Positive Sentiment Still Eludes Sabio Holdings Inc. (CVE:SBIO) Following 26% Share Price Slump

Unfortunately for some shareholders, the Sabio Holdings Inc. (CVE:SBIO) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

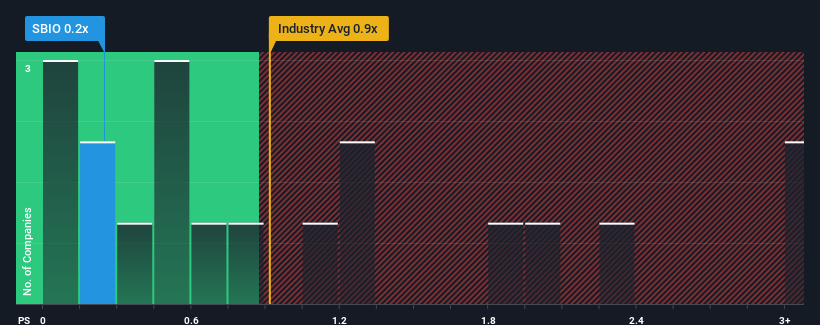

Since its price has dipped substantially, when close to half the companies operating in Canada's Media industry have price-to-sales ratios (or "P/S") above 1x, you may consider Sabio Holdings as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Sabio Holdings

What Does Sabio Holdings' P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Sabio Holdings has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Sabio Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Sabio Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 210% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 7.9% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 0.2% growth forecast for the broader industry.

With this information, we find it odd that Sabio Holdings is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Sabio Holdings' P/S

The southerly movements of Sabio Holdings' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Sabio Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Sabio Holdings has 6 warning signs (and 3 which are a bit unpleasant) we think you should know about.

If you're unsure about the strength of Sabio Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SBIO

Sabio Holdings

Operates as a technology provider in the advertising areas of connected TV (CTV) and over-the-top (OTT) streaming in the United States and the United Kingdom.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.