Unfortunately for shareholders, when Phyto Extractions Inc. (CSE:XTRX) reported results for the period to December 2020, its auditors, Davidson & Company, expressed uncertainty about whether it can continue as a going concern. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

View our latest analysis for Phyto Extractions

What Is Phyto Extractions's Net Debt?

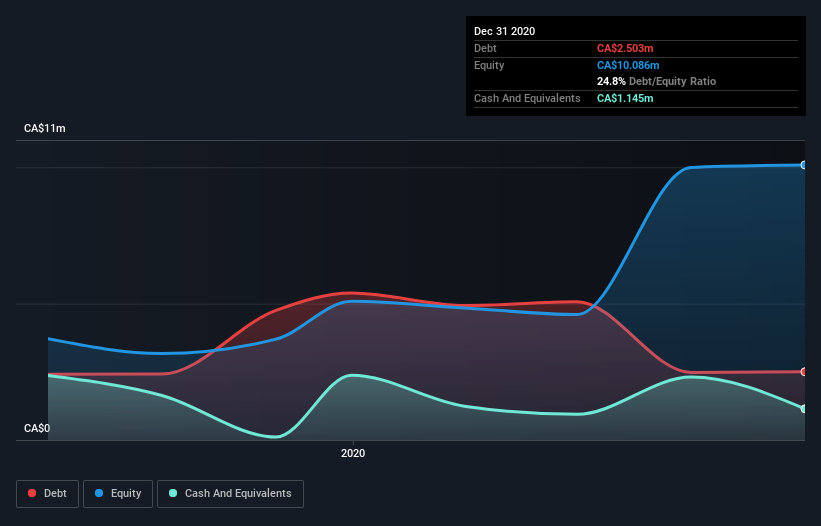

You can click the graphic below for the historical numbers, but it shows that Phyto Extractions had CA$2.50m of debt in December 2020, down from CA$5.39m, one year before. On the flip side, it has CA$1.15m in cash leading to net debt of about CA$1.36m.

How Healthy Is Phyto Extractions' Balance Sheet?

We can see from the most recent balance sheet that Phyto Extractions had liabilities of CA$3.59m falling due within a year, and liabilities of CA$60.0k due beyond that. Offsetting this, it had CA$1.15m in cash and CA$1.13m in receivables that were due within 12 months. So it has liabilities totalling CA$1.38m more than its cash and near-term receivables, combined.

Given Phyto Extractions has a market capitalization of CA$42.9m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Phyto Extractions's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Phyto Extractions managed to produce its first revenue as a listed company, but given the lack of profit, shareholders will no doubt be hoping to see some strong increases.

Caveat Emptor

Importantly, Phyto Extractions had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable CA$7.2m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through CA$4.6m of cash over the last year. So in short it's a really risky stock. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Phyto Extractions , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:XTRX

Adastra Holdings

Adastra Holdings Ltd. extracts and processes cannabis for recreational and medical markets in Canada.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion