Trulieve Cannabis Corp.'s (CSE:TRUL) 28% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Trulieve Cannabis Corp. (CSE:TRUL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 121% in the last twelve months.

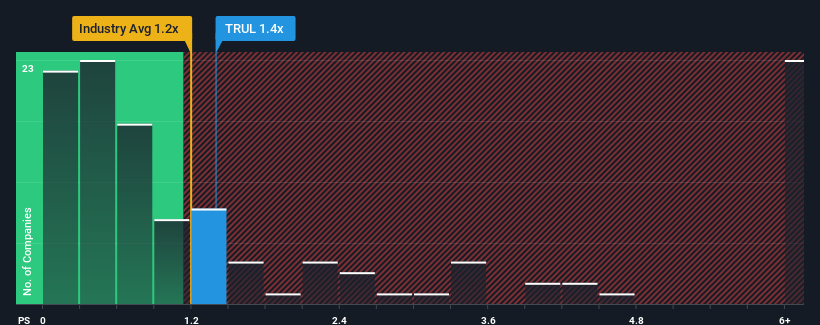

In spite of the heavy fall in price, there still wouldn't be many who think Trulieve Cannabis' price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Canada's Pharmaceuticals industry is similar at about 1.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Trulieve Cannabis

How Trulieve Cannabis Has Been Performing

While the industry has experienced revenue growth lately, Trulieve Cannabis' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Trulieve Cannabis.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Trulieve Cannabis' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. Still, the latest three year period has seen an excellent 84% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 3.8% each year as estimated by the analysts watching the company. With the industry predicted to deliver 8.6% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Trulieve Cannabis is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Trulieve Cannabis looks to be in line with the rest of the Pharmaceuticals industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Trulieve Cannabis' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Trulieve Cannabis, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Trulieve Cannabis, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Trulieve Cannabis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:TRUL

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives