- Canada

- /

- Metals and Mining

- /

- TSXV:ALTA

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

With Canada's election now behind it, one source of uncertainty has been removed, allowing policymakers to focus on trade and economic issues. As the market adjusts to these changes, investors are keenly watching for opportunities that align with evolving fiscal policies and potential interest rate cuts. Penny stocks, though a somewhat outdated term, still represent smaller or newer companies that can offer value when backed by strong financials. We've identified three such stocks that may provide both stability and growth potential in today's shifting landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.80 | CA$79.91M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.19 | CA$89.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.64 | CA$432.44M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.14 | CA$623.15M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.78 | CA$3.94M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$512.64M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.55 | CA$128M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.23 | CA$88.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.47 | CA$13.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.64 | CA$124.83M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 917 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

InnoCan Pharma (CNSX:INNO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InnoCan Pharma Corporation is a pharmaceutical technology company that develops drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients, operating in the United States, Canada, Europe, and internationally, with a market cap of CA$52.64 million.

Operations: The company generates revenue primarily from online sales, amounting to $29.40 million.

Market Cap: CA$52.64M

InnoCan Pharma, with a market cap of CA$52.64 million, remains pre-revenue but has shown significant progress in reducing losses by 15.1% annually over the past five years. The company is debt-free and maintains a stable cash runway exceeding three years based on current free cash flow, providing financial resilience despite an unqualified auditor's opinion expressing going concern doubts. Recent strategic moves include securing patent allowances for its CBD-based technologies in Mexico and filing applications in China, enhancing its intellectual property portfolio across key markets. These developments support InnoCan's efforts to penetrate new regions and strengthen its position in cannabidiol-based therapeutic solutions.

- Click to explore a detailed breakdown of our findings in InnoCan Pharma's financial health report.

- Gain insights into InnoCan Pharma's historical outcomes by reviewing our past performance report.

Altamira Gold (TSXV:ALTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Altamira Gold Corp. is involved in the acquisition, exploration, development, and mining of mineral properties in Brazil and Canada with a market cap of CA$25.44 million.

Operations: Currently, there are no reported revenue segments for Altamira Gold Corp.

Market Cap: CA$25.44M

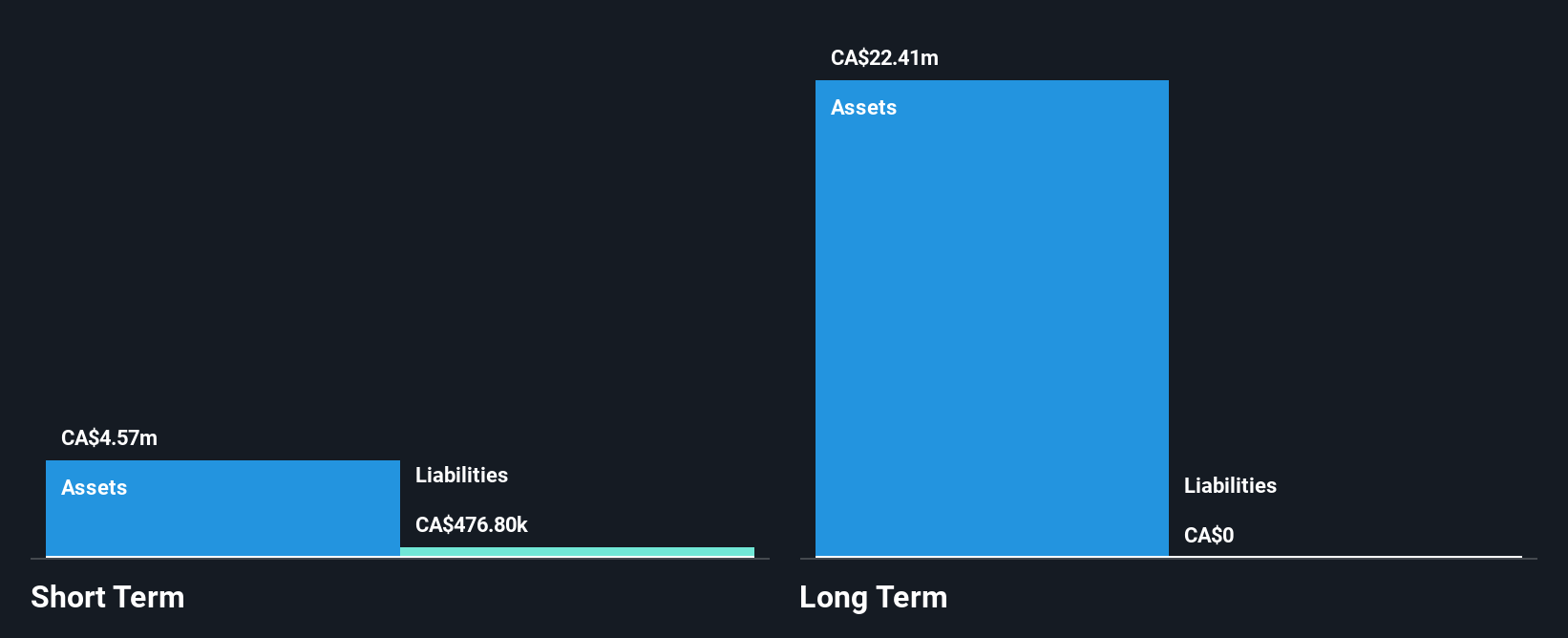

Altamira Gold Corp., with a market cap of CA$25.44 million, is currently pre-revenue and unprofitable, facing increasing losses over the past five years. Despite this, the company remains debt-free and has not experienced significant shareholder dilution recently. Its short-term assets of CA$1.6 million comfortably cover its liabilities of CA$214.3K, although it has less than a year of cash runway based on current free cash flow trends. Recent exploration results at Serafim and Tavares Norte have shown promising gold assays, potentially enhancing its mineral resource base near Cajueiro Central Mineral Resource in Brazil.

- Click here and access our complete financial health analysis report to understand the dynamics of Altamira Gold.

- Review our historical performance report to gain insights into Altamira Gold's track record.

Quorum Information Technologies (TSXV:QIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quorum Information Technologies Inc. is an information technology company specializing in the automotive retail sector in Canada and the United States, with a market cap of CA$69.18 million.

Operations: Quorum Information Technologies generates revenue through three primary segments: Services and One-Time (CA$1.14 million), Software as a Service (SaaS) (CA$28.84 million), and Business Development Centre (BDC) (CA$9.97 million).

Market Cap: CA$69.18M

Quorum Information Technologies Inc., with a market cap of CA$69.18 million, reported stable revenues of CA$39.95 million for 2024, while net income rose significantly to CA$2.55 million from the previous year. The company has demonstrated high-quality earnings and experienced management with an average tenure of 5.3 years. Despite its low Return on Equity at 8.6%, Quorum's debt is well-covered by operating cash flow, and it has reduced its debt-to-equity ratio over five years from 29.1% to 17.9%. However, short-term assets fall short in covering long-term liabilities, presenting a potential risk factor for investors.

- Get an in-depth perspective on Quorum Information Technologies' performance by reading our balance sheet health report here.

- Explore Quorum Information Technologies' analyst forecasts in our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 917 TSX Penny Stocks here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 29 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALTA

Altamira Gold

A junior exploration company, engages in the acquisition, exploration, development, and mining of mineral properties.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives