A Piece Of The Puzzle Missing From Sabio Holdings Inc.'s (CVE:SBIO) 28% Share Price Climb

The Sabio Holdings Inc. (CVE:SBIO) share price has done very well over the last month, posting an excellent gain of 28%. The last month tops off a massive increase of 111% in the last year.

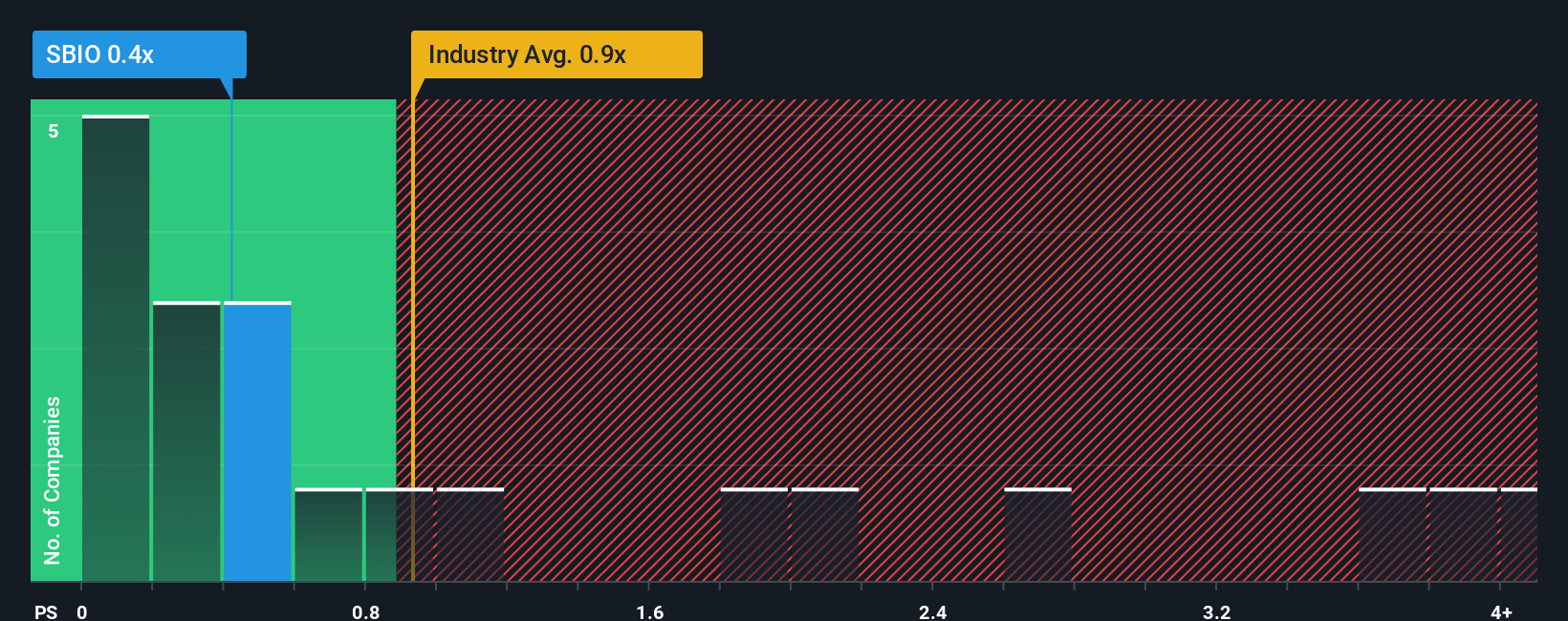

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Sabio Holdings' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Media industry in Canada is also close to 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sabio Holdings

How Sabio Holdings Has Been Performing

Sabio Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Sabio Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Sabio Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 46%. The strong recent performance means it was also able to grow revenue by 92% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 6.4% as estimated by the three analysts watching the company. With the industry only predicted to deliver 1.4%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Sabio Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Sabio Holdings' P/S?

Its shares have lifted substantially and now Sabio Holdings' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Sabio Holdings' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 2 warning signs for Sabio Holdings you should be aware of, and 1 of them is potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SBIO

Sabio Holdings

Operates as a technology provider in the advertising areas of connected TV (CTV) and over-the-top (OTT) streaming in the United States and the United Kingdom.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026