We're Hopeful That Liberty Leaf Holdings (CNSX:LIB) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Liberty Leaf Holdings (CNSX:LIB) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business's cash, relative to its cash burn.

View our latest analysis for Liberty Leaf Holdings

When Might Liberty Leaf Holdings Run Out Of Money?

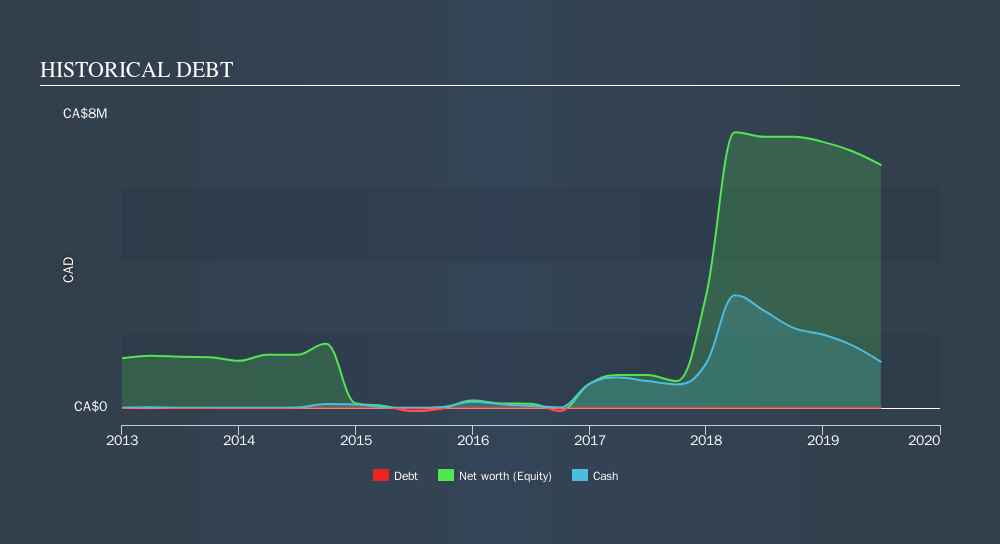

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2019, Liberty Leaf Holdings had cash of CA$1.3m and no debt. Importantly, its cash burn was CA$979k over the trailing twelve months. That means it had a cash runway of around 15 months as of June 2019. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Is Liberty Leaf Holdings's Cash Burn Changing Over Time?

Because Liberty Leaf Holdings isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. While it hardly paints a picture of imminent growth, the fact that it has reduced its cash burn by 46% over the last year suggests some degree of prudence. Liberty Leaf Holdings makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Liberty Leaf Holdings To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Liberty Leaf Holdings to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Liberty Leaf Holdings's cash burn of CA$979k is about 14% of its CA$7.1m market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Liberty Leaf Holdings's Cash Burn A Worry?

Liberty Leaf Holdings appears to be in pretty good health when it comes to its cash burn situation. Not only was its cash burn relative to its market cap quite good, but its cash burn reduction was a real positive. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Liberty Leaf Holdings's situation. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: Liberty Leaf Holdings insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

Of course Liberty Leaf Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CNSX:HEAL

Restart Life Sciences

Through its subsidiaries, operates as a biotechnology company worldwide.

Flawless balance sheet low.

Market Insights

Community Narratives