After Leaping 29% HLS Therapeutics Inc. (TSE:HLS) Shares Are Not Flying Under The Radar

The HLS Therapeutics Inc. (TSE:HLS) share price has done very well over the last month, posting an excellent gain of 29%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

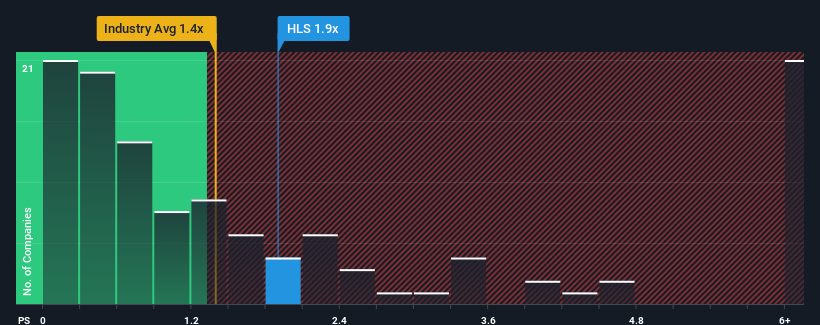

Since its price has surged higher, you could be forgiven for thinking HLS Therapeutics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in Canada's Pharmaceuticals industry have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for HLS Therapeutics

What Does HLS Therapeutics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, HLS Therapeutics has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HLS Therapeutics.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, HLS Therapeutics would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.6% last year. Revenue has also lifted 12% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 11% per year over the next three years. That's shaping up to be materially higher than the 8.1% per year growth forecast for the broader industry.

In light of this, it's understandable that HLS Therapeutics' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does HLS Therapeutics' P/S Mean For Investors?

HLS Therapeutics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into HLS Therapeutics shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for HLS Therapeutics that you need to be mindful of.

If you're unsure about the strength of HLS Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HLS Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HLS

HLS Therapeutics

A specialty pharmaceutical company, acquires and commercializes pharmaceutical products for the treatment of psychiatric disorders, central nervous system, and cardiovascular disease in Canada, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success