The Canadian stock market has experienced significant fluctuations, with the TSX reaching new all-time highs despite earlier declines driven by U.S. policy shifts and trade tensions. In such a dynamic landscape, identifying promising investment opportunities requires a focus on stocks with robust financials and clear growth potential. Penny stocks, while an older term, continue to represent smaller or less-established companies that can offer substantial value if they possess strong balance sheets and long-term prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.64 | CA$62.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.84 | CA$263.71M | ✅ 4 ⚠️ 1 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.04 | CA$105.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$512.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.93 | CA$19.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.33 | CA$181.2M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$176.45M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of CA$1.06 billion.

Operations: The company generates revenue of $124.59 million from its operations in cultivating, manufacturing, and marketing cannabis and cannabis-derived products.

Market Cap: CA$1.06B

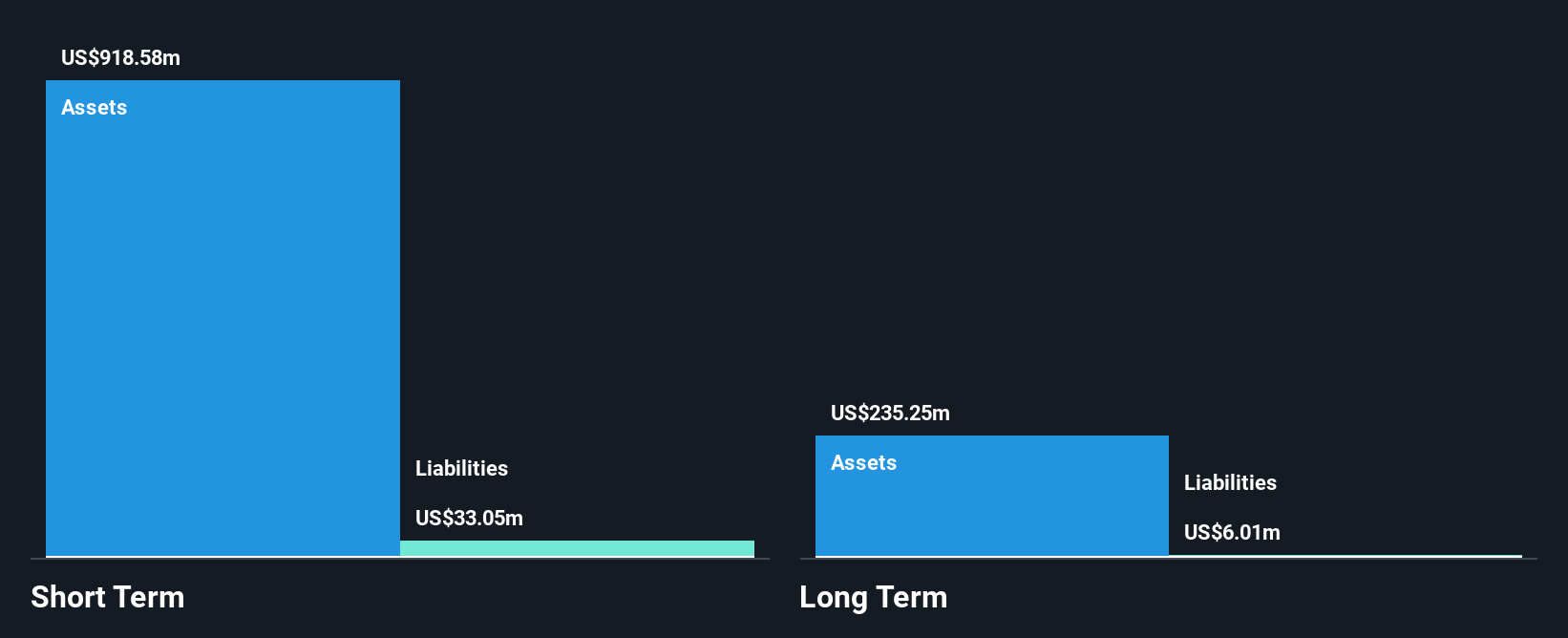

Cronos Group Inc. has demonstrated financial resilience, becoming profitable in the last year with a net income of US$6.12 million for Q1 2025, reversing a previous loss. The company maintains a strong balance sheet with no debt and substantial short-term assets exceeding liabilities. Recent strategic moves include expanding its PEACE NATURALS® medical cannabis brand into Switzerland and launching innovative products under its Spinach® brand, potentially enhancing market reach and consumer engagement. Additionally, Cronos announced a share repurchase program worth US$50 million, indicating confidence in its valuation and future prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of Cronos Group.

- Assess Cronos Group's future earnings estimates with our detailed growth reports.

Emerita Resources (TSXV:EMO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Emerita Resources Corp., operating through its subsidiary, focuses on acquiring, exploring, and developing mineral properties in Spain with a market cap of CA$372.41 million.

Operations: There are no reported revenue segments for this company.

Market Cap: CA$372.41M

Emerita Resources Corp., with a market cap of CA$372.41 million, remains pre-revenue and unprofitable, reporting increased losses in recent earnings. Despite financial challenges, the company has made significant strides in its Iberian Belt West Project in Spain. Recent metallurgical testing at La Romanera showed improved gold recovery rates and reduced environmental impact through decreased waste production. The project’s updated Mineral Resource Estimate indicates substantial zinc, lead, copper, silver, and gold deposits across three sites: La Romanera, El Cura, and La Infanta. Emerita's experienced management team continues to focus on expanding these resources through ongoing drilling campaigns.

- Click here to discover the nuances of Emerita Resources with our detailed analytical financial health report.

- Evaluate Emerita Resources' historical performance by accessing our past performance report.

01 Communique Laboratory (TSXV:ONE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 01 Communique Laboratory Inc. offers cybersecurity and remote access solutions across the United States, Asia-Pacific, and Canada, with a market cap of CA$39.90 million.

Operations: The company generates CA$0.40 million in revenue from the development and marketing of its communications software.

Market Cap: CA$39.9M

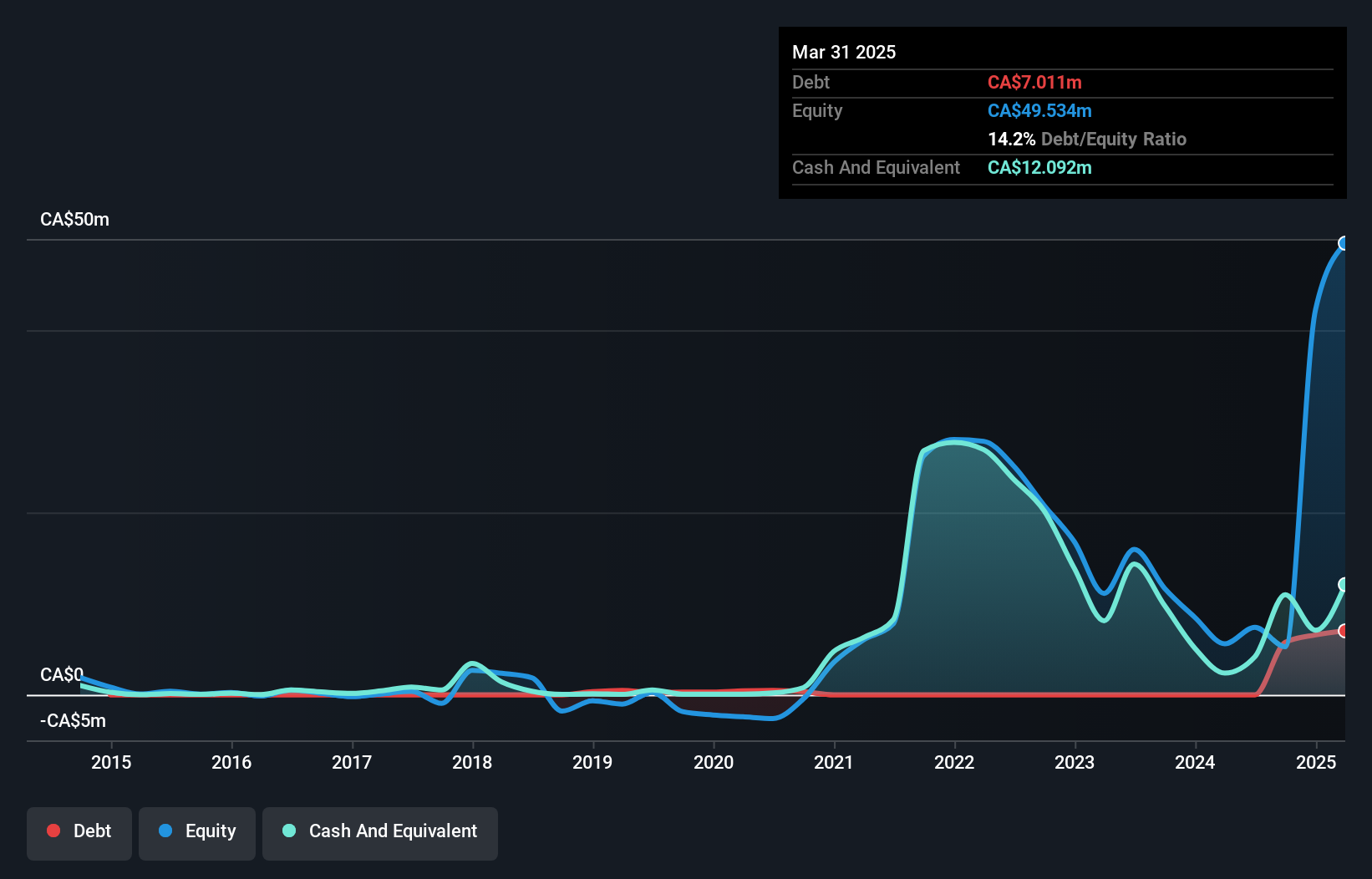

01 Communique Laboratory Inc. operates with a market cap of CA$39.90 million, generating minimal revenue of CA$0.40 million, indicating it is pre-revenue. The company remains unprofitable with negative return on equity and increased net losses in recent earnings reports, but benefits from a seasoned board and no debt obligations. Its short-term assets significantly cover both short- and long-term liabilities, providing some financial stability despite high share price volatility compared to Canadian peers. A recent private placement raised CA$511,500 for operational funding through the issuance of units comprising shares and warrants without incurring additional fees or commissions.

- Take a closer look at 01 Communique Laboratory's potential here in our financial health report.

- Learn about 01 Communique Laboratory's historical performance here.

Make It Happen

- Explore the 445 names from our TSX Penny Stocks screener here.

- Curious About Other Options? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 01 Quantum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ONE

01 Quantum

Provides cyber security and remote access solutions in the United States, Asia-Pacific, and Canada.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives