- Canada

- /

- Interactive Media and Services

- /

- TSX:EGLX

The Enthusiast Gaming Holdings (TSE:EGLX) Share Price Is Up 222% And Shareholders Are Boasting About It

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Enthusiast Gaming Holdings Inc. (TSE:EGLX) share price has soared 222% in the last year. Most would be very happy with that, especially in just one year! Better yet, the share price has gained 297% in the last quarter. We'll need to follow Enthusiast Gaming Holdings for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Enthusiast Gaming Holdings

Enthusiast Gaming Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Enthusiast Gaming Holdings grew its revenue by 1,177% last year. That's well above most other pre-profit companies. Meanwhile, the market has paid attention, sending the share price soaring 222% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

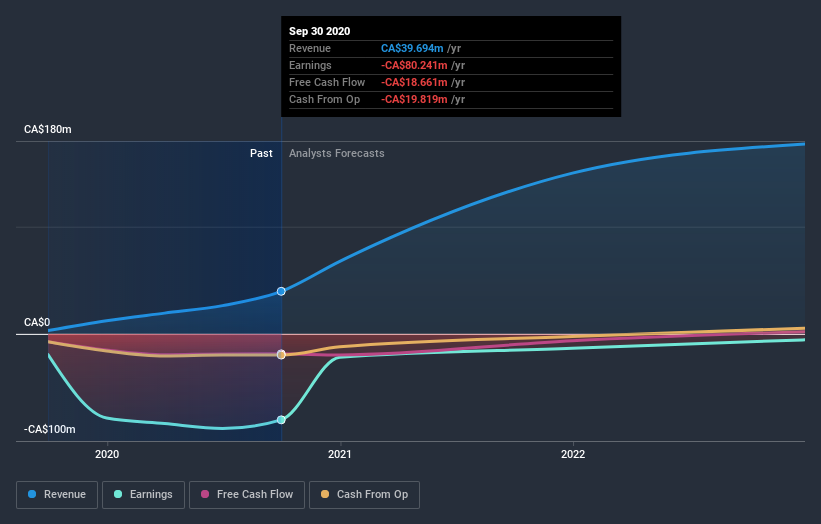

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Enthusiast Gaming Holdings

A Different Perspective

Enthusiast Gaming Holdings boasts a total shareholder return of 222% for the last year. And the share price momentum remains respectable, with a gain of 297% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Enthusiast Gaming Holdings that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Enthusiast Gaming Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enthusiast Gaming Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EGLX

Enthusiast Gaming Holdings

An integrated gaming entertainment company, engages in media and content, esports and entertainment, and subscription businesses in the United States, Canada, England and Wales, and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026