Acreage Holdings, Inc. (CSE:ACRG.A.U) Just Reported, And Analysts Assigned A US$1.50 Price Target

The analysts might have been a bit too bullish on Acreage Holdings, Inc. (CSE:ACRG.A.U), given that the company fell short of expectations when it released its quarterly results last week. Revenues missed expectations somewhat, coming in at US$61m and leading to a corresponding blowout in statutory losses. The loss per share was US$0.09, some 12% larger than the analysts forecast. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Acreage Holdings

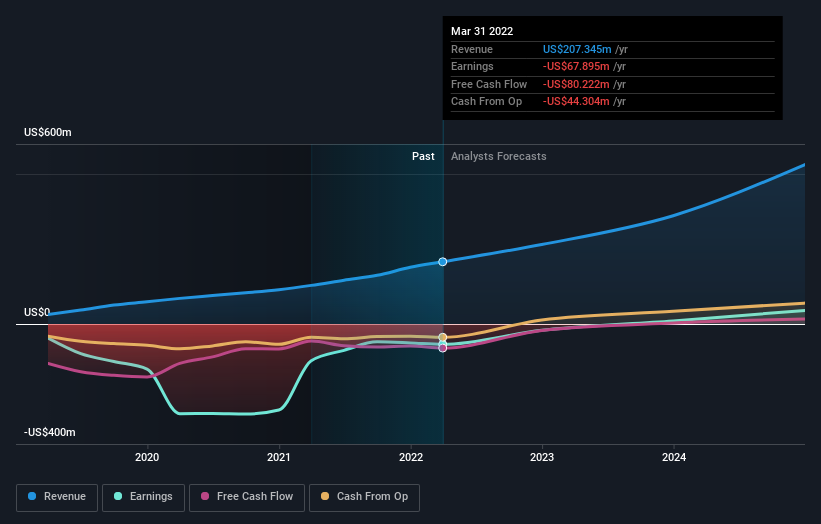

Taking into account the latest results, the most recent consensus for Acreage Holdings from six analysts is for revenues of US$264.9m in 2022 which, if met, would be a substantial 28% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 46% to US$0.33. Before this earnings announcement, the analysts had been modelling revenues of US$264.9m and losses of US$0.34 per share in 2022. It looks like there's been a modest increase in sentiment in the recent updates, with the analysts becoming a bit more optimistic in their predictions for losses per share, even though the revenue numbers were unchanged.

The consensus price target fell 46% to US$1.50despite the forecast for smaller losses next year. It looks like the ongoing lack of profitability is starting to weigh on valuations.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Acreage Holdings' growth to accelerate, with the forecast 63% annualised growth to the end of 2022 ranking favourably alongside historical growth of 47% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 23% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Acreage Holdings is expected to grow much faster than its industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Acreage Holdings going out to 2024, and you can see them free on our platform here..

It is also worth noting that we have found 2 warning signs for Acreage Holdings that you need to take into consideration.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:ACRG.A.U

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success