- Canada

- /

- Trade Distributors

- /

- TSXV:ZDC

TSX Growth Companies With High Insider Ownership In September 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic ambiguity, with central banks offering limited forward guidance and investors closely watching for signals on interest rate movements, volatility is expected to increase around major economic releases. In this environment, growth companies with high insider ownership can be particularly appealing as they may indicate strong internal confidence in the company's future prospects and resilience amid changing market conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 21.1% | 87.6% |

| Robex Resources (TSXV:RBX) | 24.3% | 93.4% |

| Propel Holdings (TSX:PRL) | 36.5% | 31.8% |

| Orla Mining (TSX:OLA) | 10.9% | 76.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| Colliers International Group (TSX:CIGI) | 14.0% | 27.2% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Aritzia (TSX:ATZ) | 17.2% | 29.6% |

| Almonty Industries (TSX:AII) | 12.6% | 64.3% |

Here's a peek at a few of the choices from the screener.

Canfor (TSX:CFP)

Simply Wall St Growth Rating: ★★★★☆☆

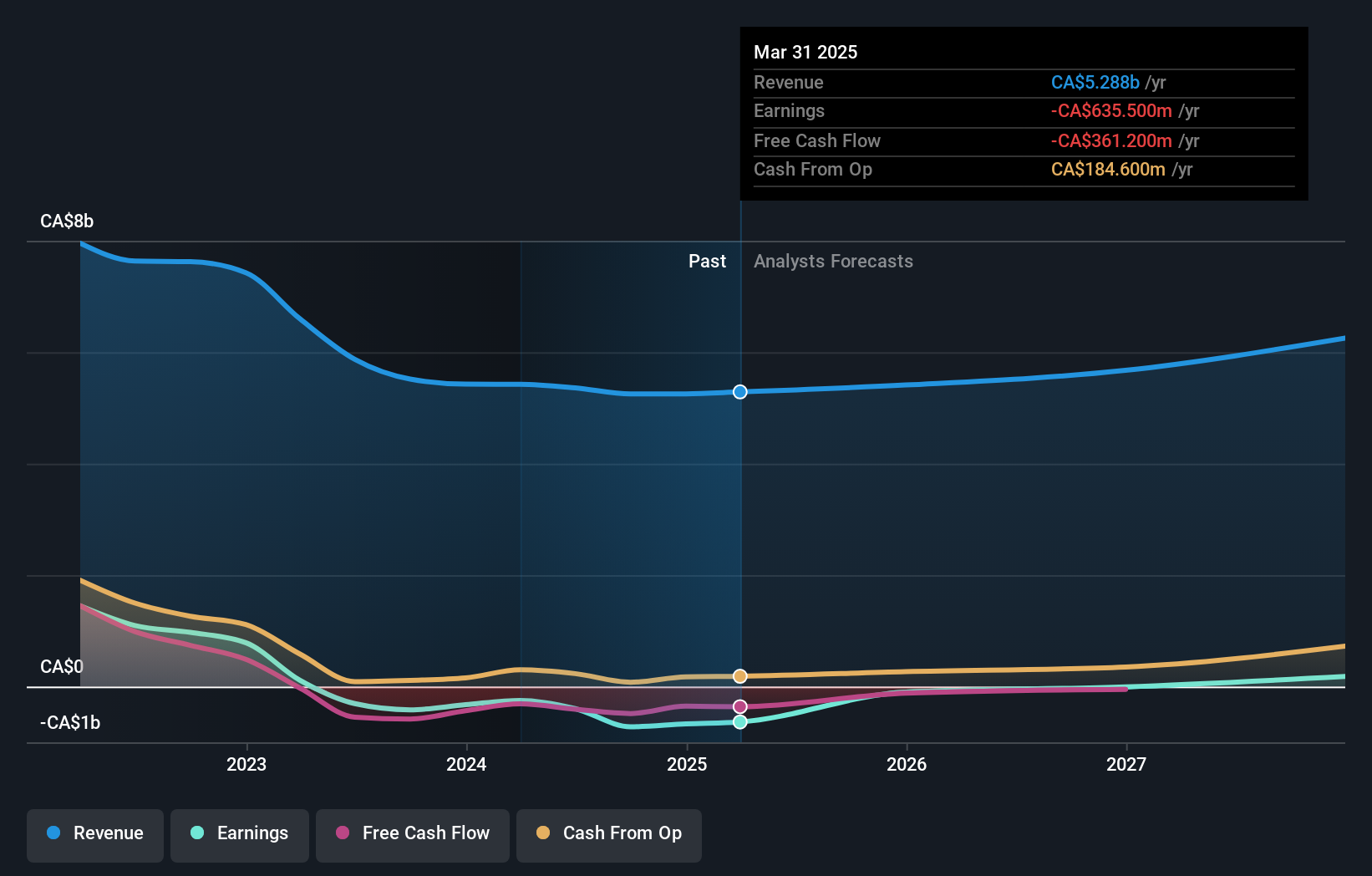

Overview: Canfor Corporation is an integrated forest products company operating in the United States, Asia, Canada, Europe, and internationally with a market cap of CA$1.50 billion.

Operations: The company's revenue segments consist of Lumber at CA$4.66 billion and Pulp & Paper at CA$730.40 million.

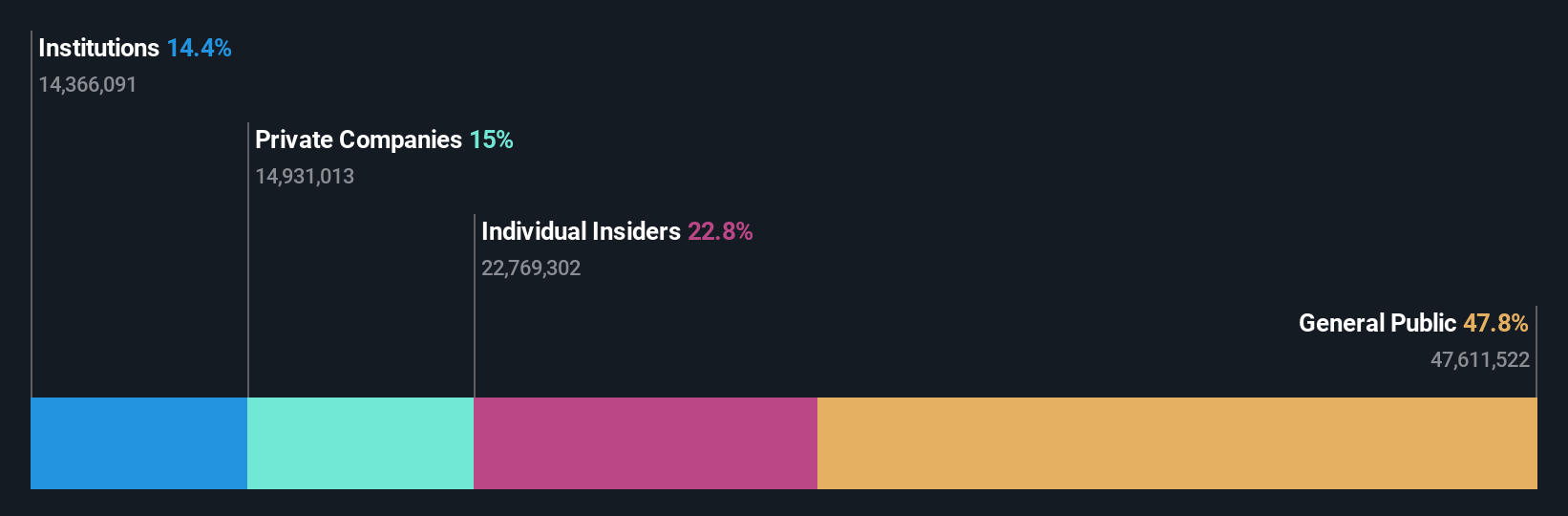

Insider Ownership: 22.8%

Earnings Growth Forecast: 74% p.a.

Canfor Corporation, with its recent decision to close two U.S. sawmills due to weak market conditions, continues to navigate challenges while maintaining insider confidence as evidenced by more insider buying than selling in the past three months. Despite a current net loss and low return on equity forecast, Canfor is trading at good value compared to peers and is expected to become profitable within three years, with revenue growth outpacing the Canadian market average.

- Get an in-depth perspective on Canfor's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Canfor's share price might be too pessimistic.

Knight Therapeutics (TSX:GUD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knight Therapeutics Inc. is involved in acquiring, in-licensing, out-licensing, marketing, and commercializing prescription pharmaceutical products across Canada and Latin America with a market cap of CA$601.91 million.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, which generated CA$384.56 million.

Insider Ownership: 22.8%

Earnings Growth Forecast: 57.1% p.a.

Knight Therapeutics is positioned for growth with high insider ownership, despite recent net losses. The company has initiated a share buyback program and raised its 2025 revenue guidance to CAD 410-420 million, driven by strong first-half performance and new agreements. Earnings are expected to grow significantly over the next three years, outpacing the Canadian market. However, revenue growth remains moderate at 8.4% annually. Knight's strategic partnerships in Latin America further bolster its long-term prospects amidst current challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Knight Therapeutics.

- In light of our recent valuation report, it seems possible that Knight Therapeutics is trading behind its estimated value.

Zedcor (TSXV:ZDC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zedcor Inc. offers turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States, with a market cap of CA$495.02 million.

Operations: The company generates revenue from its Security & Surveillance segment, amounting to CA$44.50 million.

Insider Ownership: 21.1%

Earnings Growth Forecast: 87.6% p.a.

Zedcor demonstrates strong growth potential with substantial insider ownership, despite recent mixed earnings results. The company's earnings are forecast to grow significantly at 87.6% annually, outpacing the Canadian market. Revenue is also expected to increase rapidly by 34.8% per year, well above the market average. Although trading below its estimated fair value and experiencing high past profit growth, recent net income figures show variability, highlighting both opportunities and challenges for investors.

- Unlock comprehensive insights into our analysis of Zedcor stock in this growth report.

- Upon reviewing our latest valuation report, Zedcor's share price might be too optimistic.

Seize The Opportunity

- Gain an insight into the universe of 43 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Seeking Other Investments? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zedcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZDC

Zedcor

Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026