- Canada

- /

- Metals and Mining

- /

- TSXV:GHRT

TSX Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As we approach October 2025, the Canadian market has shown resilience despite uncertainties around trade, government actions, and credit concerns. Investors are advised to consider rebalancing and diversifying their portfolios to navigate potential volatility while capitalizing on quality investments. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing opportunities for growth at lower price points. In this article, we explore three penny stocks that stand out due to their solid financial foundations and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.52 | CA$63.71M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.355 | CA$53.32M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.26 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.09 | CA$21.6M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.70 | CA$436.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.34 | CA$169.52M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.07 | CA$196.51M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 413 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

C21 Investments (CNSX:CXXI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: C21 Investments Inc. is an integrated cannabis company that cultivates, processes, distributes, and sells cannabis and hemp-derived consumer products in the United States with a market cap of CA$70.72 million.

Operations: C21 Investments generates revenue from its cannabis cultivation operations, which amounted to $32.08 million.

Market Cap: CA$70.72M

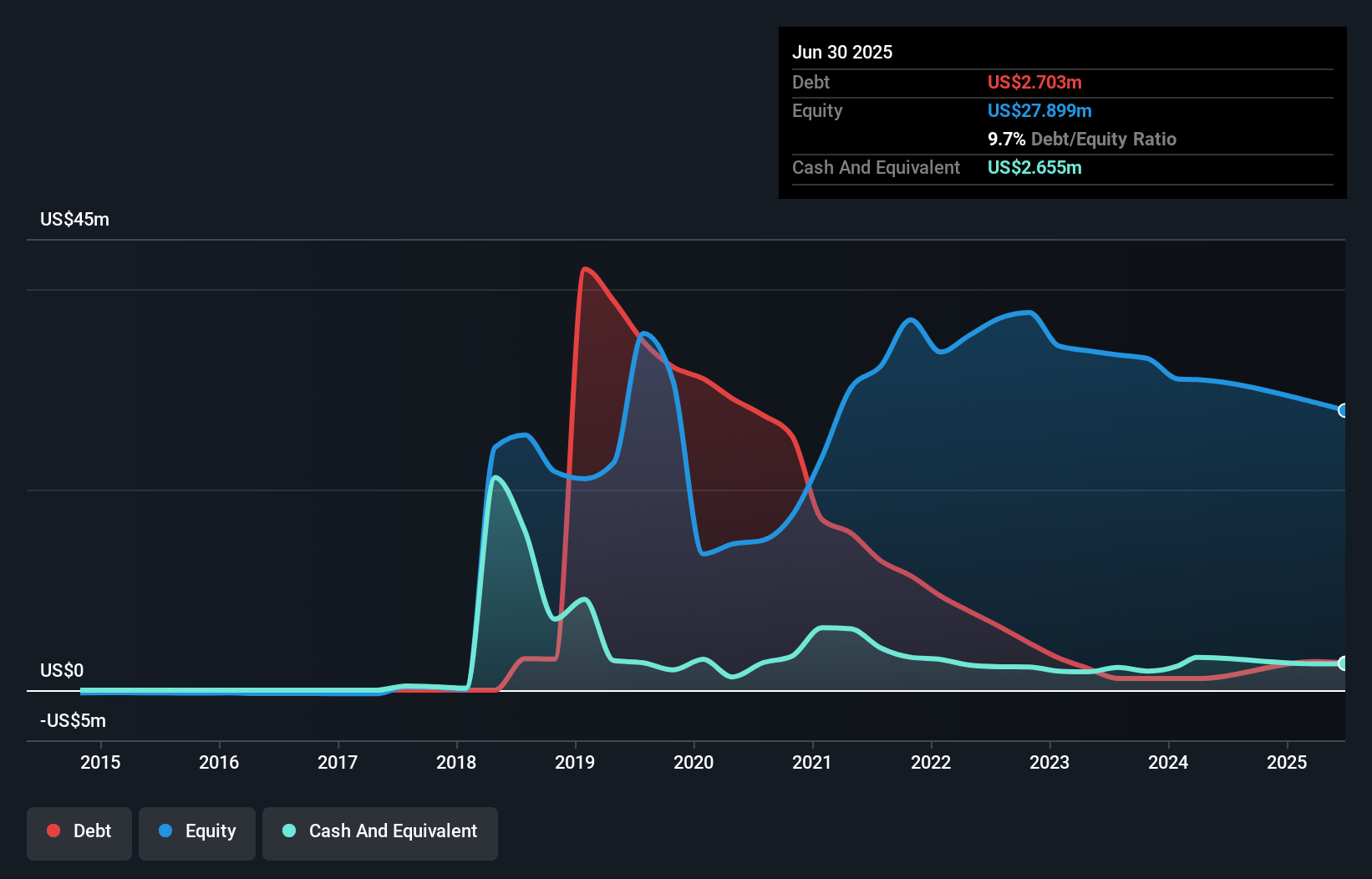

C21 Investments, with a market cap of CA$70.72 million, operates in the cannabis sector and reported revenue of US$8.55 million for Q1 2025, highlighting its active cultivation operations despite being unprofitable. The company has reduced its debt significantly over five years and maintains a satisfactory net debt to equity ratio of 0.2%. However, short-term assets do not cover liabilities, indicating liquidity challenges. Recent legal settlements require C21 to pay US$2.4 million over time while maintaining cash runway for more than three years due to positive free cash flow levels amidst high share price volatility and ongoing shareholder activities like buybacks and private placements.

- Click to explore a detailed breakdown of our findings in C21 Investments' financial health report.

- Evaluate C21 Investments' historical performance by accessing our past performance report.

Troilus Gold (TSX:TLG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Troilus Gold Corp. is involved in the acquisition, exploration, evaluation, and development of mineral properties in Canada with a market cap of CA$569.83 million.

Operations: Troilus Gold Corp. does not have any reported revenue segments.

Market Cap: CA$569.83M

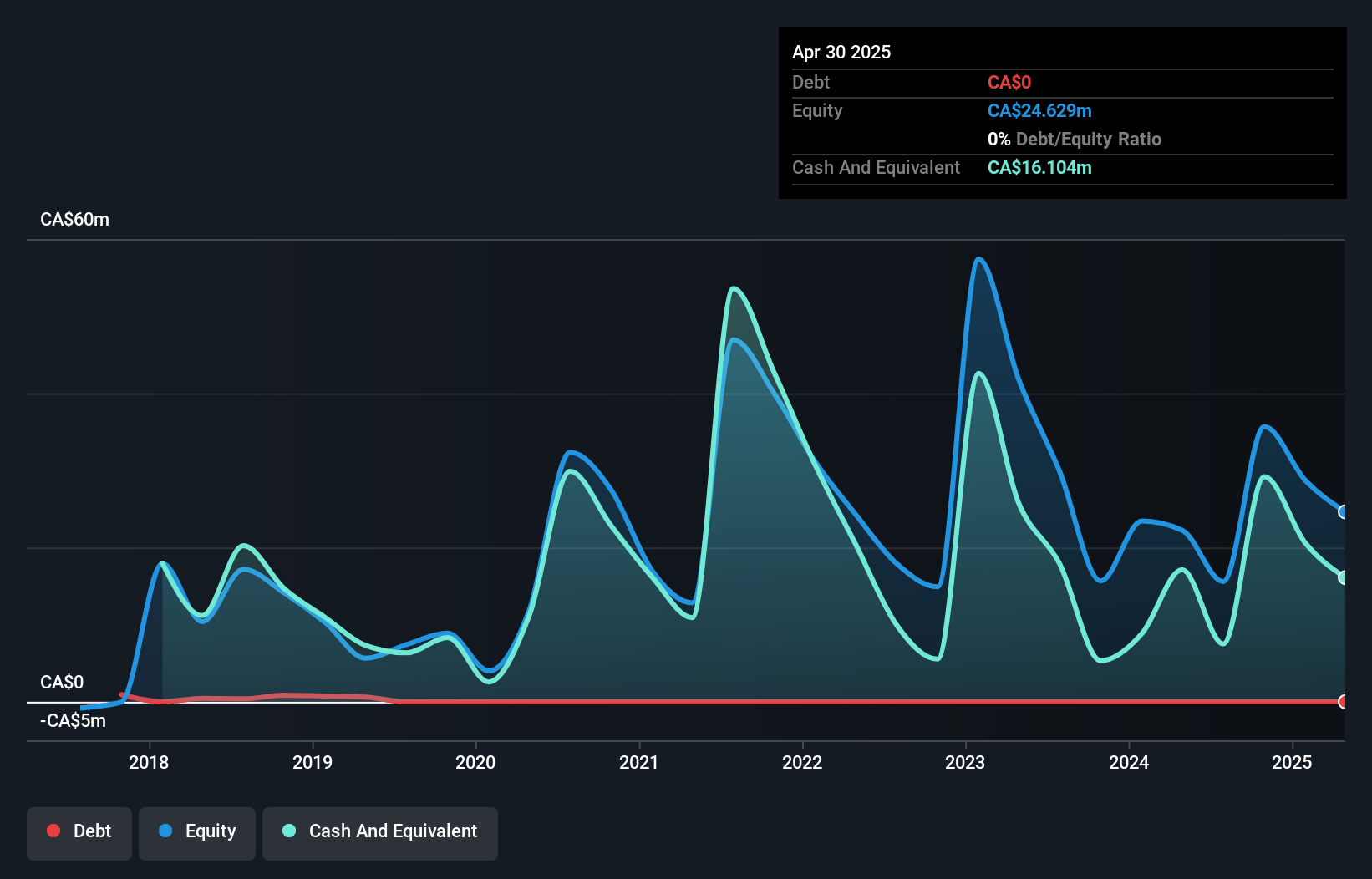

Troilus Gold Corp., with a market cap of CA$569.83 million, is pre-revenue and currently unprofitable but has reduced losses by 9% annually over five years. The company’s short-term assets exceed both its long-term and short-term liabilities, indicating solid financial positioning despite limited cash runway. Recent developments include significant engineering progress on its Troilus Project, nearing construction readiness with 85% completion of basic engineering. A Memorandum of Agreement with Aurubis AG for copper-gold concentrate offtake strengthens its strategic position as it moves toward project financing and development, supported by a potential debt package up to US$700 million.

- Click here and access our complete financial health analysis report to understand the dynamics of Troilus Gold.

- Review our growth performance report to gain insights into Troilus Gold's future.

Greenheart Gold (TSXV:GHRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenheart Gold Inc. is a mineral exploration company focused on operations in Guyana and Suriname, with a market cap of CA$211.12 million.

Operations: Greenheart Gold Inc. has not reported any revenue segments.

Market Cap: CA$211.12M

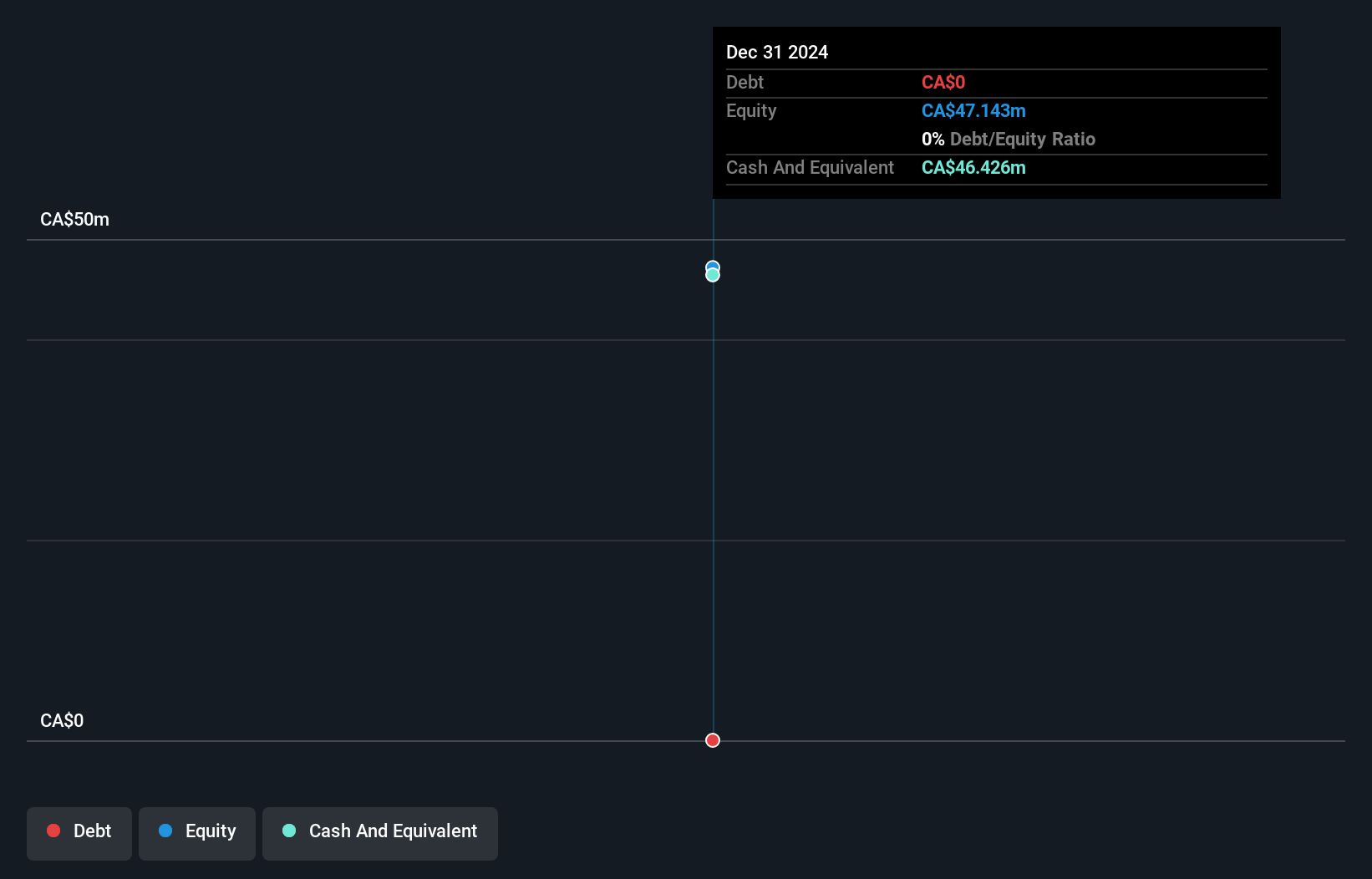

Greenheart Gold Inc., with a market cap of CA$211.12 million, is a pre-revenue mineral exploration company focused on projects in Guyana and Suriname. Recent activities include ongoing drill programs at Majorodam and Tamakay, aiming to expand known gold-bearing zones. The company remains debt-free with short-term assets of CA$46.8 million exceeding liabilities, providing some financial stability despite its unprofitable status. Leadership changes have brought experienced professionals like Tim Stubley and Julie-Anaïs Debreil to key roles, potentially enhancing exploration capabilities as they advance their strategic initiatives in the Guiana Shield region's promising gold prospects.

- Get an in-depth perspective on Greenheart Gold's performance by reading our balance sheet health report here.

- Understand Greenheart Gold's track record by examining our performance history report.

Make It Happen

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 410 more companies for you to explore.Click here to unveil our expertly curated list of 413 TSX Penny Stocks.

- Seeking Other Investments? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GHRT

Greenheart Gold

Operates as a mineral exploration company in Guyana and Suriname.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026