What Kind Of Shareholder Appears On The Algernon Pharmaceuticals Inc.'s (CSE:AGN) Shareholder Register?

Every investor in Algernon Pharmaceuticals Inc. (CSE:AGN) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Algernon Pharmaceuticals is a smaller company with a market capitalization of CA$21m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have not yet purchased shares. Let's take a closer look to see what the different types of shareholder can tell us about Algernon Pharmaceuticals.

Check out our latest analysis for Algernon Pharmaceuticals

What Does The Lack Of Institutional Ownership Tell Us About Algernon Pharmaceuticals?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

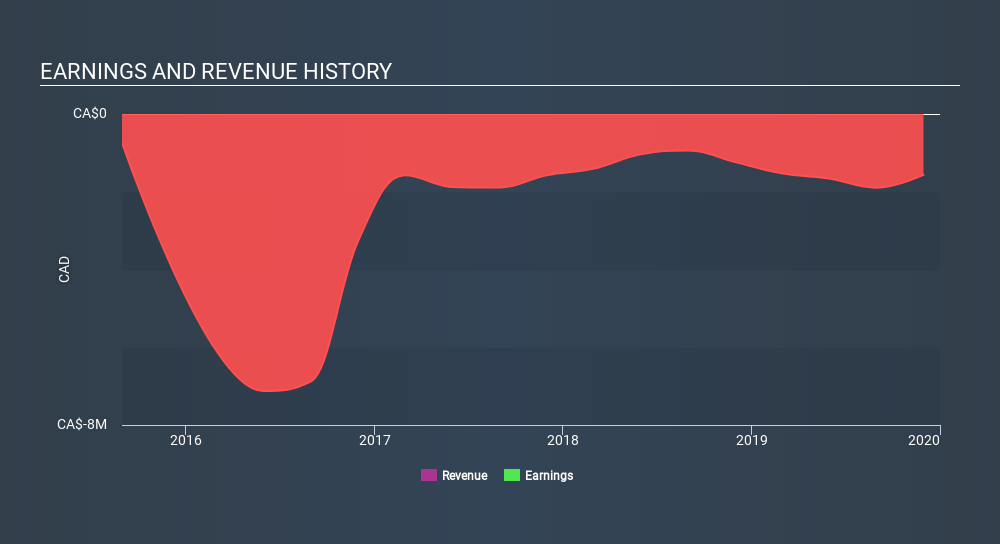

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Algernon Pharmaceuticals, for yourself, below.

Algernon Pharmaceuticals is not owned by hedge funds. Our data shows that BullRun Capital Inc. is the largest shareholder with 5.8% of shares outstanding. With 4.1% and 1.0% of the shares outstanding respectively, Mark Williams and Rajpaul Attariwala are the second and third largest shareholders. They also happen to be Chief Scientific Officer and Member of the Board of Directors, respectively. That is, insiders feature higher up in the heirarchy of the company's top shareholders.

On studying our ownership data, we found that 9 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Algernon Pharmaceuticals

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in Algernon Pharmaceuticals Inc.. As individuals, the insiders collectively own CA$1.6m worth of the CA$21m company. It is good to see some investment by insiders, but I usually like to see higher insider holdings. It might be worth checking if those insiders have been buying.

General Public Ownership

The general public -- mostly retail investors -- own 86% of Algernon Pharmaceuticals. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Private Equity Ownership

With a stake of 5.8%, private equity firms could influence the AGN board. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Algernon Pharmaceuticals better, we need to consider many other factors. For instance, we've identified 5 warning signs for Algernon Pharmaceuticals (2 are a bit concerning) that you should be aware of.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:AGN

Algernon Health

Operates as a clinical stage pharmaceutical development company in Canada and Australia.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026