Some Confidence Is Lacking In Curaleaf Holdings, Inc. (TSE:CURA) As Shares Slide 27%

Curaleaf Holdings, Inc. (TSE:CURA) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 46%, which is great even in a bull market.

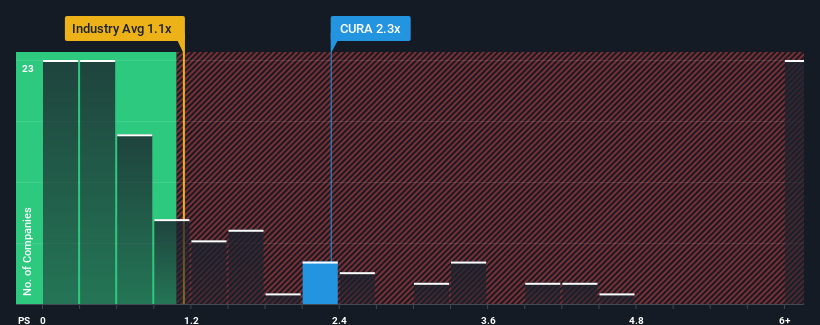

Even after such a large drop in price, you could still be forgiven for thinking Curaleaf Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in Canada's Pharmaceuticals industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Curaleaf Holdings

How Has Curaleaf Holdings Performed Recently?

Curaleaf Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Curaleaf Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Curaleaf Holdings?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Curaleaf Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.1% last year. The latest three year period has also seen an excellent 71% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% each year over the next three years. That's shaping up to be similar to the 8.7% each year growth forecast for the broader industry.

With this information, we find it interesting that Curaleaf Holdings is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

There's still some elevation in Curaleaf Holdings' P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Curaleaf Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Curaleaf Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives