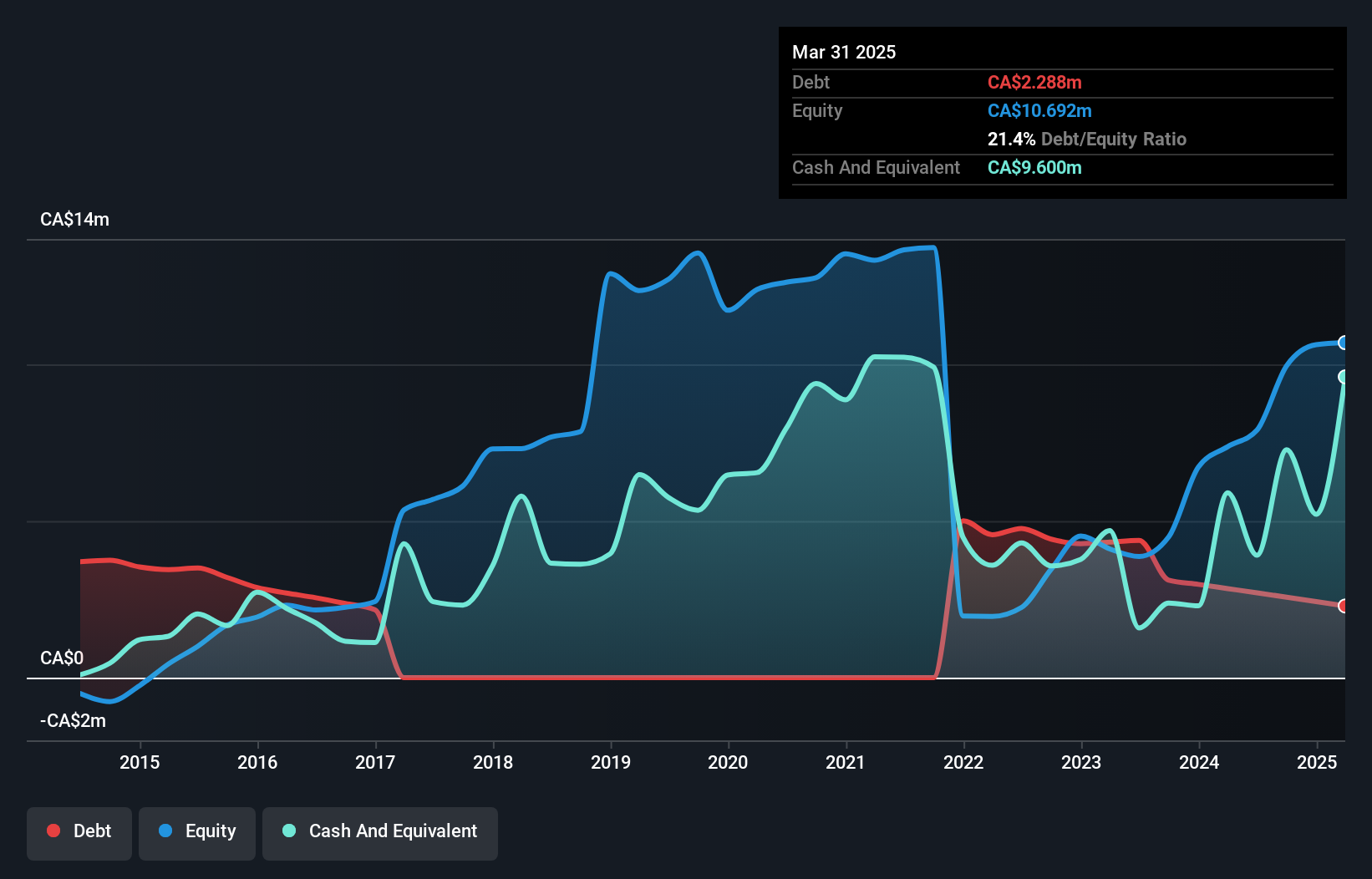

BioRem Inc., with a market cap of CA$43.15 million, shows resilience in the penny stock arena despite recent earnings declines. The company reported third-quarter sales of CA$11.25 million, down from CA$14.89 million a year ago, with net income also decreasing to CA$1.16 million from CA$2.19 million previously. BioRem's financial health is bolstered by high-quality earnings and strong interest coverage at 18.6 times EBIT, alongside more cash than debt and operating cash flow covering debt well at 128%. However, challenges include reduced profit margins and negative recent earnings growth amidst stable weekly volatility and seasoned management oversight.

- Click here and access our complete financial health analysis report to understand the dynamics of BioRem.

- Review our growth performance report to gain insights into BioRem's future.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zentek Ltd. is a Canadian company focused on the research and development of graphene and related nanomaterials, with a market cap of CA$101.94 million.

Operations: The company's revenue segments are not explicitly detailed in the provided text.

Market Cap: CA$101.94M

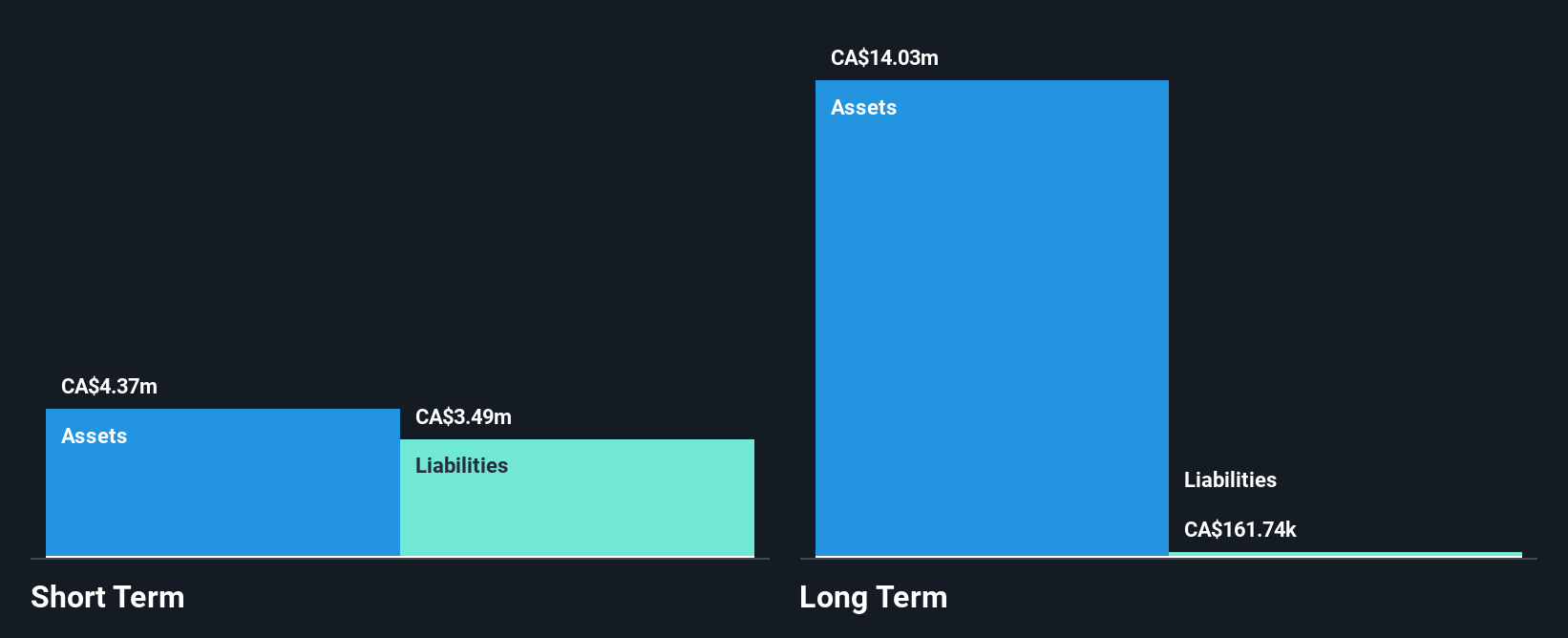

Zentek Ltd., with a market cap of CA$101.94 million, remains pre-revenue, reporting minimal sales of CA$0.064 million for the six months ending September 2025. The company faces financial challenges, as short-term liabilities exceed assets by CA$0.8M and it has only a brief cash runway despite recent capital raises totaling over CA$2 million through private placements. Leadership changes bring potential strategic shifts with the appointment of Mohammed Jiwan as CEO, known for securing investments and driving innovation in technology sectors. Zentek's development of a novel fire-retardant product could offer future commercial opportunities if successfully marketed in collaboration with Altek Advanced Materials Inc.

- Navigate through the intricacies of Zentek with our comprehensive balance sheet health report here.

- Understand Zentek's track record by examining our performance history report.

Key Takeaways

- Jump into our full catalog of 389 TSX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BioRem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BRM

BioRem

A clean technology engineering company, designs, manufactures, distributes, and sells air pollution control systems that are used to eliminate odors, volatile organic compounds, and hazardous air pollutants.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion