Cansortium Inc. (CSE:TIUM.U) Looks Inexpensive After Falling 30% But Perhaps Not Attractive Enough

Cansortium Inc. (CSE:TIUM.U) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

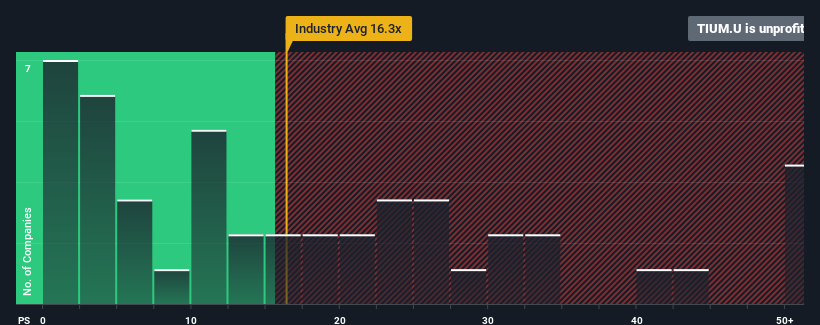

Since its price has dipped substantially, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 12x, you may consider Cansortium as a highly attractive investment with its -0.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

As an illustration, earnings have deteriorated at Cansortium over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Cansortium

How Is Cansortium's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Cansortium's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Cansortium's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Cansortium's P/E

Cansortium's P/E looks about as weak as its stock price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Cansortium revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Cansortium (1 doesn't sit too well with us!) that you should be aware of.

If you're unsure about the strength of Cansortium's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:FNT.U

FLUENT

Through its subsidiaries, cultivates, manufactures processes, distributes, and sells medical cannabis products for medical and adult-use markets in Florida, New York, Pennsylvania, and Texas.

Slight risk and slightly overvalued.

Market Insights

Community Narratives