- Canada

- /

- Electrical

- /

- TSXV:BES

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the Canadian economy navigates a period of cooling labor markets and anticipated rate cuts by the Bank of Canada, investors are keeping a close watch on how these macroeconomic shifts might influence market dynamics. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area for those seeking potential growth opportunities outside traditional large-cap equities. While historically considered high-risk, some penny stocks today offer financial resilience and growth potential that align well with current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$175.73M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$117.08M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.33 | CA$212.76M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.28 | CA$313.02M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.96 | CA$205.89M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$127.98M | ★★★★☆☆ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Braille Energy Systems (TSXV:BES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braille Energy Systems Inc. operates in the battery-manufacturing and energy storage sector both in Canada and internationally, with a market cap of CA$7.94 million.

Operations: The company generates CA$3.34 million from the production and sale of energy storage products.

Market Cap: CA$7.94M

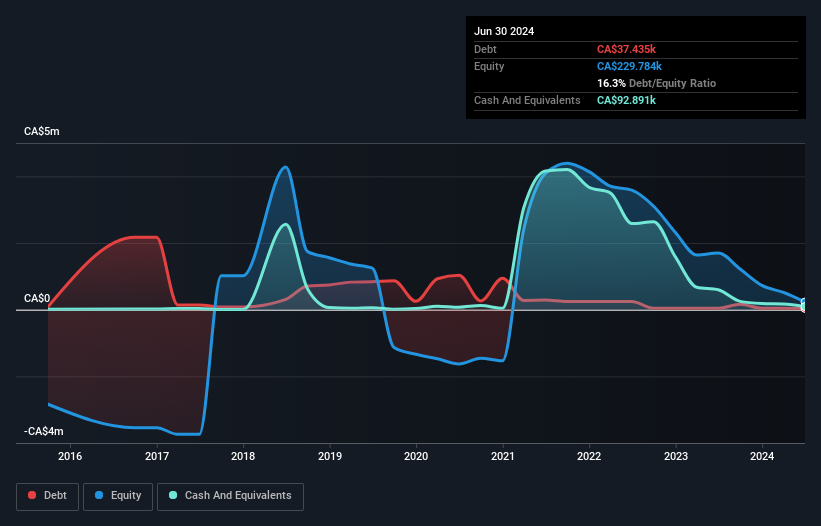

Braille Energy Systems Inc., with a market cap of CA$7.94 million, is unprofitable and has seen increasing losses over the past five years. Despite having more cash than debt and covering both short- and long-term liabilities with its assets, the company faces challenges with a limited cash runway of three months based on recent free cash flow but has raised additional capital through private placements. The company's recent product validation for its EARLYALERT Lithium Battery Thermal Warning System could enhance safety in NYC's e-micromobility market, potentially opening new revenue streams amidst declining sales figures.

- Take a closer look at Braille Energy Systems' potential here in our financial health report.

- Understand Braille Energy Systems' track record by examining our performance history report.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave machinery for the food, cannabis, and biomaterial dehydration industries in Canada and the United States with a market cap of CA$28.81 million.

Operations: EnWave Corporation has not reported any specific revenue segments.

Market Cap: CA$28.81M

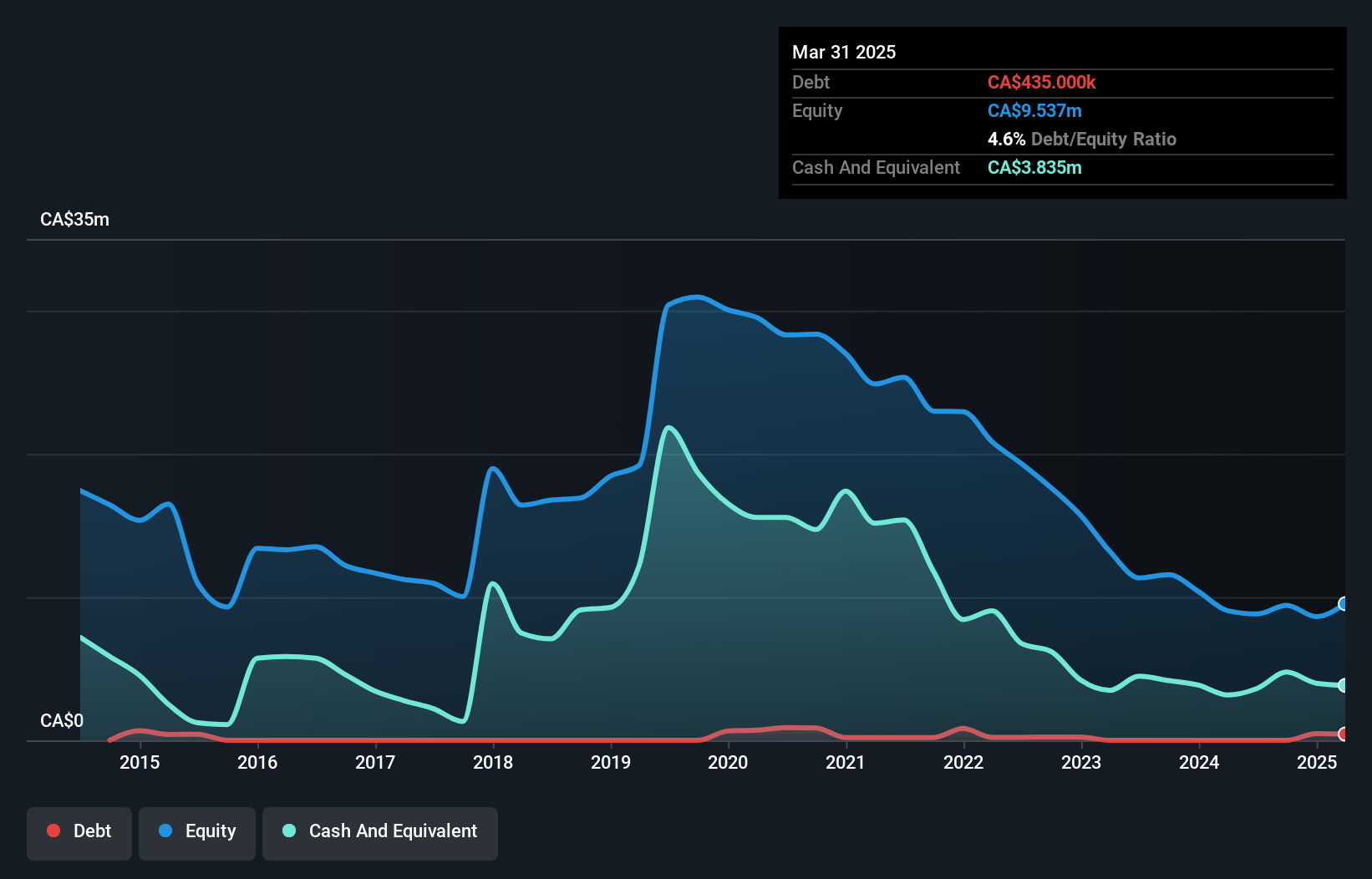

EnWave Corporation, with a market cap of CA$28.81 million, is unprofitable but has improved its financial position by reducing losses over the past five years. The company maintains a strong cash runway exceeding three years and holds no debt, supported by recent agreements like the license and equipment purchase with CNTA to expand its presence in Europe. EnWave's strategic focus on enhancing sales capabilities through non-dilutive financing arrangements with Desjardins aims to bolster its international market reach. Recent earnings show modest sales growth yet highlight ongoing challenges in achieving profitability amidst fluctuating revenue streams.

- Click here and access our complete financial health analysis report to understand the dynamics of EnWave.

- Review our historical performance report to gain insights into EnWave's track record.

Lake Victoria Gold (TSXV:LVG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lake Victoria Gold Ltd. is a junior mineral exploration company focused on acquiring, exploring, and developing mineral properties in Tanzania with a market cap of CA$19.18 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$19.18M

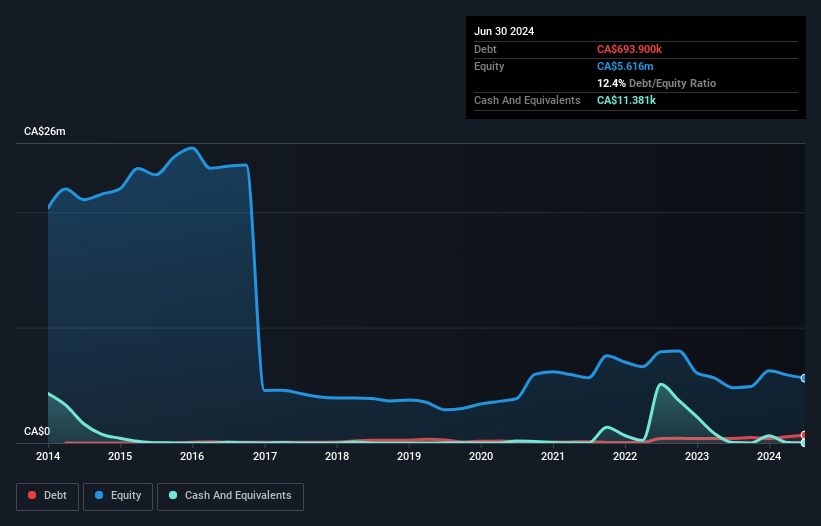

Lake Victoria Gold Ltd., with a market cap of CA$19.18 million, is pre-revenue and currently unprofitable, facing increasing losses over the past five years. Recent exploration activities in Tanzania have shown promising gold mineralization potential despite weather-related delays. The company has submitted necessary documentation for the renewal and transfer of its Imwelo Mining License, securing long-term operational rights. While Lake Victoria Gold's short-term liabilities exceed its assets, it maintains a satisfactory net debt to equity ratio of 12.2%. However, its management team lacks experience with an average tenure of 1.7 years, indicating recent changes in leadership.

- Click to explore a detailed breakdown of our findings in Lake Victoria Gold's financial health report.

- Gain insights into Lake Victoria Gold's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Click through to start exploring the rest of the 961 TSX Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Braille Energy Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BES

Braille Energy Systems

Engages in the battery-manufacturing and energy storage business in Canada and internationally.

Flawless balance sheet slight.