Stock Analysis

As the Canadian market rides a wave of optimism, buoyed by recent rate cuts from the U.S. Federal Reserve and enthusiasm surrounding AI advancements, the TSX has reached all-time highs, reflecting a broader trend of rising corporate earnings and an extended economic expansion. In this environment, high-growth tech stocks in Canada are particularly appealing to investors who are seeking opportunities that align with these positive market conditions and demonstrate potential for continued growth amidst evolving economic landscapes.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.22% | 179.27% | ★★★★☆☆ |

| BlackBerry | 24.19% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Computer Modelling Group (TSX:CMG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company specializing in reservoir simulation and seismic interpretation software, with a market capitalization of CA$911.01 million.

Operations: The company focuses on developing and licensing reservoir simulation and seismic interpretation software, generating CA$90.29 million in revenue from its core operations.

Computer Modelling Group Ltd. (CMG) has recently demonstrated innovation with its launch of Focus CCS, enhancing CO2 storage site selection and validation processes. This development aligns with CMG's strategic focus on providing advanced solutions in carbon capture and storage, a critical component in global efforts towards net-zero emissions. Financially, CMG reported a robust first-quarter sales increase to CAD 30.52 million from CAD 20.75 million year-over-year, although net income dipped to CAD 3.96 million from CAD 6.9 million due to strategic investments into R&D and market expansion efforts. These figures underscore CMG’s commitment to growth through innovation—revenue is expected to climb by 11.5% annually, outpacing the Canadian market's average of 7%. Moreover, earnings are projected to surge by an impressive 24.6% per year, suggesting strong future prospects despite current profitability pressures.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

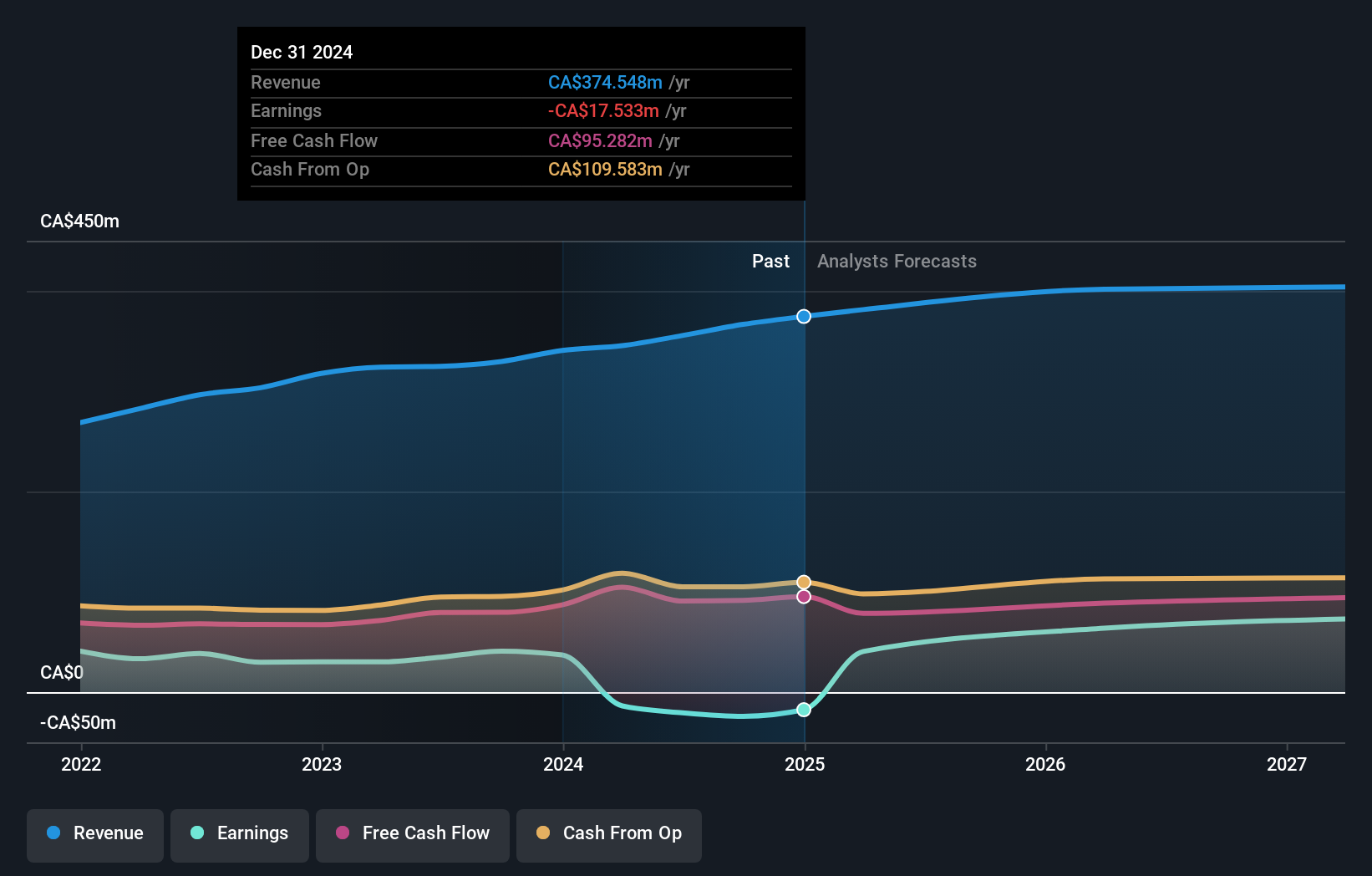

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across various regions including the United States, Europe, Asia, and Canada, with a market cap of CA$4.51 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $457.72 million. The focus is on providing cloud-based solutions for supply chain management across multiple regions.

Amidst a dynamic backdrop of investor activism and strategic shifts, Kinaxis stands out with its robust commitment to innovation and market expansion. Recently, the company announced significant client acquisitions like Mahindra & Mahindra Ltd., enhancing its footprint in the complex auto supply chain sector. This move aligns with Kinaxis's strategic use of AI in supply chain orchestration, notably through its Maestro platform. Financially, the firm is on a growth trajectory with R&D expenses marked at 14.5% of revenue, aimed at capturing more from the $16 billion market potential. Despite challenges such as leadership transitions and activist pressures for a sale review by Irenic Capital Management, Kinaxis reported a notable increase in sales to $118.28 million this quarter from $105.77 million last year, underscoring resilience and an agile response strategy that continues to attract top-tier clients like Volvo and Ford.

- Click to explore a detailed breakdown of our findings in Kinaxis' health report.

Understand Kinaxis' track record by examining our Past report.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of CA$512.90 million.

Operations: The company generates revenue primarily from two segments: Radio, contributing CA$154.41 million, and Broadcasting and Commercial Music, which brings in CA$201.10 million.

Stingray Group's strategic initiatives, such as the launch of the Stingray Karaoke app on VIZIO and innovative in-car entertainment solutions with Ford, underscore its commitment to diversifying consumer engagement. Despite a modest revenue growth forecast of 4.9% annually, which trails the Canadian market average, Stingray is positioning itself for future profitability with expected earnings growth surging by 69.2%. The firm has also reinforced shareholder value through a significant share repurchase program, buying back 6.39% of its issued capital this year. These moves reflect a focused strategy to enhance its digital media offerings and expand market reach amidst competitive pressures.

- Get an in-depth perspective on Stingray Group's performance by reading our health report here.

Gain insights into Stingray Group's historical performance by reviewing our past performance report.

Summing It All Up

- Delve into our full catalog of 24 TSX High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KXS

Kinaxis

Provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada.