Optimistic Investors Push Cresco Labs Inc. (CSE:CL) Shares Up 27% But Growth Is Lacking

Cresco Labs Inc. (CSE:CL) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 60% share price decline over the last year.

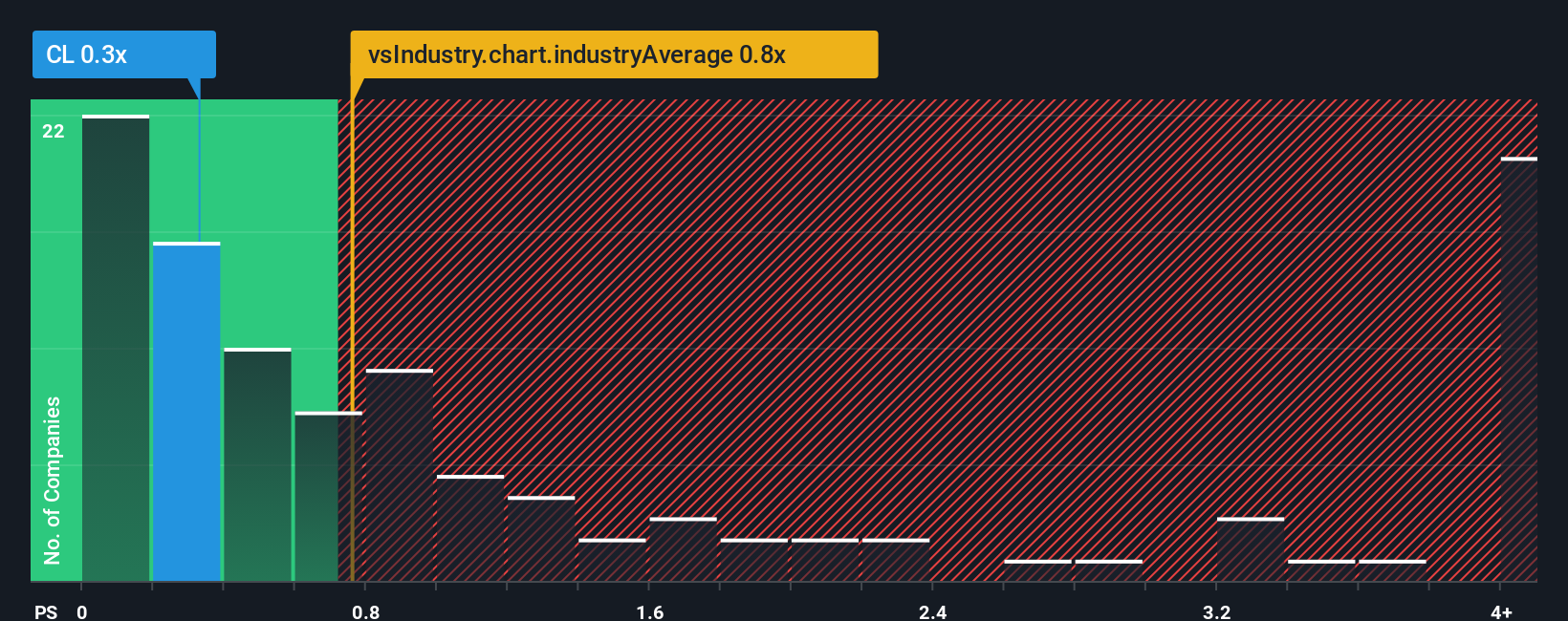

Even after such a large jump in price, there still wouldn't be many who think Cresco Labs' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Canada's Pharmaceuticals industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Cresco Labs

What Does Cresco Labs' P/S Mean For Shareholders?

Cresco Labs hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cresco Labs.How Is Cresco Labs' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Cresco Labs' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.7%. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.7% each year as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 5.5% each year, which paints a poor picture.

With this information, we find it concerning that Cresco Labs is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Cresco Labs' P/S Mean For Investors?

Cresco Labs appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Cresco Labs' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It is also worth noting that we have found 2 warning signs for Cresco Labs that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:CL

Cresco Labs

Cresco Labs Inc. cultivates, manufactures, and sells retail and medical cannabis products in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives