With EPS Growth And More, Green Thumb Industries (CSE:GTII) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Green Thumb Industries (CSE:GTII). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Green Thumb Industries with the means to add long-term value to shareholders.

Check out our latest analysis for Green Thumb Industries

Green Thumb Industries' Improving Profits

In the last three years Green Thumb Industries' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Over the last year, Green Thumb Industries increased its EPS from US$0.34 to US$0.36. That amounts to a small improvement of 6.0%.

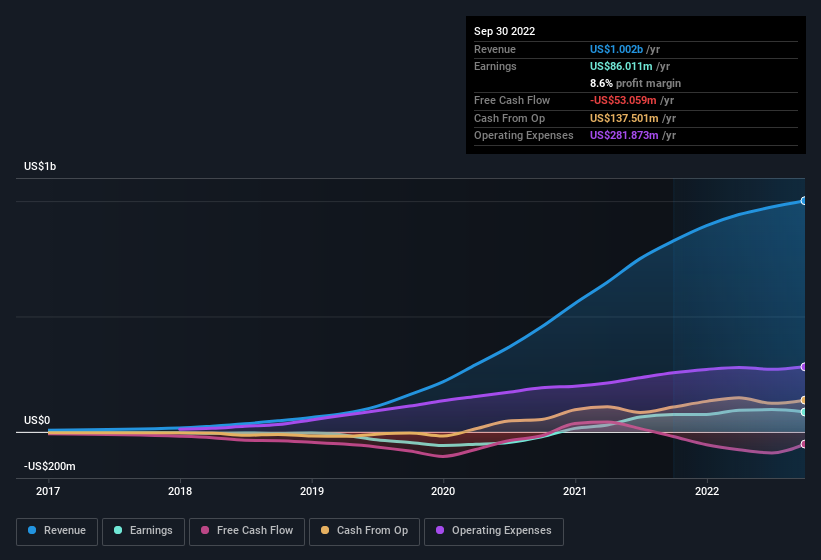

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Green Thumb Industries has done well over the past year, growing revenue by 21% to US$1.0b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Green Thumb Industries.

Are Green Thumb Industries Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Green Thumb Industries insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth US$390m. This totals to 14% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between US$1.0b and US$3.2b, like Green Thumb Industries, the median CEO pay is around US$2.2m.

Green Thumb Industries offered total compensation worth US$1.7m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Green Thumb Industries To Your Watchlist?

One positive for Green Thumb Industries is that it is growing EPS. That's nice to see. Earnings growth might be the main attraction for Green Thumb Industries, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Now, you could try to make up your mind on Green Thumb Industries by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives