Slammed 32% Cansortium Inc. (CSE:TIUM.U) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Cansortium Inc. (CSE:TIUM.U) share price has dived 32% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 28% in the last year.

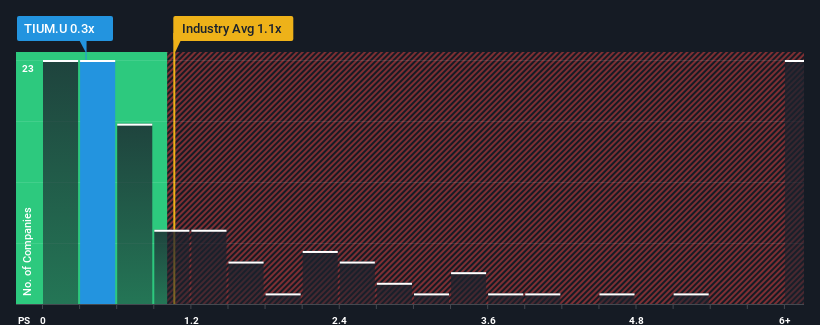

Since its price has dipped substantially, given about half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Cansortium as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cansortium

How Cansortium Has Been Performing

Recent times have been advantageous for Cansortium as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Cansortium's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cansortium's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. This was backed up an excellent period prior to see revenue up by 75% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 8.7% over the next year. That's shaping up to be materially higher than the 6.5% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Cansortium's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The southerly movements of Cansortium's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Cansortium currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Cansortium that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:FNT.U

FLUENT

Through its subsidiaries, cultivates, manufactures processes, distributes, and sells medical cannabis products for medical and adult-use markets in Florida, New York, Pennsylvania, and Texas.

Slight risk and slightly overvalued.

Market Insights

Community Narratives