- Canada

- /

- Entertainment

- /

- TSXV:OAM

After Leaping 49% OverActive Media Corp. (CVE:OAM) Shares Are Not Flying Under The Radar

Despite an already strong run, OverActive Media Corp. (CVE:OAM) shares have been powering on, with a gain of 49% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

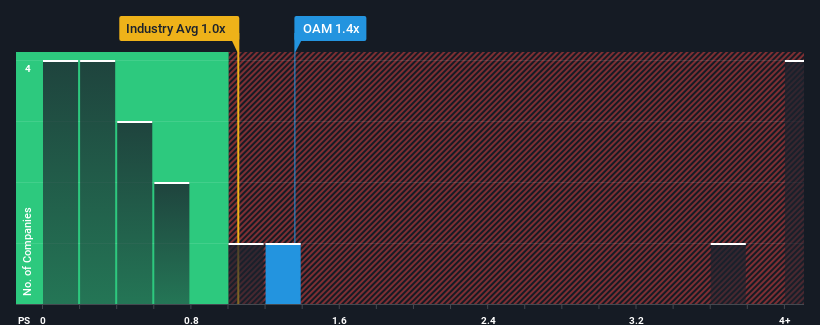

After such a large jump in price, you could be forgiven for thinking OverActive Media is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in Canada's Entertainment industry have P/S ratios below 0.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for OverActive Media

How OverActive Media Has Been Performing

OverActive Media hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think OverActive Media's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like OverActive Media's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 84% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 45% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in mind, it's not hard to understand why OverActive Media's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in OverActive Media's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that OverActive Media maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Entertainment industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware OverActive Media is showing 3 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on OverActive Media, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:OAM

OverActive Media

Operates as an esports and entertainment company in Canada, the United States, and Europe.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives