Ayr Wellness Inc. (CSE:AYR.A) Not Doing Enough For Some Investors As Its Shares Slump 28%

Ayr Wellness Inc. (CSE:AYR.A) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 88%, which is great even in a bull market.

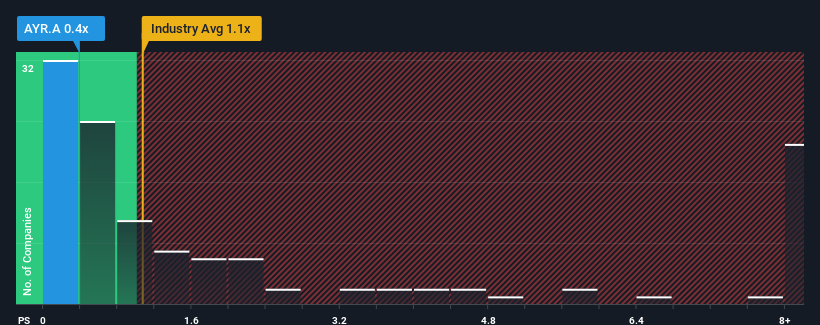

Since its price has dipped substantially, considering around half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Ayr Wellness as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Ayr Wellness

What Does Ayr Wellness' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Ayr Wellness has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ayr Wellness.How Is Ayr Wellness' Revenue Growth Trending?

In order to justify its P/S ratio, Ayr Wellness would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 91% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 8.1% per year over the next three years. With the industry predicted to deliver 11% growth per year, the company is positioned for a weaker revenue result.

With this information, we can see why Ayr Wellness is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Ayr Wellness' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Ayr Wellness' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Ayr Wellness has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Ayr Wellness, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AYR.A

Ayr Wellness

Ayr Wellness Inc. cultivates, manufactures, and retails cannabis products and branded cannabis packaged goods in United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives