Investors Don't See Light At End Of 4Front Ventures Corp.'s (CSE:FFNT) Tunnel And Push Stock Down 40%

To the annoyance of some shareholders, 4Front Ventures Corp. (CSE:FFNT) shares are down a considerable 40% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

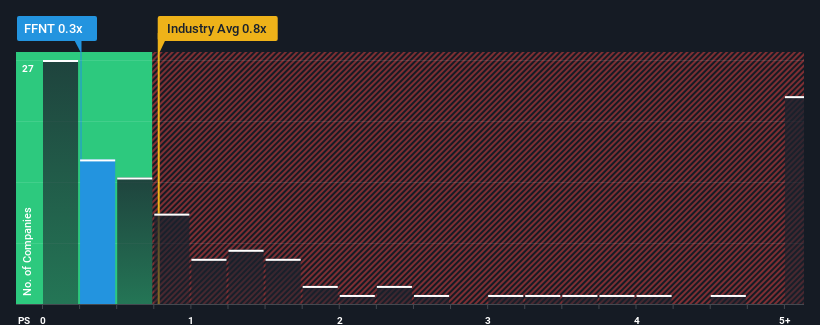

After such a large drop in price, given about half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider 4Front Ventures as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for 4Front Ventures

What Does 4Front Ventures' Recent Performance Look Like?

For instance, 4Front Ventures' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on 4Front Ventures will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on 4Front Ventures will help you shine a light on its historical performance.How Is 4Front Ventures' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as 4Front Ventures' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. As a result, revenue from three years ago have also fallen 19% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 11% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that 4Front Ventures' P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does 4Front Ventures' P/S Mean For Investors?

4Front Ventures' recently weak share price has pulled its P/S back below other Pharmaceuticals companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of 4Front Ventures confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware 4Front Ventures is showing 4 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:FFNT

4Front Ventures

Engages in cultivating, processing, manufacturing, and sale of cannabis products in the United States.

Good value slight.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success