Is InnoCan Pharma (CSE:INNO) In A Good Position To Deliver On Growth Plans?

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, InnoCan Pharma (CSE:INNO) stock is up 143% in the last year, providing strong gains for shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky InnoCan Pharma's cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for InnoCan Pharma

Does InnoCan Pharma Have A Long Cash Runway?

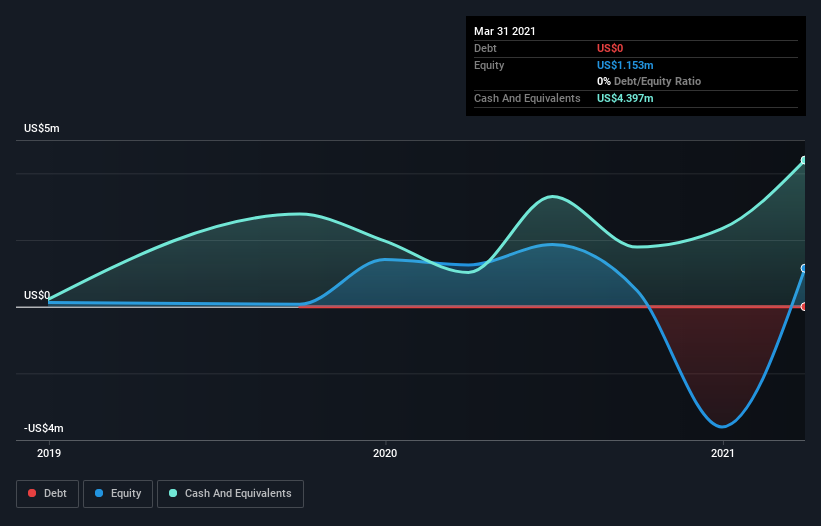

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at March 2021, InnoCan Pharma had cash of US$4.4m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was US$4.7m over the trailing twelve months. So it had a cash runway of approximately 11 months from March 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. You can see how its cash balance has changed over time in the image below.

How Is InnoCan Pharma's Cash Burn Changing Over Time?

In our view, InnoCan Pharma doesn't yet produce significant amounts of operating revenue, since it reported just US$45k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. Over the last year its cash burn actually increased by 40%, which suggests that management are increasing investment in future growth, but not too quickly. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. InnoCan Pharma makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can InnoCan Pharma Raise Cash?

Given its cash burn trajectory, InnoCan Pharma shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

InnoCan Pharma has a market capitalisation of US$89m and burnt through US$4.7m last year, which is 5.3% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About InnoCan Pharma's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought InnoCan Pharma's cash burn relative to its market cap was relatively promising. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking a deeper dive, we've spotted 4 warning signs for InnoCan Pharma you should be aware of, and 2 of them are concerning.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:INNO

InnoCan Pharma

A pharmaceutical technology company, focuses on the development of various drug delivery platforms combining cannabidiol (CBD) with other pharmaceutical ingredients in the United States, Canada, Europe, and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives