Cronos Group Inc.'s (TSE:CRON) Earnings Haven't Escaped The Attention Of Investors

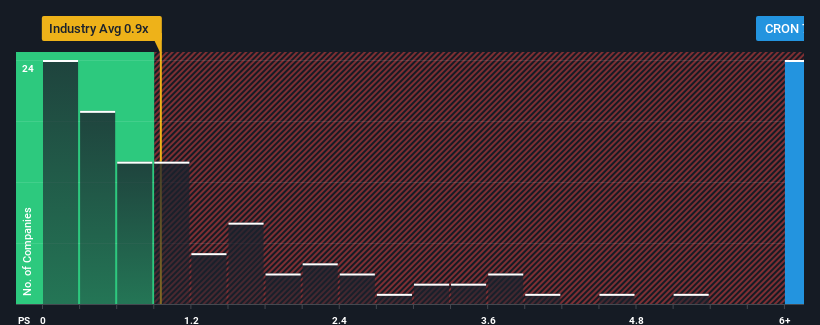

When you see that almost half of the companies in the Pharmaceuticals industry in Canada have price-to-sales ratios (or "P/S") below 0.9x, Cronos Group Inc. (TSE:CRON) looks to be giving off strong sell signals with its 7.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Cronos Group

What Does Cronos Group's Recent Performance Look Like?

Cronos Group could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Cronos Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cronos Group's Revenue Growth Trending?

In order to justify its P/S ratio, Cronos Group would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 198% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the ten analysts watching the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader industry.

With this in mind, it's not hard to understand why Cronos Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Cronos Group's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Cronos Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Cronos Group with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives