Further Upside For Sabio Holdings Inc. (CVE:SBIO) Shares Could Introduce Price Risks After 58% Bounce

Sabio Holdings Inc. (CVE:SBIO) shareholders are no doubt pleased to see that the share price has bounced 58% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 55% share price decline over the last year.

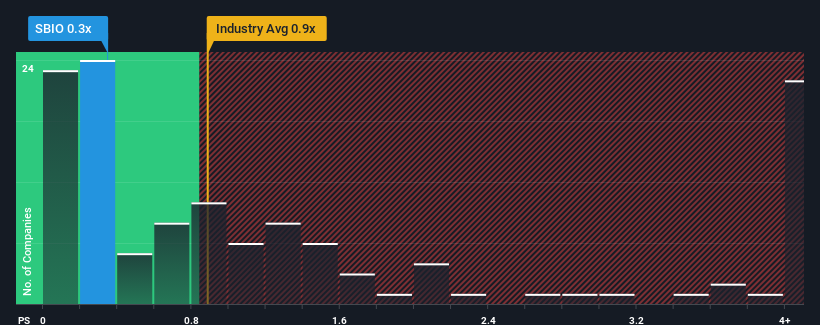

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Sabio Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Media industry in Canada is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sabio Holdings

What Does Sabio Holdings' P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Sabio Holdings has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Sabio Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Sabio Holdings?

In order to justify its P/S ratio, Sabio Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 210% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 7.9% over the next year. That's shaping up to be materially higher than the 1.4% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Sabio Holdings' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Sabio Holdings' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Sabio Holdings' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 6 warning signs for Sabio Holdings (3 don't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Sabio Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SBIO

Sabio Holdings

Operates as a technology provider in the advertising areas of connected TV (CTV) and over-the-top (OTT) streaming in the United States and the United Kingdom.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026