- Canada

- /

- Interactive Media and Services

- /

- TSX:EGLX

Enthusiast Gaming Holdings Inc.'s (TSE:EGLX) Shares Bounce 33% But Its Business Still Trails The Industry

Enthusiast Gaming Holdings Inc. (TSE:EGLX) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

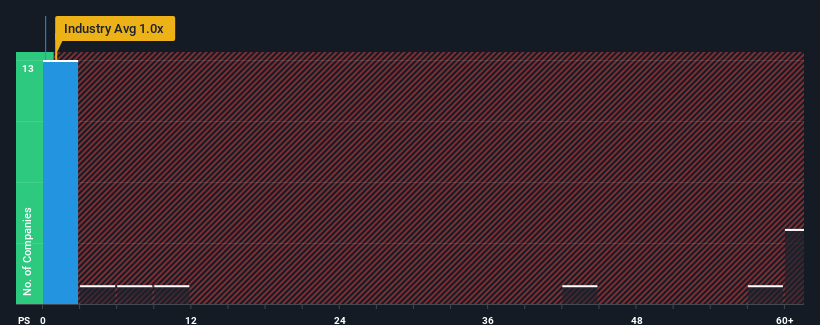

Even after such a large jump in price, Enthusiast Gaming Holdings' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Interactive Media and Services industry in Canada, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 3 warning signs about Enthusiast Gaming Holdings. View them for free.Check out our latest analysis for Enthusiast Gaming Holdings

How Has Enthusiast Gaming Holdings Performed Recently?

Enthusiast Gaming Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Enthusiast Gaming Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Enthusiast Gaming Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 57% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 2.6% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12%, which is noticeably more attractive.

In light of this, it's understandable that Enthusiast Gaming Holdings' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Enthusiast Gaming Holdings' P/S

Enthusiast Gaming Holdings' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Enthusiast Gaming Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Enthusiast Gaming Holdings (including 2 which are potentially serious).

If these risks are making you reconsider your opinion on Enthusiast Gaming Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Enthusiast Gaming Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EGLX

Enthusiast Gaming Holdings

An integrated gaming entertainment company, engages in media and content, esports and entertainment, and subscription businesses in the United States, Canada, England and Wales, and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026