Why Investors Shouldn't Be Surprised By Verano Holdings Corp.'s (CSE:VRNO) 34% Share Price Surge

Verano Holdings Corp. (CSE:VRNO) shareholders have had their patience rewarded with a 34% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

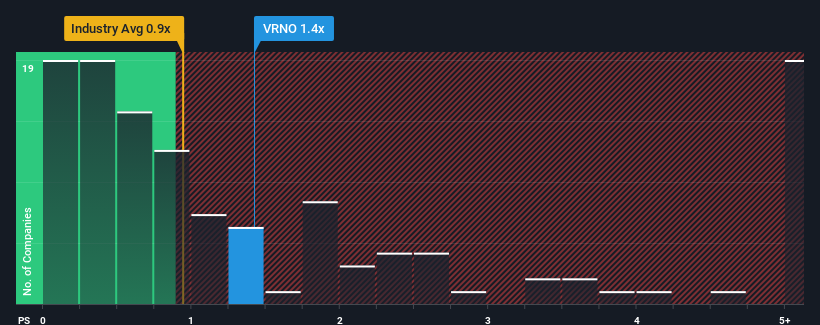

Even after such a large jump in price, there still wouldn't be many who think Verano Holdings' price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Canada's Pharmaceuticals industry is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Verano Holdings

What Does Verano Holdings' P/S Mean For Shareholders?

Recent times haven't been great for Verano Holdings as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Verano Holdings will help you uncover what's on the horizon.How Is Verano Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Verano Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.4% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.6% each year during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 11% each year growth forecast for the broader industry.

With this in mind, it makes sense that Verano Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Verano Holdings' P/S?

Verano Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Verano Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Pharmaceuticals industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 3 warning signs for Verano Holdings that you need to take into consideration.

If you're unsure about the strength of Verano Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NEOE:VRNO

Verano Holdings

Operates as a vertically integrated multi-state cannabis operator in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives