- Canada

- /

- Real Estate

- /

- TSX:CIGI

Top TSX Growth Stocks With High Insider Ownership September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, but it is up 13% over the past year with earnings expected to grow by 15% per annum. In this favorable environment, growth companies with high insider ownership can offer compelling opportunities as insiders' stakes often signal confidence in their business prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.5% | 70.7% |

| Allied Gold (TSX:AAUC) | 22.5% | 73.5% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Propel Holdings (TSX:PRL) | 40% | 37.2% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 72.4% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

Let's review some notable picks from our screened stocks.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

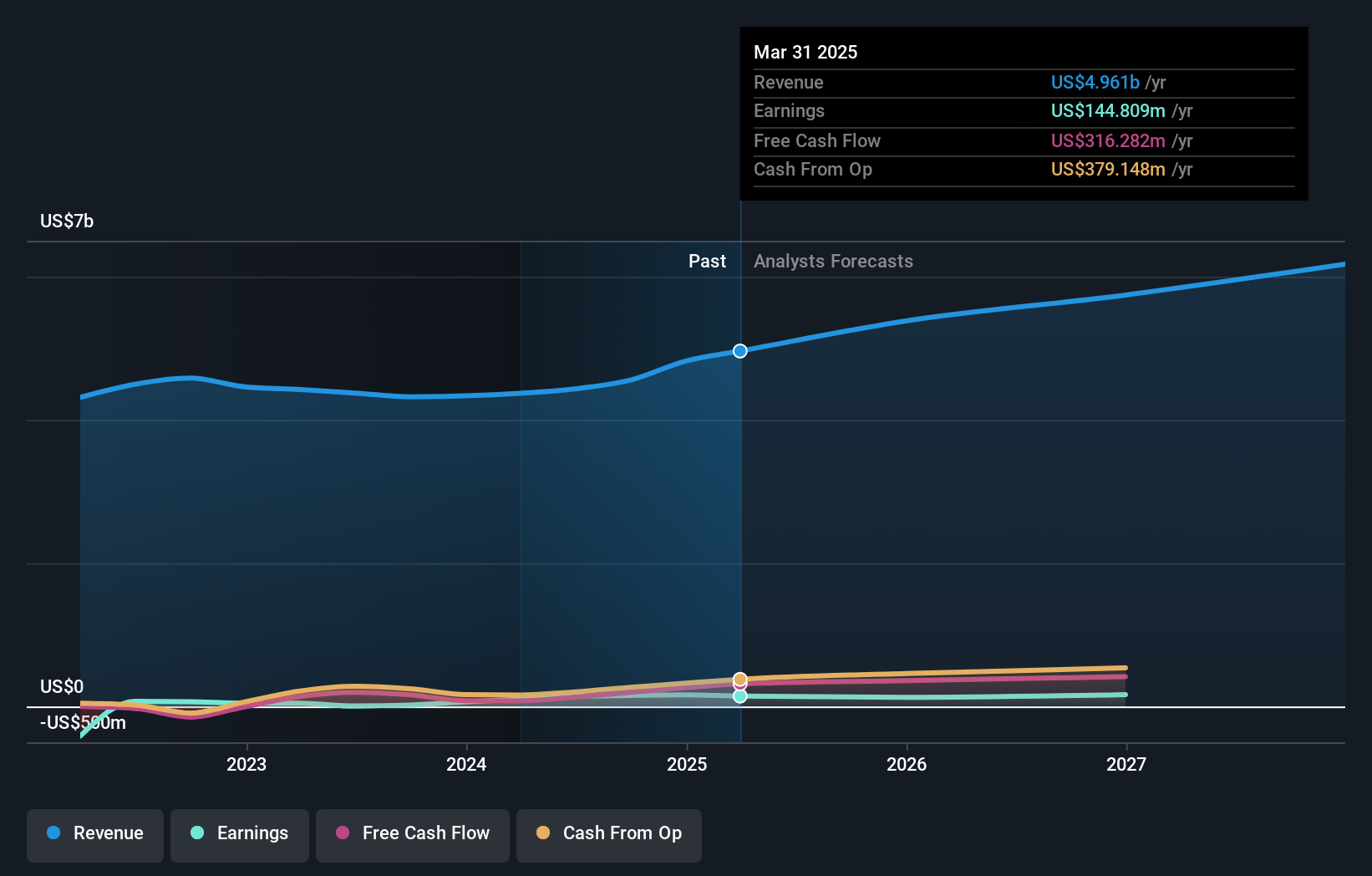

Overview: Colliers International Group Inc. provides commercial real estate professional and investment management services to corporate and institutional clients across various regions, with a market cap of CA$9.71 billion.

Operations: The company's revenue segments are comprised of $2.59 billion from the Americas, $614.55 million from Asia Pacific, $496.42 million from Investment Management, and $734.93 million from Europe, Middle East & Africa (EMEA).

Insider Ownership: 14.2%

Earnings Growth Forecast: 20.8% p.a.

Colliers International Group has demonstrated strong growth, reporting Q2 2024 earnings of US$36.72 million, a significant improvement from a net loss the previous year. The company maintains high insider ownership and insiders have substantially bought shares over the past quarter. Colliers' revenue and earnings are expected to grow faster than the Canadian market, with forecasts indicating annual profit growth of 20.8%. Recent strategic expansions in Europe and acquisitions like Englobe bolster its growth prospects.

- Navigate through the intricacies of Colliers International Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Colliers International Group shares in the market.

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

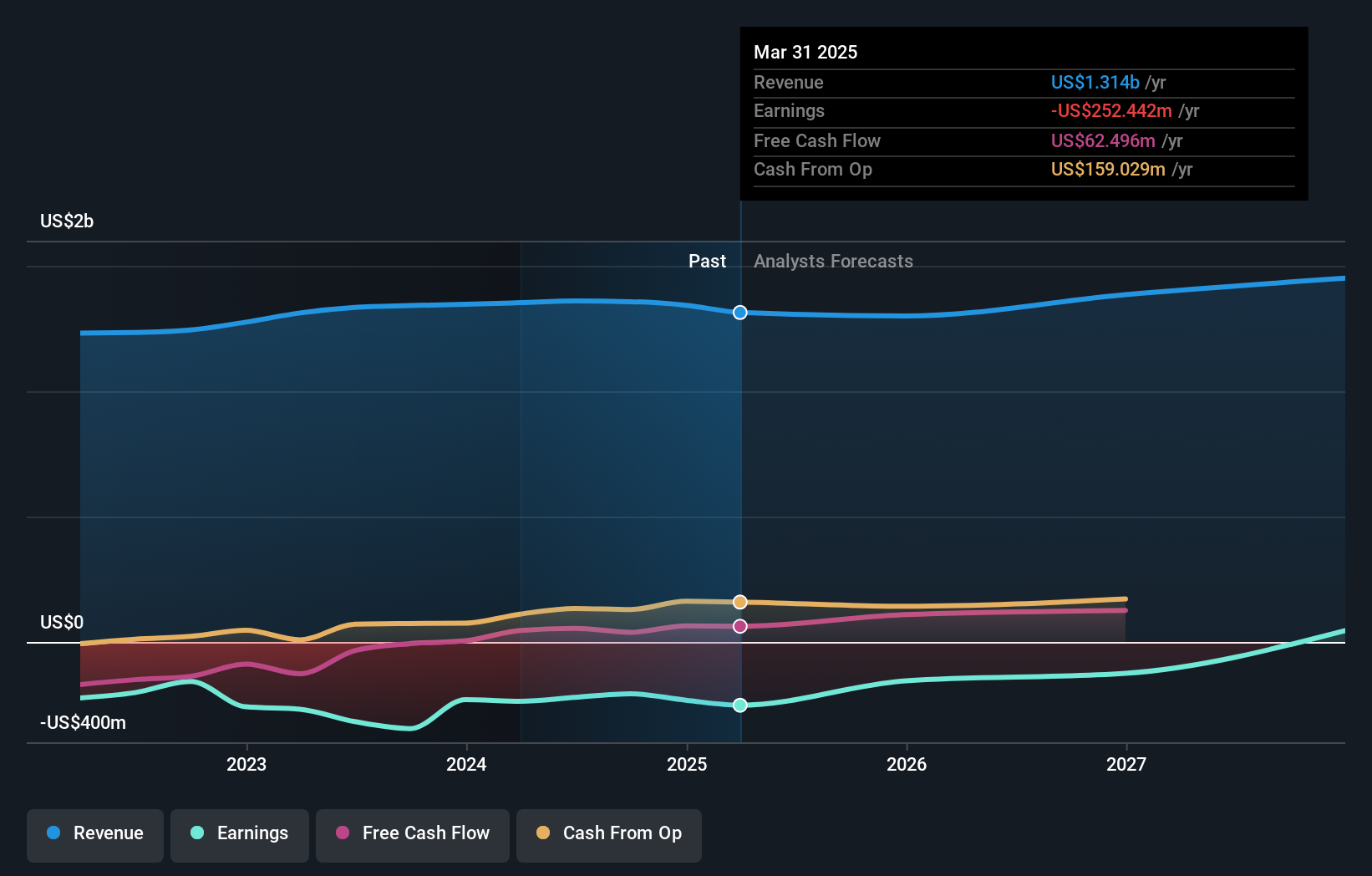

Overview: Curaleaf Holdings, Inc. operates as a cannabis operator in the United States and has a market cap of CA$3.16 billion.

Operations: Curaleaf Holdings generates revenue primarily from the cultivation, production, distribution, and sale of cannabis, amounting to $1.36 billion.

Insider Ownership: 19.9%

Earnings Growth Forecast: 78.2% p.a.

Curaleaf Holdings is expanding rapidly, with new dispensaries in Florida and New York, and adult-use operations commencing in Ohio. The company reported Q2 2024 revenue of US$342.29 million but incurred a net loss of US$48.89 million. Boris Jordan's appointment as CEO underscores strong insider involvement, given his foundational role since 2014. Despite past shareholder dilution, Curaleaf's revenue is forecast to grow faster than the Canadian market, with profitability expected within three years.

- Click to explore a detailed breakdown of our findings in Curaleaf Holdings' earnings growth report.

- According our valuation report, there's an indication that Curaleaf Holdings' share price might be on the cheaper side.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★☆☆

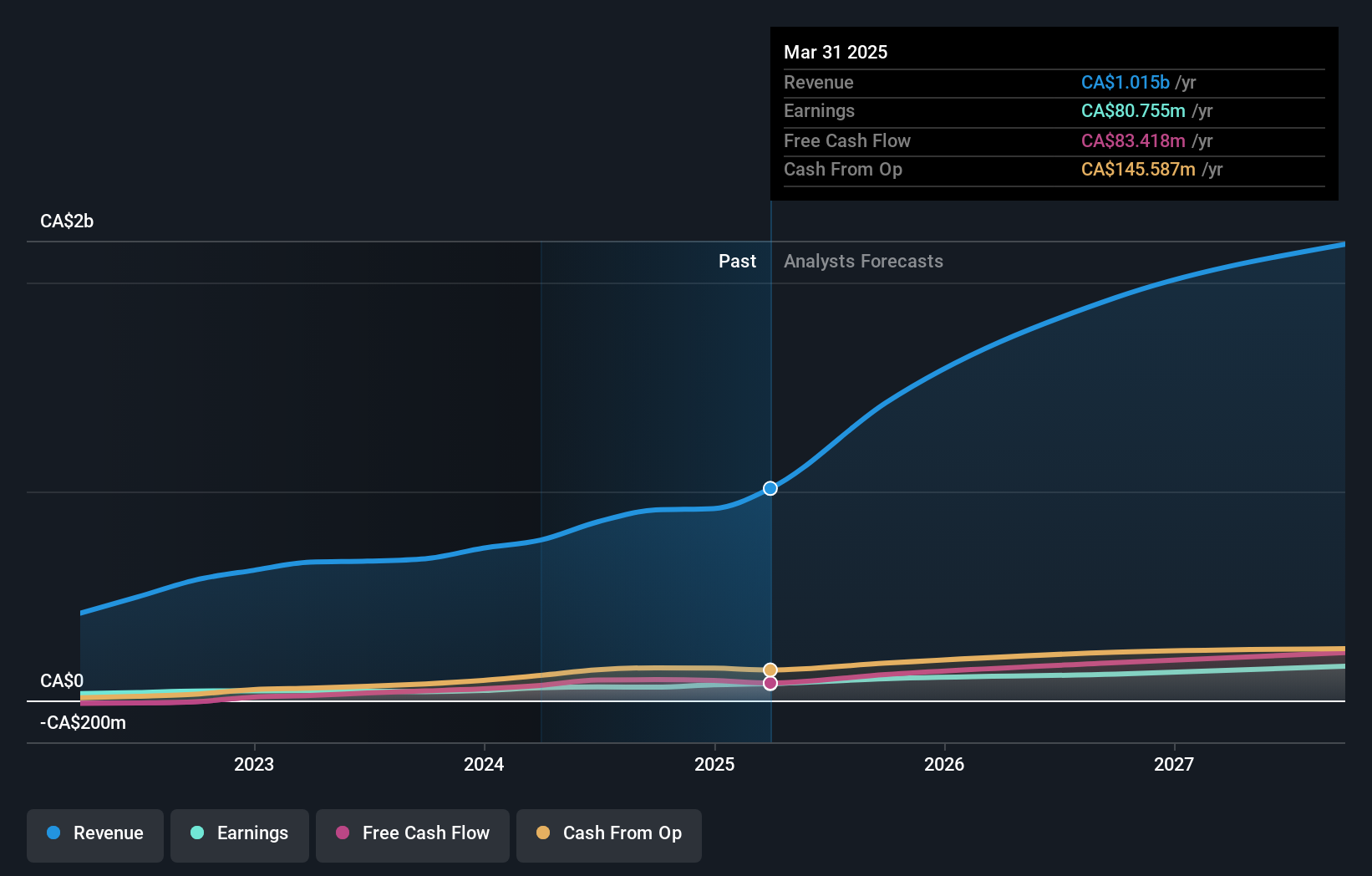

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.85 billion.

Operations: The company's revenue segments include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million).

Insider Ownership: 21.9%

Earnings Growth Forecast: 21.1% p.a.

TerraVest Industries has shown robust growth, with earnings increasing by 43.6% over the past year and revenue for Q3 2024 reaching C$238.13 million, up from C$150.36 million a year ago. Despite having high debt levels and past shareholder dilution, its earnings are forecast to grow significantly at 21.1% per year, outpacing the Canadian market's average of 15.2%. Insider ownership remains strong with no substantial selling in recent months, enhancing investor confidence.

- Get an in-depth perspective on TerraVest Industries' performance by reading our analyst estimates report here.

- Our valuation report here indicates TerraVest Industries may be overvalued.

Seize The Opportunity

- Click here to access our complete index of 39 Fast Growing TSX Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives