- Canada

- /

- Metals and Mining

- /

- TSXV:GMV

TSX Penny Stocks To Consider In August 2025

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of fluctuating inflation and employment rates, investors are keenly observing how these factors might influence stock performance. The term "penny stocks" might seem outdated, yet these investments continue to offer intriguing possibilities due to their affordability and potential for growth. In this article, we will examine three penny stocks that stand out for their financial resilience and promise in today's economic climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.68 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$488.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$19.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.01 | CA$201.5M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.81 | CA$646.16M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.65 | CA$158.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.91 | CA$179.49M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.69 | CA$8.62M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 436 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

C21 Investments (CNSX:CXXI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: C21 Investments Inc. is an integrated cannabis company that cultivates, processes, distributes, and sells cannabis and hemp-derived consumer products in the United States with a market cap of CA$35.33 million.

Operations: C21 Investments Inc. has not reported specific revenue segments.

Market Cap: CA$35.33M

C21 Investments Inc. has shown revenue growth, with first-quarter sales reaching US$8.55 million, up from US$6.6 million the previous year, yet it remains unprofitable with a net loss of US$0.76 million for the quarter. The company's financial stability is bolstered by a significant reduction in its debt-to-equity ratio over five years and a satisfactory net debt level of 0.2%. Despite high volatility and ongoing losses, C21's seasoned management team and sufficient cash runway for over three years provide some reassurance to investors navigating the volatile landscape of penny stocks in Canada’s cannabis sector.

- Dive into the specifics of C21 Investments here with our thorough balance sheet health report.

- Gain insights into C21 Investments' historical outcomes by reviewing our past performance report.

GMV Minerals (TSXV:GMV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GMV Minerals Inc. is an exploration stage company focused on sourcing and exploring mineral properties in the United States, with a market cap of CA$19.71 million.

Operations: Currently, GMV Minerals Inc. does not report any revenue segments.

Market Cap: CA$19.71M

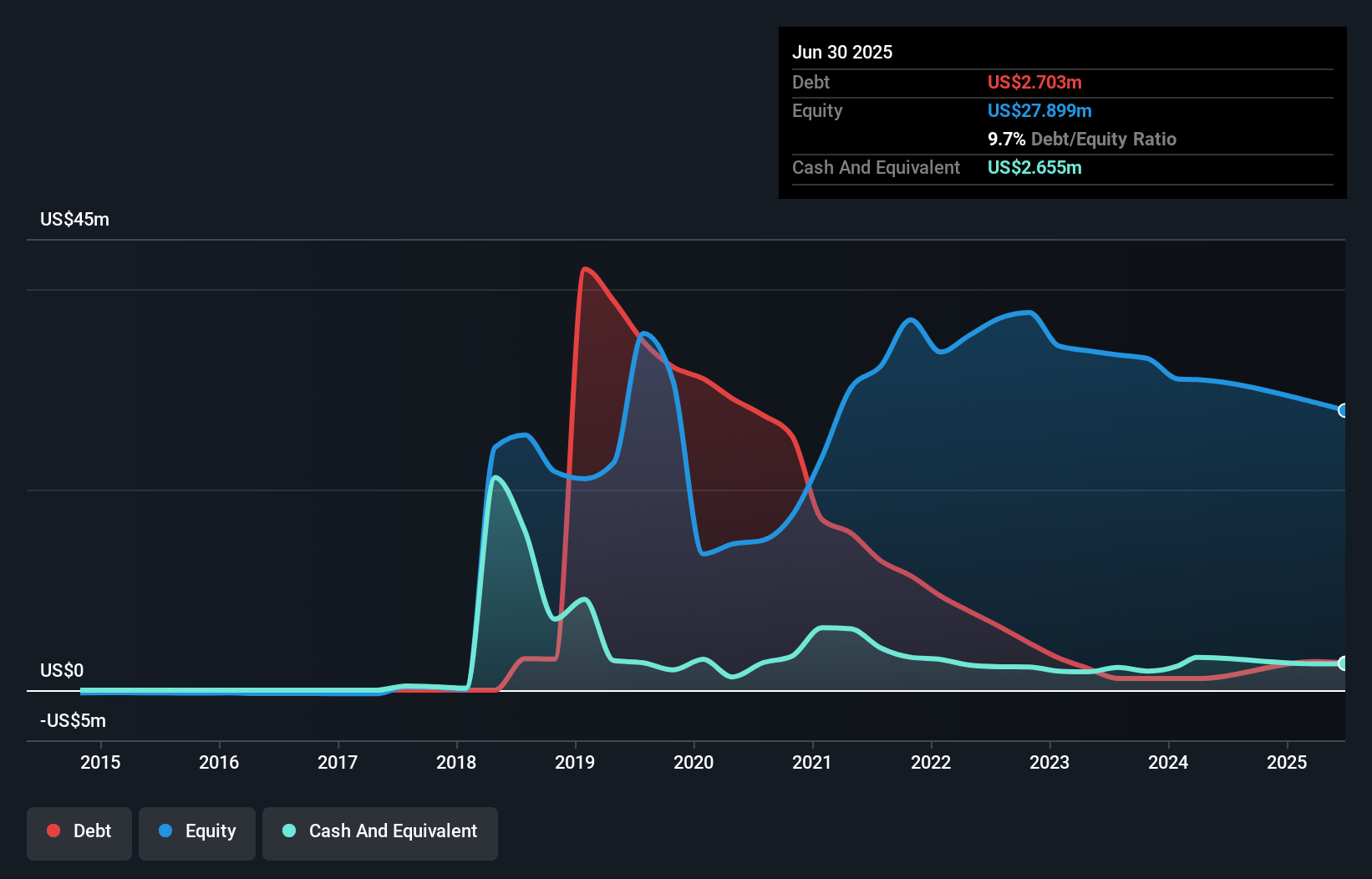

GMV Minerals Inc., with a market cap of CA$19.71 million, is a pre-revenue exploration stage company focused on mineral properties in the U.S. Despite being unprofitable, it has reduced losses over five years by 3.8% annually. The company recently reported a narrowed net loss for the nine months ending March 2025 compared to the previous year. GMV's seasoned board and management team offer stability, while its debt-free status and lack of long-term liabilities reduce financial risk. However, its highly volatile share price and insufficient cash runway highlight potential challenges for investors in this penny stock environment.

- Navigate through the intricacies of GMV Minerals with our comprehensive balance sheet health report here.

- Assess GMV Minerals' previous results with our detailed historical performance reports.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, with a market cap of CA$145.97 million.

Operations: The company's revenue of $74.87 million is derived from the exploration, development, and operation of mining properties.

Market Cap: CA$145.97M

Majestic Gold Corp., with a market cap of CA$145.97 million, shows promise in the penny stock arena due to its stable financials and experienced management team. The company has consistently improved net profit margins and reduced its debt-to-equity ratio over five years, while maintaining strong cash flow coverage for its debt. Short-term assets comfortably cover both short- and long-term liabilities, indicating robust liquidity. Despite high share price volatility, earnings have grown significantly by 37.1% over the past year, although they lag behind industry growth rates. Recent earnings reports show increased sales and net income compared to the previous year.

- Get an in-depth perspective on Majestic Gold's performance by reading our balance sheet health report here.

- Evaluate Majestic Gold's historical performance by accessing our past performance report.

Seize The Opportunity

- Investigate our full lineup of 436 TSX Penny Stocks right here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GMV

GMV Minerals

An exploration stage company, engages in the sourcing and exploration of mineral properties in the United States.

Flawless balance sheet low.

Market Insights

Community Narratives