1933 Industries Inc. (CSE:TGIF) Stock's 50% Dive Might Signal An Opportunity But It Requires Some Scrutiny

1933 Industries Inc. (CSE:TGIF) shareholders that were waiting for something to happen have been dealt a blow with a 50% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

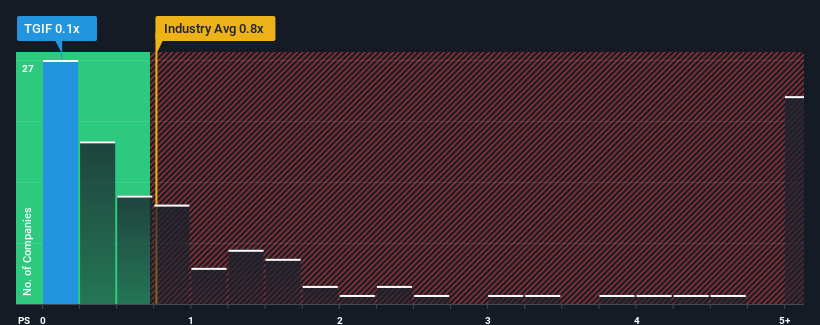

Following the heavy fall in price, considering around half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider 1933 Industries as an solid investment opportunity with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for 1933 Industries

What Does 1933 Industries' P/S Mean For Shareholders?

Revenue has risen firmly for 1933 Industries recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for 1933 Industries, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like 1933 Industries' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. Pleasingly, revenue has also lifted 69% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that 1933 Industries' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On 1933 Industries' P/S

1933 Industries' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of 1933 Industries revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 4 warning signs we've spotted with 1933 Industries (including 3 which don't sit too well with us).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:TGIF

1933 Industries

Engages in the cultivation, extraction, and production of cannabis products in the United States.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success