MTL Cannabis (CSE:MTLC) Ticks All The Boxes When It Comes To Earnings Growth

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in MTL Cannabis (CSE:MTLC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for MTL Cannabis

How Fast Is MTL Cannabis Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that MTL Cannabis' EPS has grown from CA$0.02 to CA$0.023 over twelve months. There's little doubt shareholders would be happy with that 18% gain.

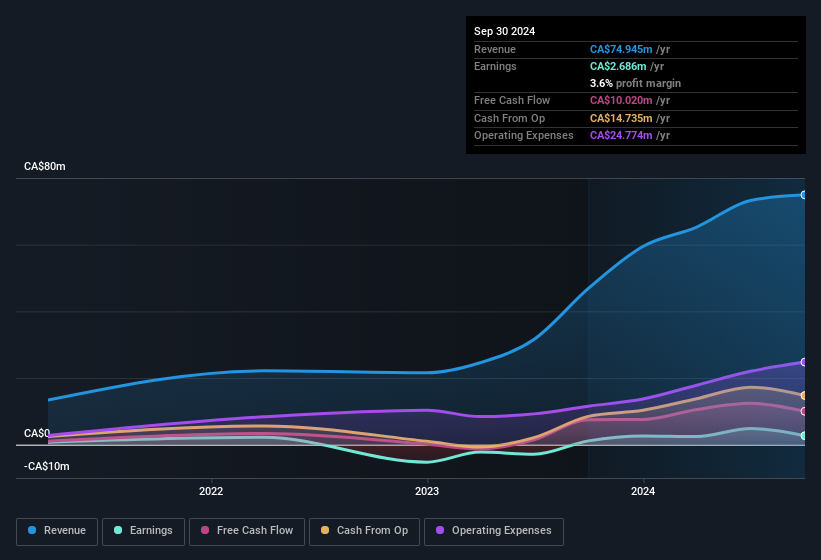

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. MTL Cannabis shareholders can take confidence from the fact that EBIT margins are up from 1.6% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since MTL Cannabis is no giant, with a market capitalisation of CA$46m, you should definitely check its cash and debt before getting too excited about its prospects.

Are MTL Cannabis Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that MTL Cannabis insiders spent CA$261k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the company insider, Kevin Weitzman, who made the biggest single acquisition, paying CA$119k for shares at about CA$0.47 each.

On top of the insider buying, we can also see that MTL Cannabis insiders own a large chunk of the company. To be exact, company insiders hold 77% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at CA$35m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does MTL Cannabis Deserve A Spot On Your Watchlist?

One positive for MTL Cannabis is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Even so, be aware that MTL Cannabis is showing 3 warning signs in our investment analysis , and 2 of those are concerning...

Keen growth investors love to see insider activity. Thankfully, MTL Cannabis isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:MTLC

MTL Cannabis

Through its subsidiaries, engages in the cultivation and production of cannabis products for recreational and medical purposes in Canada.

Fair value with imperfect balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026