Market Cool On Planet 13 Holdings Inc.'s (CSE:PLTH) Revenues Pushing Shares 26% Lower

Planet 13 Holdings Inc. (CSE:PLTH) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

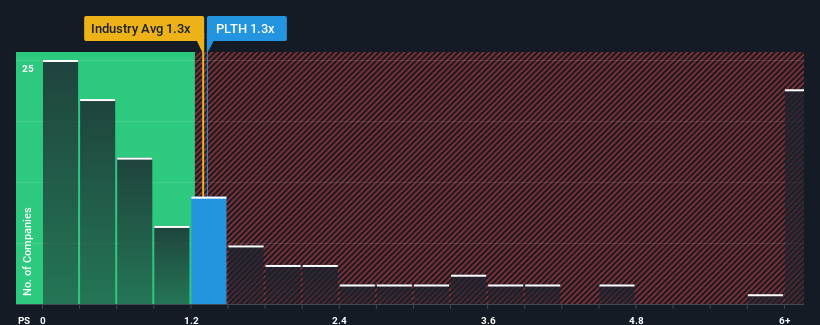

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Planet 13 Holdings' P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Planet 13 Holdings

How Planet 13 Holdings Has Been Performing

Planet 13 Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Planet 13 Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Planet 13 Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 40% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 82% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 6.1%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Planet 13 Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Planet 13 Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Planet 13 Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You need to take note of risks, for example - Planet 13 Holdings has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

If you're unsure about the strength of Planet 13 Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:PLTH

Planet 13 Holdings

Planet 13 Holdings Inc., together with its subsidiaries, cultivates and provides cannabis and cannabis-infused products for medical and retail cannabis markets in the United States.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success