David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Aurora Cannabis Inc. (TSE:ACB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

What Is Aurora Cannabis's Debt?

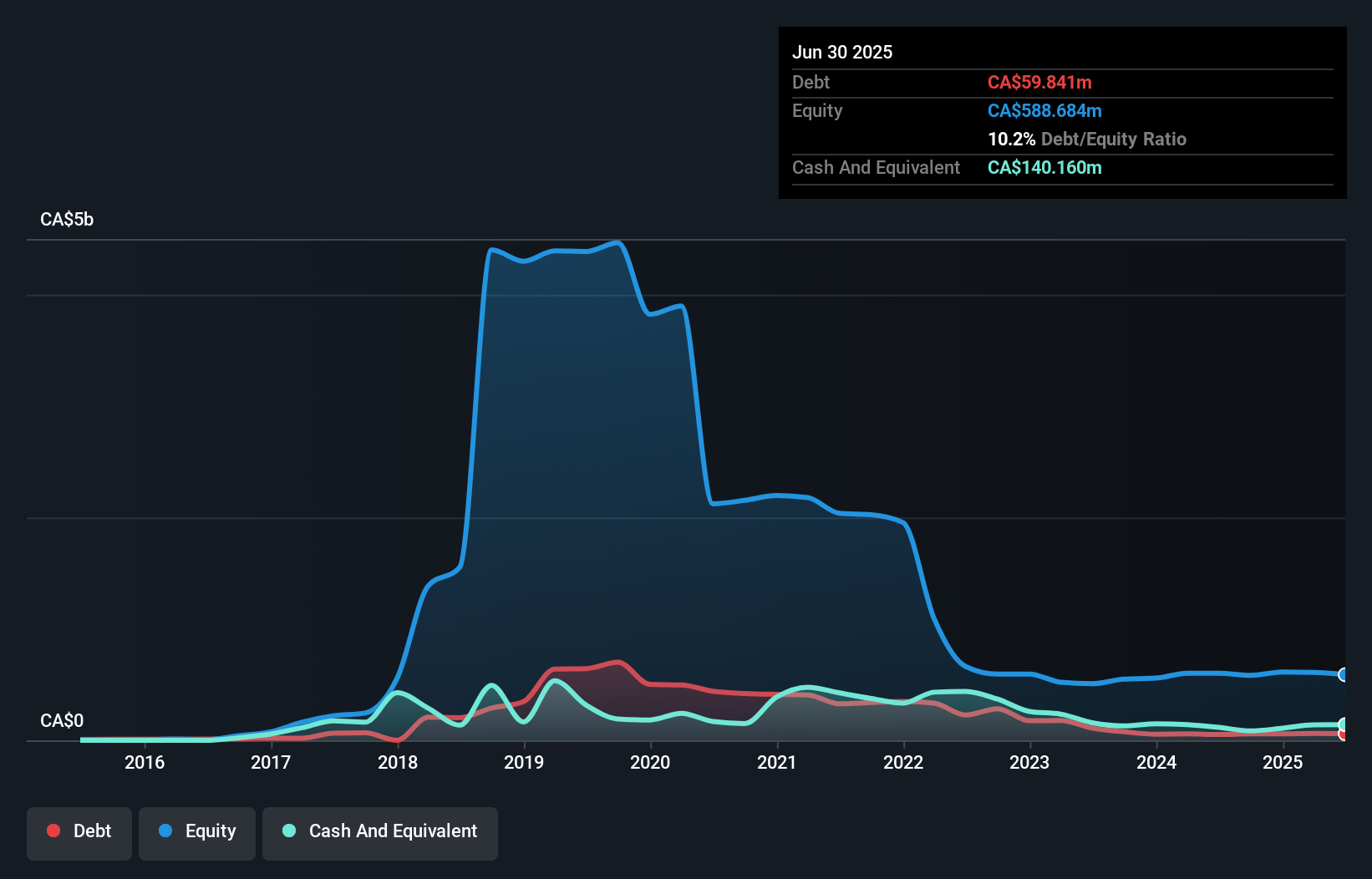

You can click the graphic below for the historical numbers, but it shows that as of June 2025 Aurora Cannabis had CA$59.8m of debt, an increase on CA$52.4m, over one year. However, its balance sheet shows it holds CA$140.2m in cash, so it actually has CA$80.3m net cash.

How Healthy Is Aurora Cannabis' Balance Sheet?

The latest balance sheet data shows that Aurora Cannabis had liabilities of CA$156.9m due within a year, and liabilities of CA$92.3m falling due after that. On the other hand, it had cash of CA$140.2m and CA$39.1m worth of receivables due within a year. So it has liabilities totalling CA$69.9m more than its cash and near-term receivables, combined.

Given Aurora Cannabis has a market capitalization of CA$451.6m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Aurora Cannabis boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Aurora Cannabis can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Check out our latest analysis for Aurora Cannabis

Over 12 months, Aurora Cannabis reported revenue of CA$358m, which is a gain of 29%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Aurora Cannabis?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Aurora Cannabis had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of CA$999k and booked a CA$3.1m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of CA$80.3m. That kitty means the company can keep spending for growth for at least two years, at current rates. Aurora Cannabis's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Aurora Cannabis insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ACB

Aurora Cannabis

Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success