Is Now the Right Time to Revisit Curaleaf After Federal Cannabis Reform Talks in 2025?

Reviewed by Bailey Pemberton

- If you've been wondering whether Curaleaf Holdings is attractively valued right now, you're not alone. We're about to break down all the angles worth considering.

- The stock has soared 74.3% year-to-date and is up 31.9% over the past year. However, recent weeks have seen momentum cool off just a bit after a strong run.

- This shift in sentiment follows news of broader legislative discussions on U.S. cannabis reform. Renewed debates have sparked investor optimism about the potential for federal progress. At the same time, Curaleaf's expansion into new state markets and strategic acquisitions have kept the spotlight firmly on the company's growth story.

- Currently, Curaleaf scores a 4 out of 6 on our valuation checks, suggesting the stock shows value in several key areas. Let's dig into the different ways analysts evaluate Curaleaf's worth, and stick around for an even smarter approach to understanding whether this stock is truly undervalued.

Approach 1: Curaleaf Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to the present. This approach helps gauge what a business might be worth today, considering its expected ability to generate cash in coming years.

For Curaleaf Holdings, the latest Free Cash Flow stands at $48.2 Million. Analyst estimates project steady growth, with FCF expected to reach $176.6 Million by 2027. Simply Wall St’s model continues to extrapolate these trends and projects Free Cash Flow as high as $358.7 Million by 2035, based on a range of growth rates from analysts and historical data.

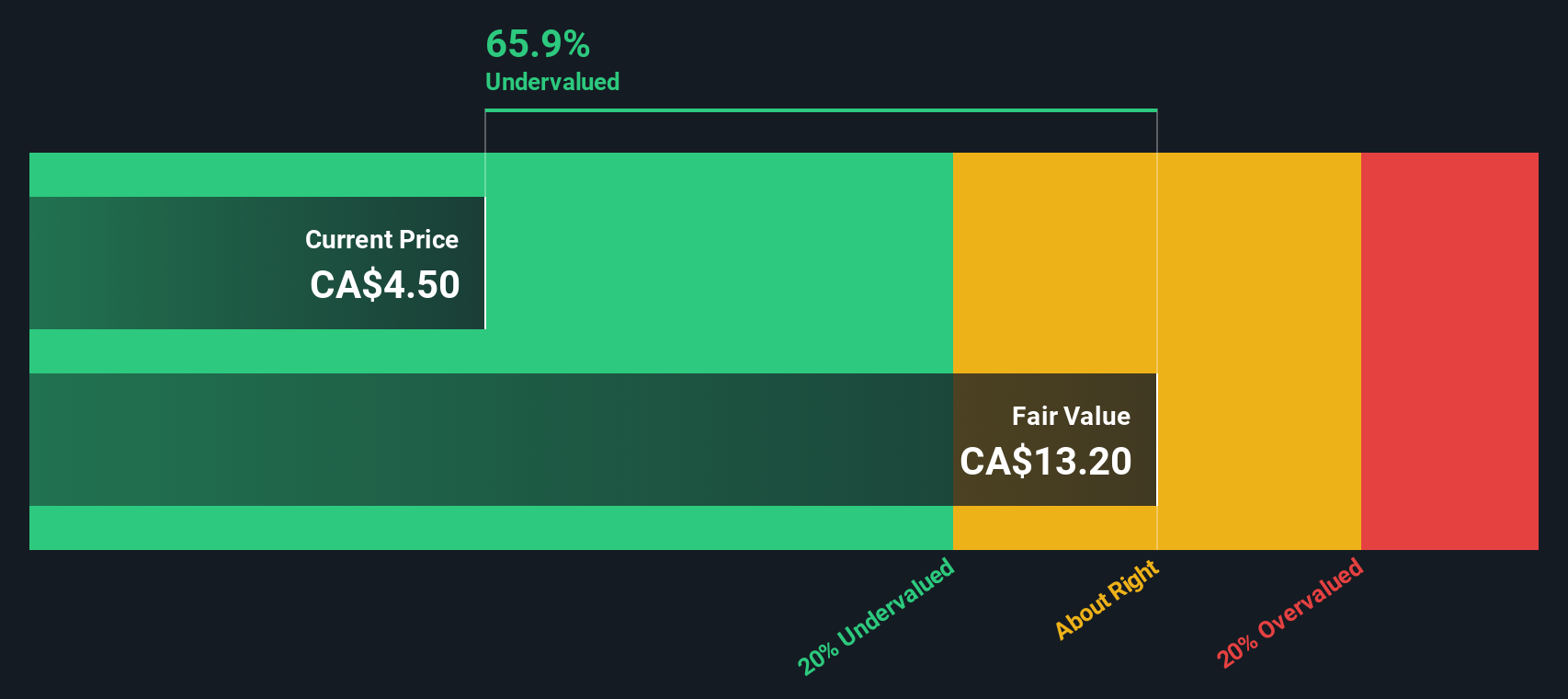

By discounting all those future cash flows back to today, the DCF method calculates Curaleaf’s estimated intrinsic value at $13.26 per share. This is a notable 69.8% above the current share price, pointing to substantial upside. In other words, based on projected future earnings, the market could be significantly undervaluing the company’s long-term potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Curaleaf Holdings is undervalued by 69.8%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: Curaleaf Holdings Price vs Sales

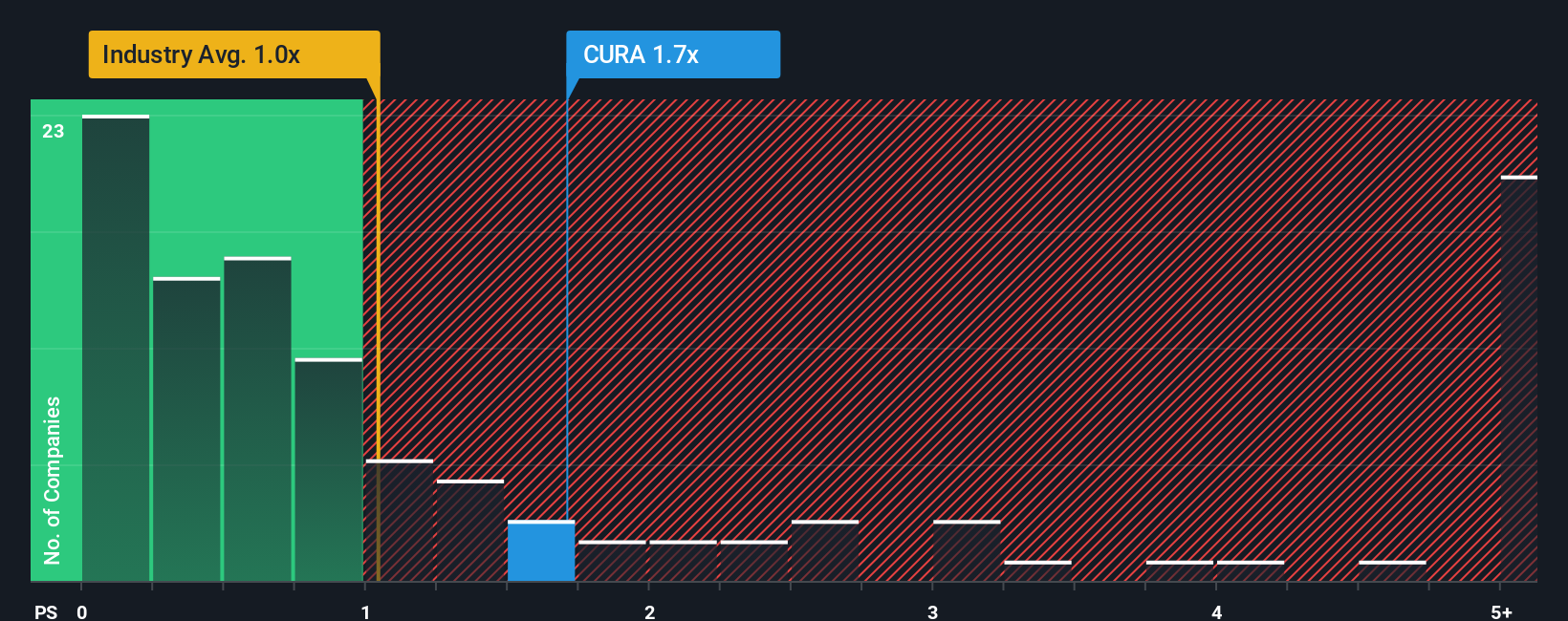

The Price-to-Sales (P/S) ratio is a widely used valuation metric for companies like Curaleaf Holdings, especially when profits may be volatile or still developing. It focuses on a company's revenues, offering a steady benchmark for comparison and making it suitable for businesses whose earnings may not yet be consistently positive but are generating significant sales.

Typically, higher growth expectations and lower risks justify a higher P/S ratio, while companies facing more uncertainty or slower growth trade at a lower multiple. Understanding how Curaleaf stacks up, its current P/S ratio sits at 1.71x. This is above the industry average of 1.00x but below the peer group average of 3.69x, giving context around how the market views its sales efficiency and growth prospects.

Simply Wall St's proprietary "Fair Ratio" for Curaleaf is 2.07x. This calculation goes beyond simple peer or industry averages by factoring in the company's unique financial profile, such as its growth outlook, profit margins, risk levels, industry characteristics, and market capitalization. Relying solely on industry or peer averages can overlook these company-specific differences, meaning the Fair Ratio offers a more tailored sense of what Curaleaf's P/S should be.

Comparing Curaleaf’s actual P/S ratio of 1.71x to its Fair Ratio of 2.07x, the stock currently appears undervalued based on sales metrics. It is trading at a meaningful discount to the level justified by its fundamentals and future outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Curaleaf Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives, a new, dynamic approach that transforms investing from analyzing just numbers into telling your own story about Curaleaf Holdings’ future and what you believe the company is worth.

Narratives are a simple tool where you connect your view of Curaleaf’s business and industry. Whether it is product innovation, global expansion, or regulatory progress, you can link these factors with your own fair value, revenue, earnings, and margin assumptions. This results in a robust financial forecast and a calculated fair value you can track against today’s price.

Available for free on Simply Wall St’s Community page, Narratives make it easy for millions of investors to check their investment logic against the latest information and market movements. This helps you decide when it might be smart to buy or sell as circumstances change, because when key data such as news or earnings updates, your Narrative updates too.

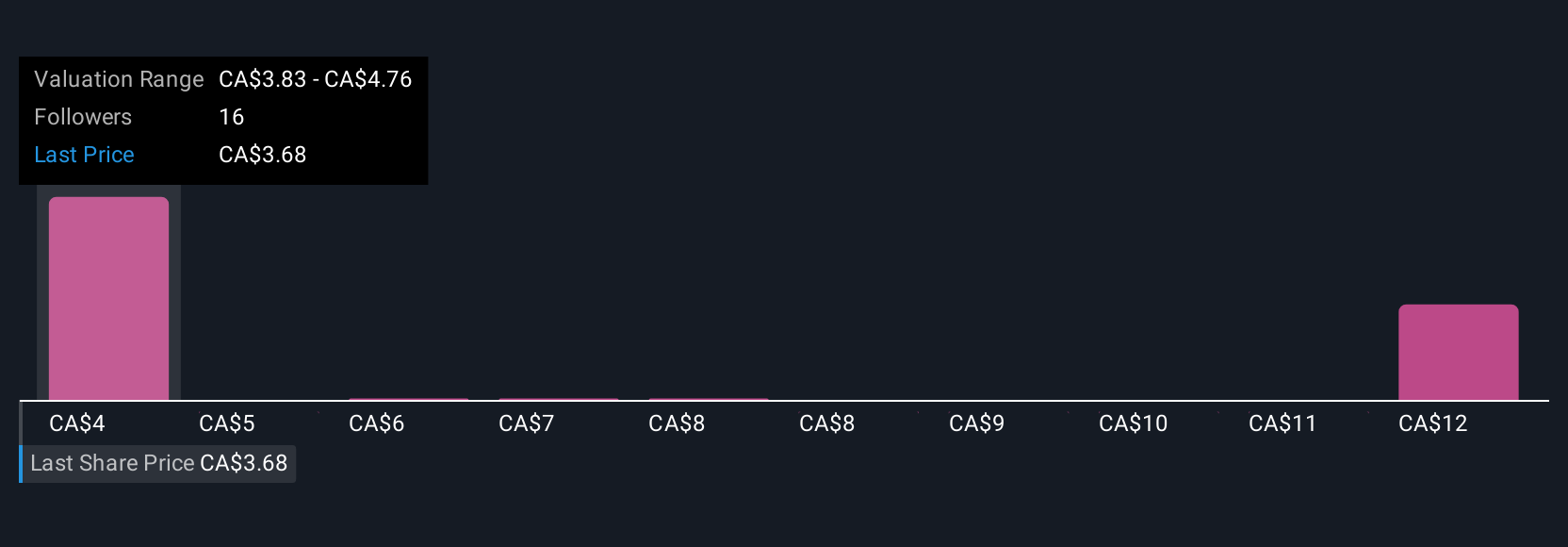

For example, some Curaleaf investors believe international growth and R&D will drive the stock to CA$4.51 per share, while others cite regulatory hurdles and margin pressures, assigning a fair value as low as CA$2.65. Narratives let you see, create, and compare both perspectives in real time, so your decisions are grounded in the story you trust most.

Do you think there's more to the story for Curaleaf Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives