Vireo Growth Inc. (CSE:VREO) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Vireo Growth Inc. (CSE:VREO) shares have had a really impressive month, gaining 25% after a shaky period beforehand. This latest share price bounce rounds out a remarkable 348% gain over the last twelve months.

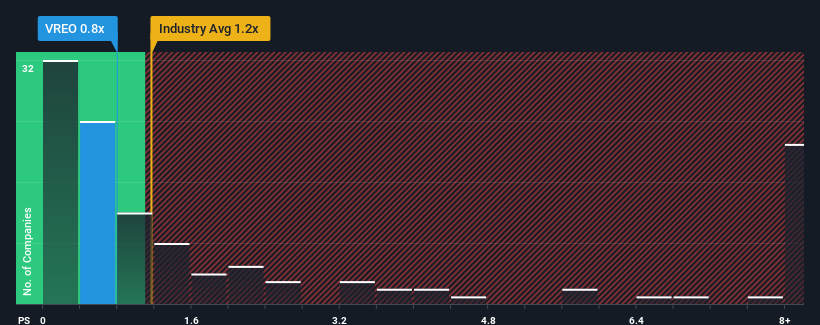

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Vireo Growth's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is also close to 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Vireo Growth

What Does Vireo Growth's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Vireo Growth has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Vireo Growth will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Vireo Growth would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 87% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 1.3% over the next year. With the industry predicted to deliver 8.6% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Vireo Growth's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Vireo Growth's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that Vireo Growth currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Vireo Growth (2 shouldn't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:VREO

Vireo Growth

Operates as a cannabis company that cultivates, manufactures, processes, and distributes medical and adult-use cannabis products in Maryland, Minnesota, and New York.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives